The Australian’s Paul Kelly is on the the territory that matters for the new parliament:

Moving our rating from stable to negative means the AAA credit rating may be lost this term. That would increase our borrowing costs and the burden on taxpayers.

Australia acts like a classic spoilt child. It has enjoyed the good life for so long, it refuses to believe its special privileges are being cancelled and that old disciplines need to be reimposed. When the Prime Minister and Treasurer tell the country we need to “live within our means” they are accused of being out of touch. In fact, the country is in denial; the longer the denial lasts the more ugly and painful the eventual economic crunch.

The S & P warning is an opportunity for Turnbull and Scott Morrison. It is an economic lever to use against Labor and the populist spenders entering the Senate. Turnbull says budget repair remains “absolutely a very high priority”. Morrison says it means the pace of fiscal consolidation “cannot be postponed or slowed”. Yet this is Labor’s policy. In the campaign it proposed higher deficits, $16.5 billion across the forward estimates. Shorten’s campaign pitch was higher spending, no price signals in Medicare and Gonski on steroids.

The conflict between politics and finance is deepening. Labor’s Treasury spokesman Chris Bowen offers no quarter, saying the S&P warning “is the responsibility of Malcolm Turnbull alone”. If the rating agencies want evidence of the link between a dysfunctional parliament and fiscal disrepair, it is everywhere. In truth, Labor’s budget and costings policy must change.

In power terms there are two stories at this election: Turnbull’s narrow survival and the rising power of the sprawling progressive alliance constituting Labor, the Greens, trade unions and Get Up! And Labor is winning a touch more than 50 per cent of the two-party preferred vote.

Critically, the Left is winning the policy debate. At this election it won the Medicare debate; the logic of Shorten’s position is a higher Medicare levy to fund higher health spending. The Construction Forestry Mining and Energy Union and other unions have probably won the construction industry debate — the origin of the double dissolution — killing hopes for a new cop on the beat.

The Left has already won the debate against a higher GST and against a more flexible labour market. It is positioned to win the tax-and-spend debate, making the politics of spending cuts too hard and opening the way to bigger government and higher taxes.

This arises from our newly fragmented politics. What unites the two big winners in the Senate, Nick Xenophon with three senators and Pauline Hanson with two or three senators? It is their populist bent for protection, regulation, battler politics, hostility towards markets and lack of interest in the budget bottom line.

Since the 2013 election the Coalition has been losing the battle of ideas and policy. Abbott lost ground with his 2014 budget. Turnbull was driven into a modest policy package but lost ground in the campaign. Business and the banks have been bashed. The corporate tax cuts at the centre of Turnbull’s campaign cannot be passed in full.

The basic problem identified is right: we’re living beyond our means. But because Kelly doesn’t examine what that means in detail, and where the excesses and imbalances are, his political descriptions are coloured by yesteryear’s frame of reference. Kelly is stuck on quantitative fiscal consolidation. For him less public spending is an intrinsic good and good enough to fix things. Neither is true, at least not in the way he thinks.

Australia’s fiscal challenge now runs far deeper than public spending crowding out private. S&P made that explicit in its critique:

Australia has, for some time, had a large external vulnerability.

We believe without strong fiscal policy decisions the return to surplus will be slower and may push out to 2021.

Parliamentary gridlock, particularly in the senate has slowed the process and we don’t see that ending any time soon.

On the fiscal deficit:

We’re looking at the government to stick to its current forecast for a return to budget surplus, which is around 2020-21.

There have been a number of years with fiscal slippage and it’s really time for the government to step up and deliver on what they’re saying.

On borrowing offshore for house price pumping:

Is increasing house prices the best use of … capital?.

There are better and more productive uses of capital in the economy.

Australia’s challenge is not now to just to reform away the fiscal deficit, it is to reform away the current account deficit. Jacob Greber at the AFR is onto it:

The inexorable rise in what Australian governments, companies and households owe the rest of the world has for 30 years been met with general indifference.

That may be about to change, say analysts concerned by the prospect that Australia is on the cusp of losing its coveted AAA credit rating.

For the first time since the “banana republic” days of the mid-1980s – when Macquarie Bank famously likened Australia’s escalating reliance on offshore debt to the plight of a boiling frog – the spectre has re-emerged of a worrying national “twin deficit”.

“The problem is that losing the triple-A status exposes Australian assets to the vulnerability of the twin deficits,” said Vimal Gor, head of fixed income at BT Investment Management.

…Economists have long clashed on whether a large current account deficit is a bad thing, as it often reflects the fact that Australia is a worthy investment destination for foreign savings – particularly in resources investment over the past decade. This is often dubbed the “consenting adults” view of the current account.

“Australia’s high stock of external debt and structural current account deficits are mostly generated by the private sector and they reflect the productive investment opportunities available in Australia, foreign investor confidence in Australia’s rule of law, the high creditworthiness of its banking system, and the positive yield available on highly rated debt,” S&P said on Thursday.

Less impressive, suggests S&P, has been the surge in offshore debt that was used to fund Australia’s housing market, much of which has done little more than to push up the value of existing dwellings.

“It isn’t really doing a lot for the productivity of the Australian market,” Mr Walker said on Friday. Architects of Labor’s negative gearing policy would no doubt agree.

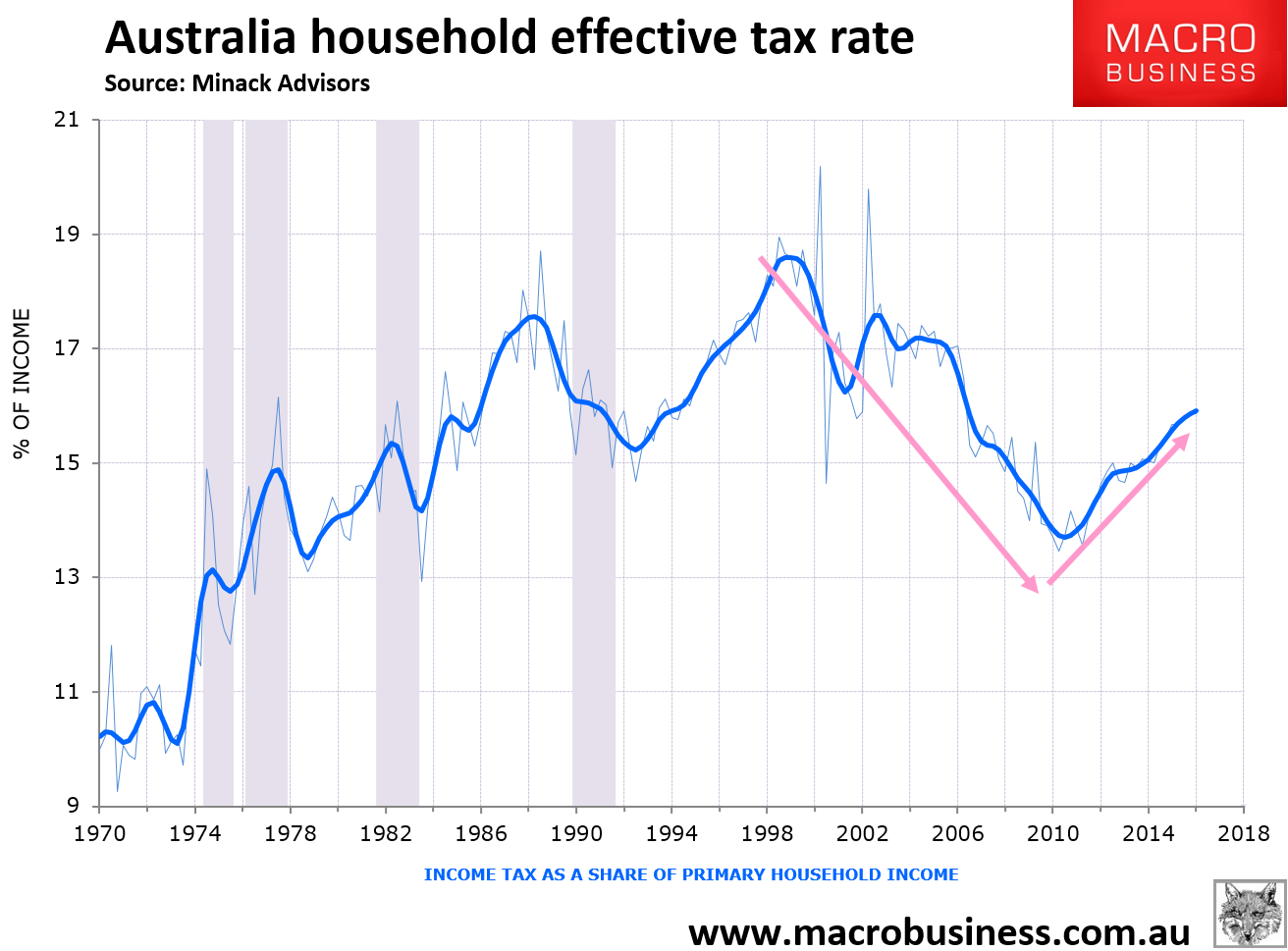

I wonder if Paul Kelly really understands what he’s proposing. The Libs are addressing only half of the “twin deficits” problem and are not doing a very good job of even that. That’s because they know that if they do react to the S&P warning, and cut spending hard, the economic blow back will be immediate and self-defeating as falling growth whacks tax receipts. They know because that’s what the bubble managers at the RBA and Treasury are telling them. It’s also the lesson that they learned in the 2014 Budget. The income that households generate from being a “spoiled child” on the public teat, the same income that Tony Abbott tried to rip out, is the essential underpinning of household’s giant mortgages that have mushroomed since the millennium, chart from Gerard Minack:

Topple one and you’ll topple the other. Even so, the Kelly Prescription might succeed in bringing about the structural change that S&P needs to see:

- as the terms of trade keep falling the Budget will need to cut in the vicinity of $40 billion per annum in recurrent public spending to reach surplus;

- that’s roughly 2.5% of GDP so it will very likely push a fragile domestic economy into recession;

- a housing bust is likely as a second round effect so the recession will be deep, even more so given there’ll be no fiscal stimulus;

- interest rates will go to zero (or as close to it as they can) and the Aussie dollar crater into the low 50s;

- the blow back for Budget receipts as unemployment climbs past 10% will be north of $100bn per annum so long as growth shrinks and quite high for as high unemployment lasts, let’s say five years;

- that will be a one off hit that adds to the public debt stock (leading to further downgrades) but the economy will rebalance away from consumption and towards tradables as the combined dollar, wages and land prices deflation repairs economic competitiveness via an accelerated shakeout;

- it would shunt Australia into a different growth model at the cost of carrying a much higher public debt load. But a surplus might then be possible and the current account deficit would be much smaller.

There is a second option to bring about some budget repair and extend the life of the current account deficit model. It’s been championed by Professor Warwick McKibbin. MB calls it the McKibbin Dystopia and it is the path we’re currently on:

- to over time shift budget spending from recurrent giveaways towards productive infrastructure:

- sustain high immigration to fund the current account deficit by selling assets to the Chinese;

- standards of living will grind lower but growth continue;

- however, it comes with the dual problems that the new pubic spending will be diverted to pork so the productivity dividend will be low and ongoing rorting of the visa system will perpetuate wages deflation by stealth ensuring an angry and confused populace keeps turning over governments, probably derailing the fiscal cuts and necessitating even more sales of assets to Chinese capital;

- the current account deficit will thus remain large, driven by asset prices, over-consumption, and failed fiscal tightening and still end in a shock and consolidation, at which point Chinese capital will be invited to own everything that’s not nailed down, including the banks;

- it culminates in the defacto dissolution of the ANZUS alliance as Australia is effectively integrated as a Chinese branch office – which could be argued provides us security within Asia – and in rising social dysfunction around marginalised youth and intensified race-based politics like One Nation.

For years now, MB has offered a third path to repair our broken economic model which takes the best of both of the above remedies:

- recurrent public spending is steadily cut but matched with productive investment in infrastructure on a recognisable path to fiscal repair that does not trash growth;

- immigration growth is shifted downwards to historic norms and visa loop-holes tightened to support income growth and skills generation;

- structural tax reform is undertaken to nudge Australia’s pattern of economic growth away from holes and houses towards a broader tradables recovery, including major cuts to tax concessions;

- a full blown, inter-agency effort is made to lower the Australian dollar to 50 cents urgently;

- innovation, competition and Federation reform can do more for productivity growth as well, and

- all of it is done within a framework of shared sacrifice orchestrated by political leadership that demands concessions from labour, capital and balanced across generations.

In short, it is a combined quantitative and qualitative program of budget repair; a voluntary effort to deflate the economy into something much more lean and competitive that can take advantage of the Asian century without plunging itself into ‘recession shock therapy’ or selling its soul on the quiet. It’s primary challenge is rhetorical.

MB backed the rise of Malcolm Turnbull because his combined policy utterances and rhetorical power suggested he could bring this agenda to fruition. Alas, he had no backbone for it. Moreover, behind him, the Libs do not appear to have any interest in qualitative budget repair. One thing that is abundantly clear post-election is that the Coalition is welded to tax concessions that support the largest rent seekers in the land, from Phil Coorey today:

Angry conservative Liberals are blaming some of the changes to superannuation concessions, announced five days before the election was called, for costing the Coalition support, both direct and indirect, and alienating its base.

Senior sources said the party room would fight hardest to overturn the impost of a $500,000 lifetime cap on non-concessional contributions backdated to 2007, on the basis it was retrospective. This measure is worth $550 million in savings to the budget over four years.

Also to be discussed is the proposal to drop from $30,000 to $25,000 – or from $35,000 to $25,000 for those aged 50 and over – the annual limit on contributions that are taxed at the concessional rate of 15 per cent. This measure is worth about $2 billion over four years.

Some are also arguing about the proposal to cap at $1.6 million the total amount in a retirement account. But there is less support to change this.

…At the weekend, Immigration Minister Peter Dutton said there would have to be changes while another senior conservative, who asked not to be identified, said the push for change would be “large”.

On the Labor side, Bill Shorten also appears to have no backbone for Australia’s structural fight. Although he took deep qualitative budget reform to the election there was no quantitative effort to go with it. His instincts deployed fairness as a merit in itself as opposed to part of a more nuanced economic agenda of mutual sacrifice that could support prosperity long term. He is indeed a populist in that sense. But Labor does still have the policy space to do the right thing and the one guy in the Parliament left over with the intellect and rhetorical skills to carry the MB structural reform program is Shadow Treasurer Chris Bowen.

My best guess is that for now we’re going to stumble along the path between recession and dystopia until the former takes over. If that’s true then Chris Bowen may well need all of his skills after the next election.