Over the last month, we have witnessed several major New Zealand banks become more hawkish on interest rates, despite clear signs that the economy is weakening and inflation is easing.

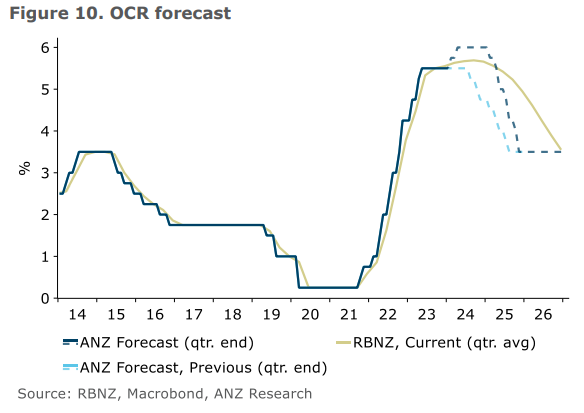

ANZ is particularly hawkish, tipping that the Reserve Bank will hike the official cash rate (OCR) by 0.25% at both its February and April meetings.

“We are now forecasting 25bp hikes in both February and April, taking the OCR to 6%”, ANZ wrote in a note earlier this month.

“We are now forecasting cuts from February 2025, ultimately taking the OCR back to 3.5% as before”, the bank said.

Westpac also revised its OCR forecast, swinging from rates being cut later this year to anticipating rates remaining on hold until 2025.

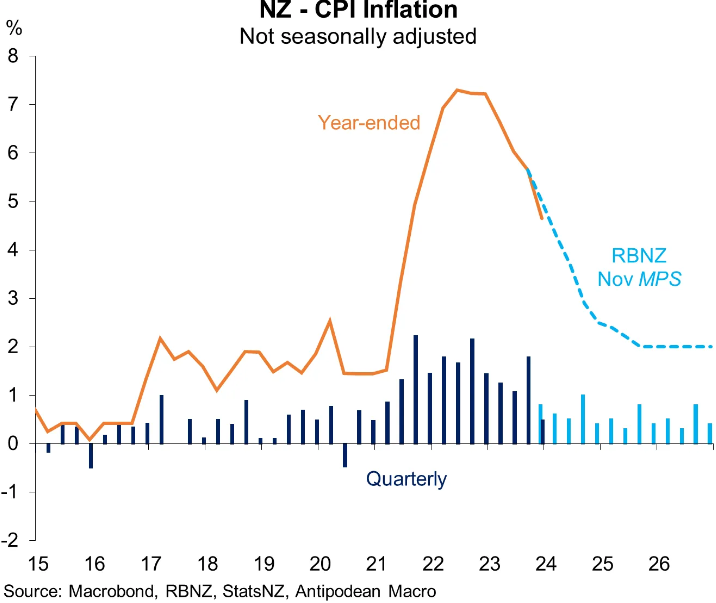

I always viewed this newfound hawkishness as ill-founded, given that inflation is falling faster than the Reserve Bank’s projections.

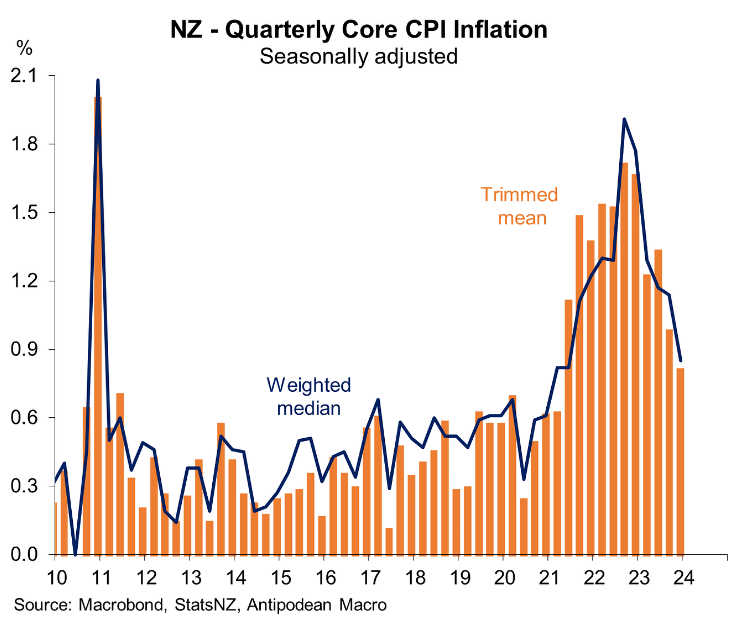

New Zealand’s core inflation has also fallen swiftly:

.

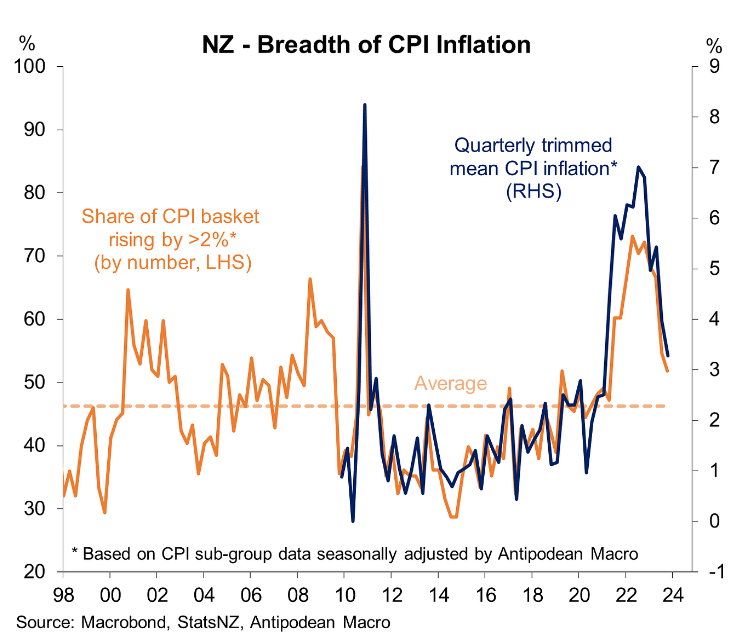

. And the breadth of inflation across New Zealand has plummeted:

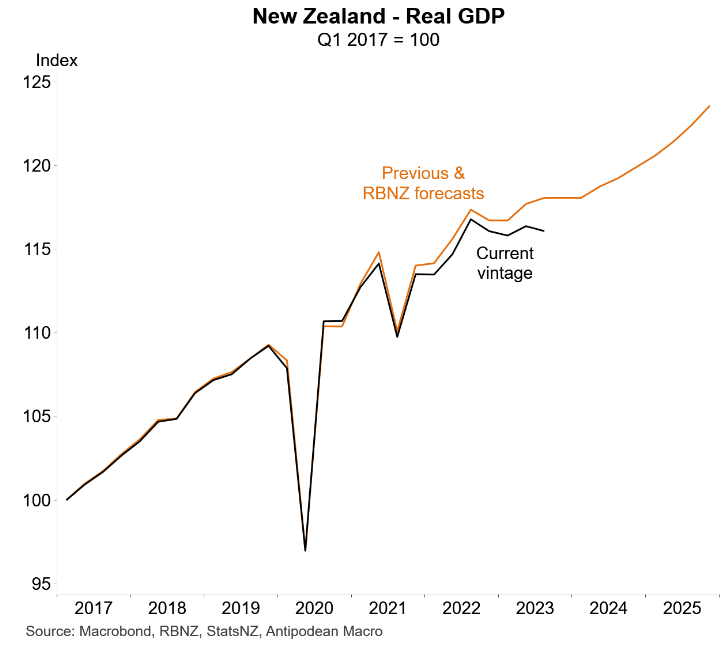

Moreover, New Zealand’s economy has slowed faster than the Reserve Bank projected, with the economy already in recession:

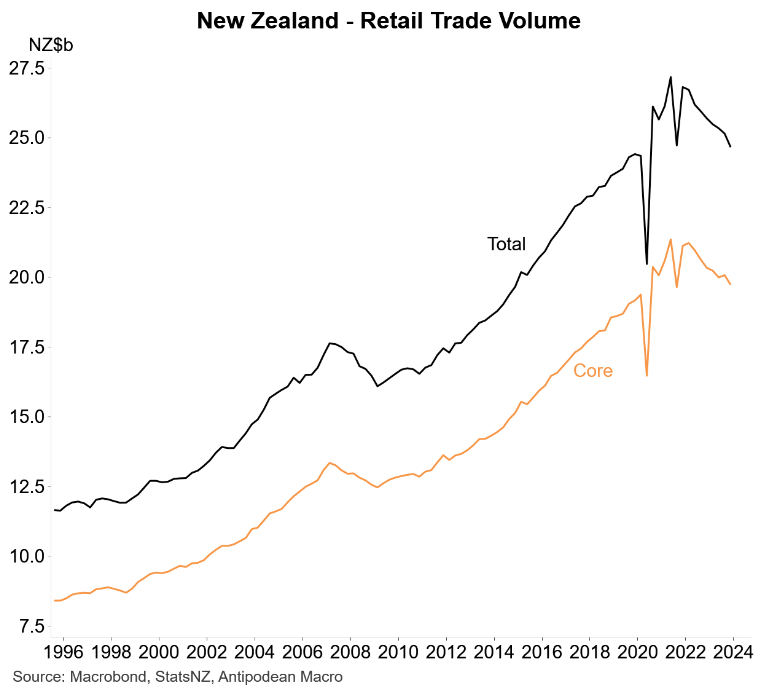

On Friday, Statistics New Zealand released data on retail sales, which showed that retail spending has fallen for eight consecutive quarters.

The total volume of retail sales fell by 1.9% in the December 2023 quarter in seasonally adjusted terms, whereas the total nominal value of sales fell by 1.5%.

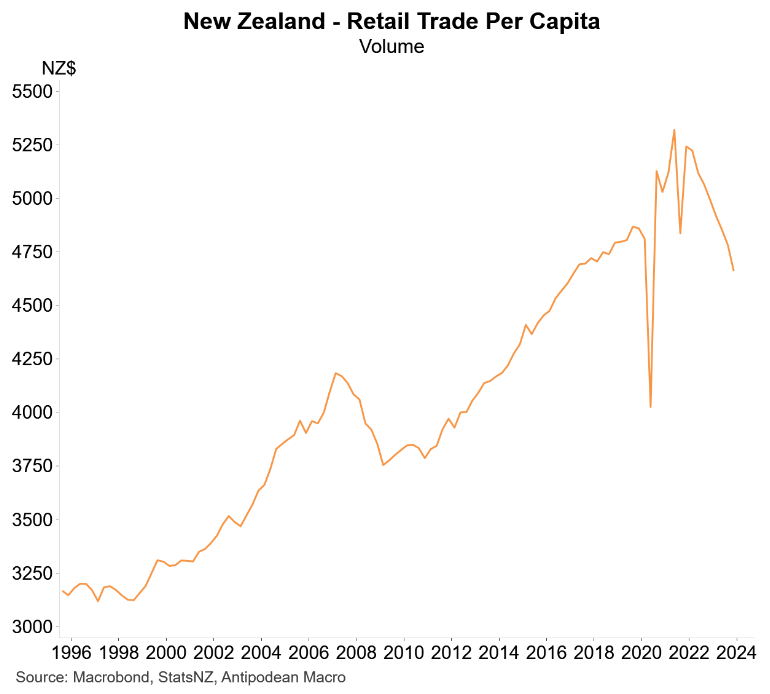

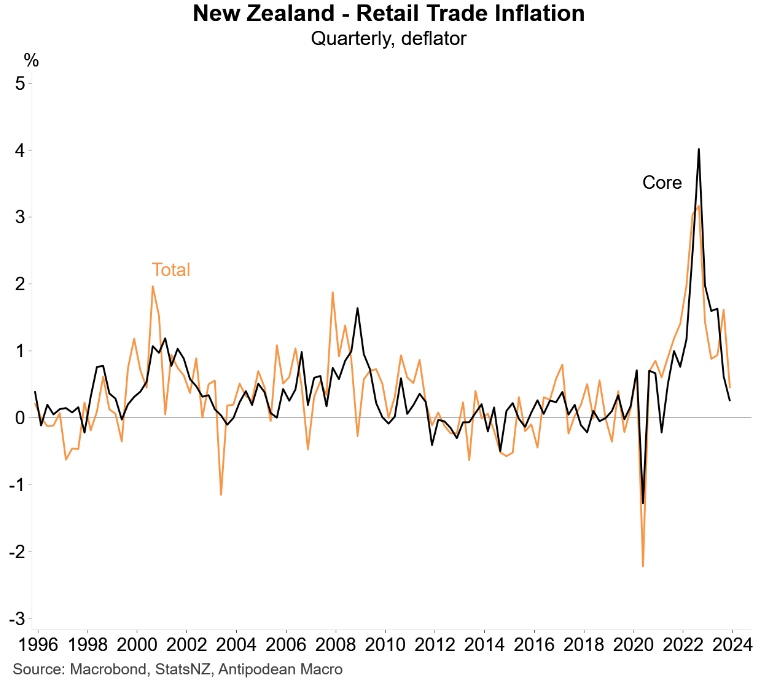

The below charts from Justin Fabo at Antipodean Macro tell the tale.

Fabo notes that the volume of retail trade in New Zealand has now “fallen by more from the peak than during the Global Financial Crisis”:

To add further insult to injury, retail trade per capita in Q4 fell to its lowest level since the March quarter of 2017:

New Zealand retail trade has also collapsed:

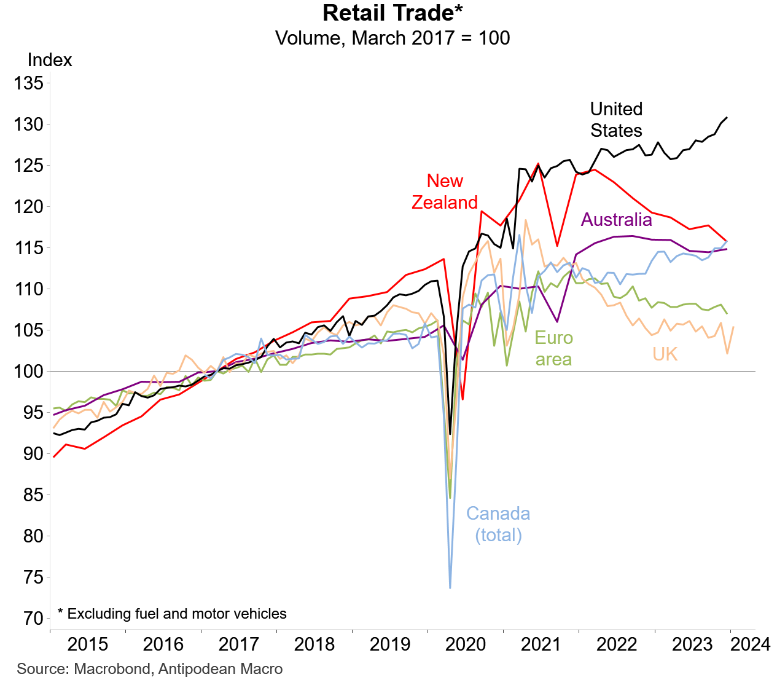

Finally, New Zealand’s collapse in retail trade volumes has been particularly sharp from a global perspective:

The above charts are confirmation that New Zealand’s economy is mired in recession.

As a result, there is little chance of the Reserve Bank hiking rates further.

To the contrary, the Reserve Bank will likely join other central banks in cutting interest rates later this year.