The Washington-based International Strategic Studies Association is the latest to warn of settlement risks in the apartment market, warning that “changes in local banking policies” could see foreign investment in the property sector “decline markedly”, precipitating a “market collapse”. From News.com.au:

“We estimate that Australia has about six weeks or so to turn this situation around, otherwise there would be a massive hit on property valuations and the building trades,” he said.

“The urgency is, I believe, based on the fact that this is about how long it will take for the banks’ policies to start switching off a lot of existing and planned contracts for Australian properties.

“The banks clearly believe Australian real estate values will decline, so they are attempting to avoid that risk. They’ve learned from the US collapse that seizing real estate collateral is a no-win scenario when the volume is great and the market slow.

“In so doing, they precipitate the market collapse but are less exposed to it.”

…“it is much more likely to be a self-fulfilling prophesy by depressing demand, creating oversupply and putting downward pressure on prices, thereby creating paper losses at the settlement date which would tempt buyers to walk away”.

I have little doubt that Australia will experience a clean out in the apartment sector at some point, but within six weeks or so sounds heroic.

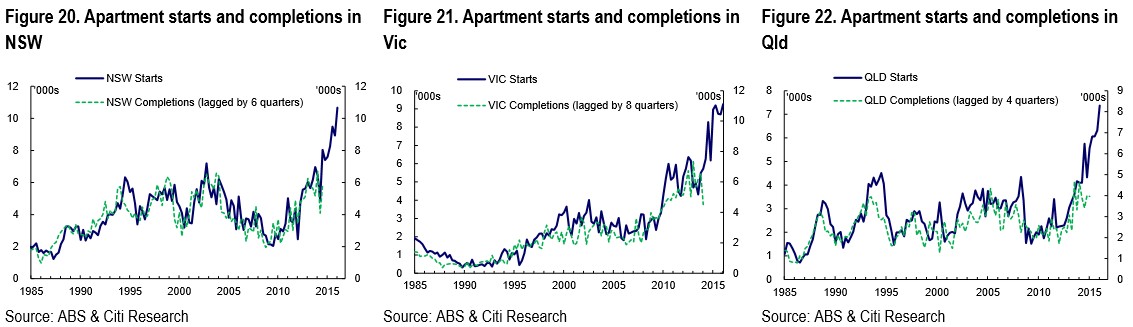

2017-18 seems more likely to me, given the massive number of apartments still to flood the market: