From the AFR:

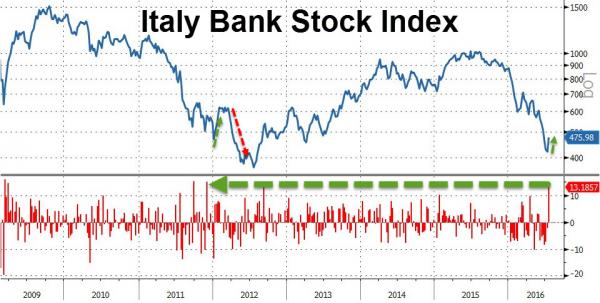

Platinum, the Sydney-based global value investor, is defying the bearish mood and buying more European bank stocks after its positions in banks accounted for almost half of the fund manager’s losses so far this year.

The Platinum Unhedged Fund’s latest report shows that its value fell 10 per cent in 2015-16 compared with a 1 per cent fall for global equities. Platinum is not alone; many Australian fund managers who invest globally have seen returns hurt by the Brexit vote through falling positions in European bank stocks such as Lloyds Banking Group, including at PM Capital and Magellan among others.

…What is unusual is Platinum’s willingness to buy mor

…”The banks’ share prices are factoring in fear of further political risk, namely, a full break-up of the European Union. The impact of recency bias plays a big role here. As we have just seen, a large country making a shock exit, suddenly the probability of further exits feels significantly heightened,” the fund manager told clients. “But we need to take into account that the European governments will react and concessions will be made.”

I am sure that Platinum is joking when it says that European banks are priced for a “full break-up of the European Union”. They have fallen a long way, however, and that rather amusing statement does not mean that it is wrong about Europe giving ground on Italy, from Bloomie:

It may seem like there are many different ways this critical situation can pan out, but all bar one would be fatal for the euro zone. The only option is to bail out the banks without “bailing in” investors.

Of course the banks will be rescued. This column has previously outlined how Italian banks will be saved precisely because the alternative is the collapse of the Italian economy, which would likely precipitate the breakup of the euro.

So the crunch decision is whether bond investors share some of the cost of that bailout. Since January, the EU has legislated that investors must be bailed in, and bail-ins have happened elsewhere, e.g. 54% haircut for senior creditors of Heta Asset Resolution in Austria.

Surely the EU can’t blatantly break its own new rules just for Italy? That would set a bad precedent, completely undermine its authority, create large moral hazard within the euro zone, and weaken the euro.

But it can. And it most likely will. Because the alternative is much scarier. In Italy, too much of the subordinated bank debt is owned by private individuals. If they’re made to pay for this, then Italy’s constitutional referendum in October will fail, resulting in Prime Minister Renzi resigning and the collapse of the government.

Italy will be in crisis, and anti-EU sentiment will gain a significant boost at a time when the euroskeptic Five-Star Movement has already become the most popular party. Again, the euro zone will be in serious jeopardy.

So there’s really only one path to be followed: the one that doesn’t threaten to break up the euro zone. The Italian banks will be bailed out and investors will not be bailed in.

This will be a boost to global equities and positive- yielding bonds, yet another boon for emerging markets. It will be less good for the euro, which is trading within 1% of its 18-month high versus a trade-weighted index.

That is probably too black and white and a partial bail-in is more likely with a distinction made between small and large bond holders. So, to that extent, Platinum is probably right.

Except that that is not the real problem. This is, from The Telegraph:

The bondholders’ losses risk harming the government’s reputation at a delicate moment.

Prime Minister Matteo Renzi is already facing a close-fought referendum over a planned constitutional reform. If he loses the vote, it could mean the end of his government, and polls indicate that the eurosceptic Five Star party, headed by Beppe Grillo, could perform well in a general election, spreading further political instability through the European Union.

Italian pragmatists argue the cost of a government-backed bailout would be worth paying, to avoid financial instability. Yet the equation is not that simple.

The EU insists bondholders have to bear the cost of the recapitalisation, sparing taxpayers and forcing investors to think about the risks they are taking, to help stop future crises at banks and in governments’ finances.

Officials at the Eurogroup and European Central Bank are digging in their heels – they do not want the past five years of financial reforms undermined immediately by Italy.

Such a result would sap their own authority and open the door to similar state-backed deals in Portugal, which is also suffering from bad bank loans.

Still, even a bailout would bring political risks to Mr Renzi.

Lorenzo Codogno, former director- general of the Treasury Department at the Italian economy ministry, says there is a risk that a bail-in of retail investors could be politically toxic, even if a conversion of debt into equity, could be a “gift” for many bondholders who now have illiquid subordinated debt.

“The risk is clearly that it is not taken well by the electorate, affecting political support for the PM,” says Codogno, the current chief economist of LC Macro Advisors.

Does Platinum understand Italian politics so deeply (making it pretty unique) that it knows how this is going to play with the polity amid BREXIT, French attacks, a rising Five Star Movement, as well as the likelihood that any European bailout concession will very likely come with reform conditions that will do great harm to growth before anything improves? Platinum clearly did not see BREXIT coming so why would it be any better on Italy? The blood is up in Europe, this is not just a numbers game anymore.

Perhaps holding on at this juncture makes sense given Platinum’s losses but buying more?