The Australian retirement system is based on the presumption that the vast majority of people would own their homes.

However, due to falling home ownership rates and people carrying mortgage debt well into their retirement years, that assumption is failing.

A report by the Australian Housing Urban Research Institute (AHURI) estimates that 440,000 older households will be unable to find or afford suitable housing by 2031.

The study also warned that the mortgage debt burden for senior Australians has increased 600% over the last three decades, placing them under greater financial strain in their retirement years.

Older Australians are also increasingly using their superannuation nest eggs to pay off their mortgage debts, making them more reliant on the aged pension.

Meanwhile, low-income older households who can’t afford any form of mortgage are paying a large proportion of their incomes on rent.

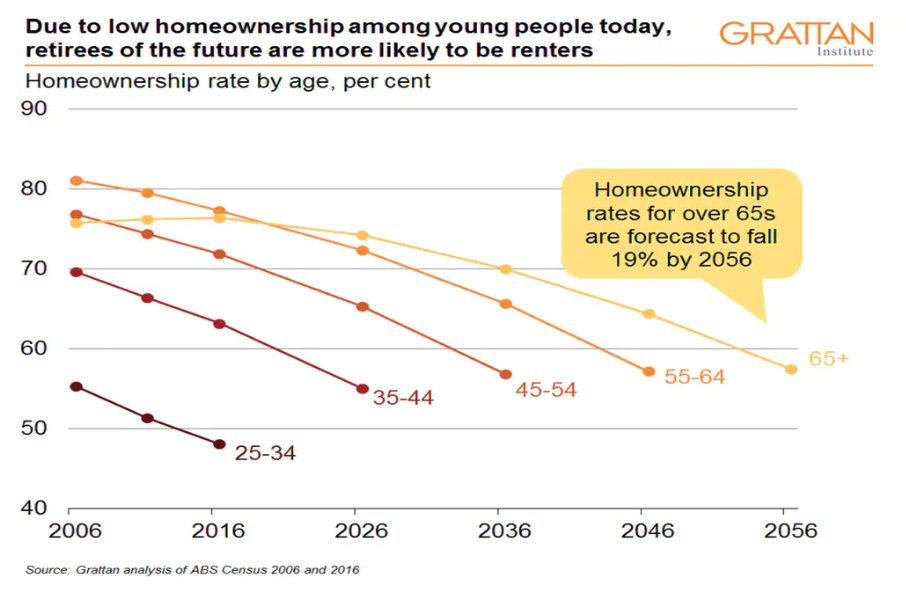

According to the Grattan Institute, the proportion of adults over the age of 65 who own a home is predicted to fall from 76% presently to 57% by 2056.

Less than half of low-income retirees will own a home, down from more than 70% today:

So basically, future retirees will increasingly rent, while others will carry higher levels of mortgage debt.

Both factors will place significant strain on the retirement system, which currently operates under the presumption of widespread debt-free home ownership.

Around 40% of superannuation withdrawals in 2016-17 were used to pay down mortgages and other debt. This figure has likely risen since then.

Average national rental costs, according to CoreLogic, are around $30,000 per year currently ($580 per week), which consumes nearly all of the full Age Pension for a single person ($27,600 per year) plus Commonwealth Rent Assistance (circa $4500 per year).

“It basically means: hitting retirement either as a renter or as a heavily indebted mortgagor is going to impact the retirement security of very many Australians, possibly putting pressure on both the Age Pension and superannuation system”, warned Harry Chemay last month.

In short, Australia’s housing crisis is set to blow up the nation’s retirement system.