No end in sight for the deflation tsunami in goods. Morgan Stanley with the note.

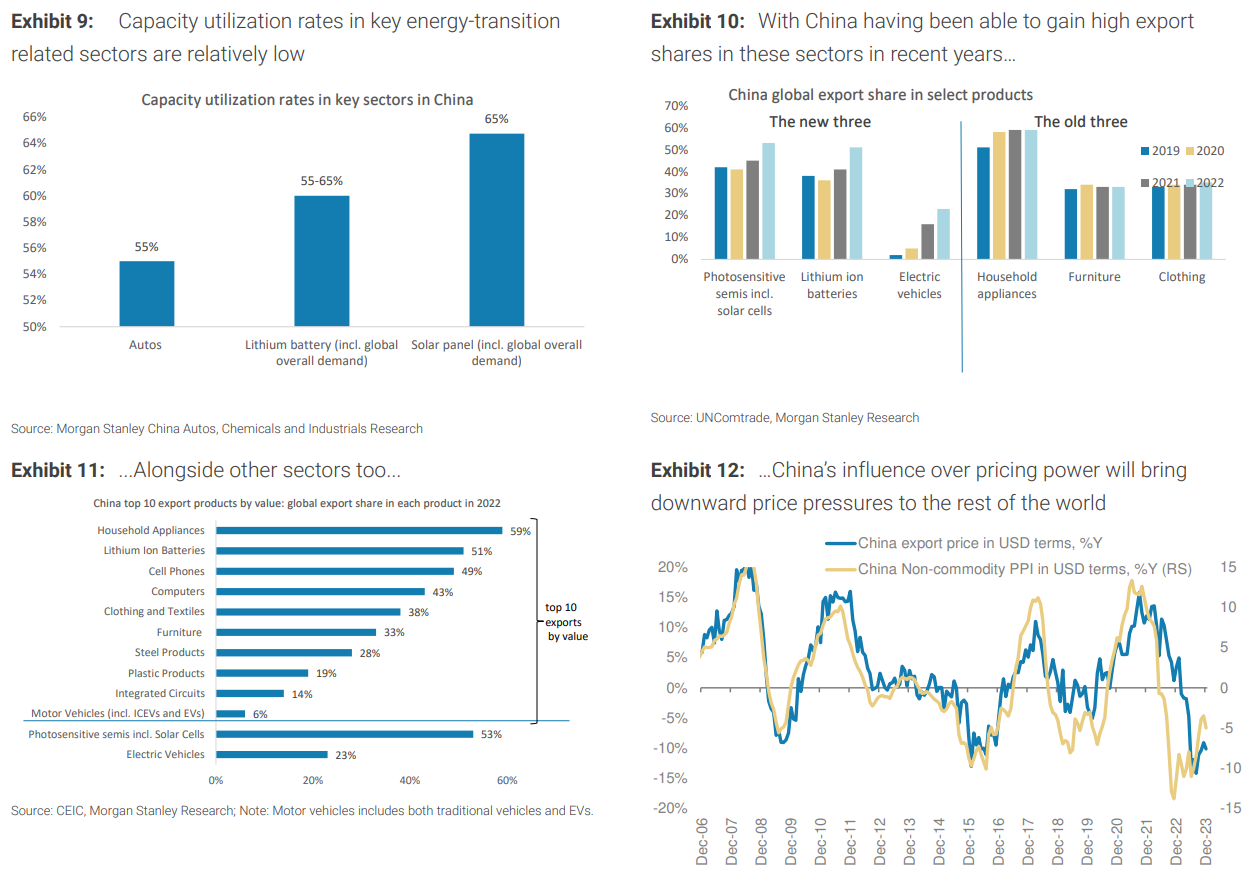

The rise of excess capacity in China…: As we highlighted previously, despite declining returns, China’s investment to GDP remains high at 41% of GDP. Indeed, notwithstanding the decline in property investment, nominal growth in infrastructure and manufacturing sector investment is relatively stable and averaged 7.5% YoY in 2023 (compared with a nominal GDP growth rate of 5%). In an integrated global economy, the effects of this over-investment and the resultant excess capacity will extend well beyond China’s weight in the overall aggregate.

… Has begun to weigh on prices: China has an influence over pricing power in other parts of the world given its role as a large market but, more important, it is the marginal competitor and that too of some size. We estimate that China accounted for 27% of global investment in 2023 compared with 22% in 2013. Hence, as China continues to invest with low-return expectations, we believe this will continue to weigh on the price dynamics of a number of sectors, particularly those where China has a large market share. To be sure, producers in China are innovating and have reaped the benefits of these innovation efforts and the resulting cost efficiencies. But recent price trends suggest to us that the effects are well over and above the cost efficiencies. Indeed, over the last two quarters, China has been cutting prices of key manufactured goods such as cars, solar cells, lithium batteries and older-generation semiconductors. In this context, we think that China, which is already a formidable competitor in traditional, lower value-added segments like household appliances, furniture and clothing is making inroads as a leading competitor in new strategic sectors such as those related to the energy transition, where it is competing head-on with DM economies.