The Australian, The AFR and the opposition parties continue to scaremonger over the Albanese Government’s announced increase in the concessional tax rate for superannuation balances of more than $3 million, from 15% to 30% after the next federal election.

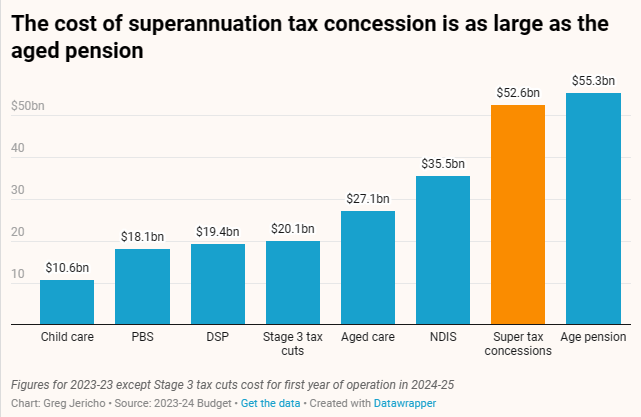

The changes are expected to impact about 80,000 wealthy individuals, or less than 0.5% of all super accounts, and are projected to shave around $2 billion off the gigantic cost of superannuation concessions, which rivals the aged pension:

Righteous indignation has swept independent Teal MPs representing some of the nation’s wealthiest voters.

Independent MP Zoe Daniel says the appeal of superannuation is being harmed by governments of both persuasions constantly tinkering with it.

Fellow independent MP Allegra Spender referred to the government’s plans as an “ad hoc tax grab”, while North Sydney MP Kylea Tink described them as “unsophisticated”.

Whereas independent MP Zali Steggall, who holds the Sydney northern beaches seat of Warringah, accused Labor of indulging in class warfare to try and fix the budget.

For his part, Opposition Leader Peter Dutton described the changes “yet another broken promise by this tricky prime minister” in Monday’s Question Time.

Thankfully, for every dozen or so media hacks, you get an honest commentator. And The Canberra Time’s Crispin Hull has injected some much needed commonsense into the debate.

Hull notes that “middle Australians simply do not have superannuation balances above $3 million. The median balance of those between 60 and 65 is just $158,000”.

By contrast, “there are 11,000 Australians with more than $5 million in super, the Australian Superannuation Federation says. Only about 80,000 people have more than $2 million and 27 self-managed funds have more than $100 million”.

“In short, this change affects a mere half of one per cent of Australians”, according to Hull.

Contrary to the scaremongering, Hull describes Labor’s superannuation changes as “a partial removal of a too-generous concession. That concession was aimed at encouraging savings for a dignified retirement, not for people to build up multi-million-dollar accounts to pass on to their children”.

“The tax on the earnings of these accounts will rise from 15% to 30% – still a 17% concession”.

Hull then uses an example to highlight the absurdity of the opposition to Labor’s modest reforms.

“Let’s take one of the 11,000 people with more than $5 million in their account. The (say, 6% or $120,000) earnings on the balance over Labor’s $3 million threshold now attracts just $18,000 in tax. Labor would raise that to $36,000”.

“What are the hard-working middle Australian families to make of this?”

“For a start, a hard-working Australian’s hard-earned wage of $120,000 would attract much more tax than the $18,000 tax on the unearned $120,000 of the multi-millionaire superannuant”.

“The reaction of middle Australia is more likely to be: “It is about time the bastards paid some tax”, Hull argues.

Hull warns that the Coalition is barking up the wrong tree in opposing these reforms and their opposition will very likely backfire.

“Critically, unlike in the past, the tax debate is happening in the context of years of declining government services – Medicare under impossible strain; public schools struggling while private schools wallow in money; and infrastructure buckling under the high immigration that only benefits big business”.

“In this new context, people are less likely to fall for a higher-taxes scare. More likely, they are likely to applaud a realignment in the tax system if it provides money for better services”.

“Dutton’s knee-jerk reaction to reverse Labor’s changes is a clear message to the electorate that the Coalition is on the side of tax breaks for the rich at the expense of government services for the many”.

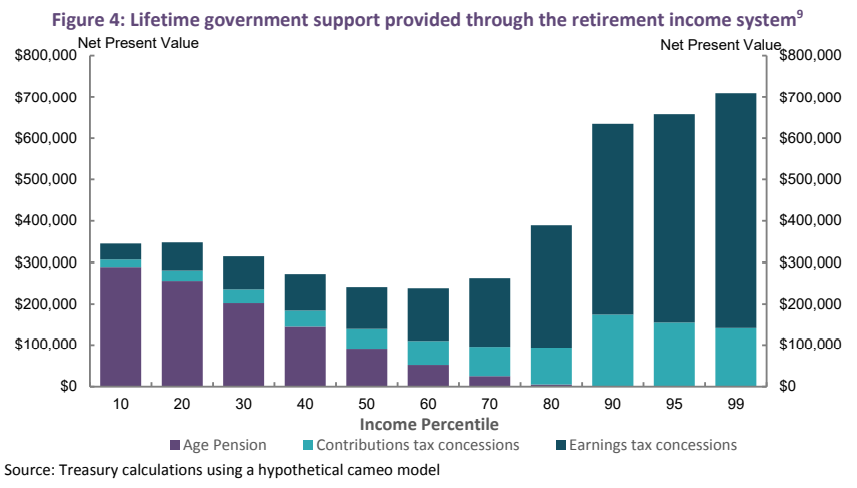

Let’s get real here. The Australian Treasury’s own modelling shows that superannuation concessions are grossly unfair and flow to where they are not needed: i.e. the highest income Australians:

Just study the above chart. The top 1% of income earners currently receive around 14-times the superannuation concessions of the bottom 10% of income earners. On what planet is that justifiable?

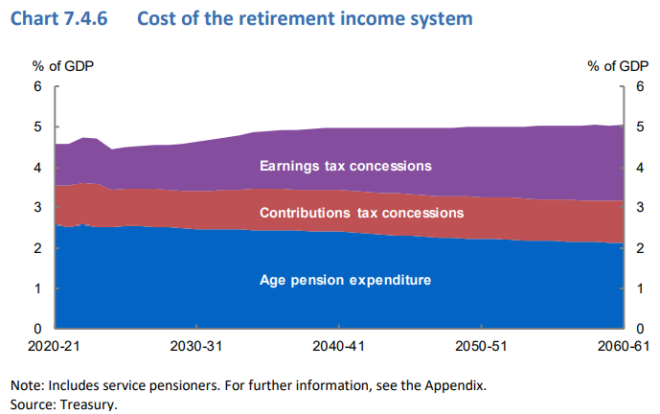

The fact of the matter is that the cost of superannuation concessions must be reined-in, otherwise they will end up costing more than the aged pension, according to the Australian Treasury:

Blind Freddy can see that Labor’s modest $3 million super cap is entirely justifiable on equity and budget sustainability grounds.

Superannuation is for retirement purposes, not tax planning.