The past month has seen New Zealand’s interest rate watchers and financial markets gyrate wildly on interest rates.

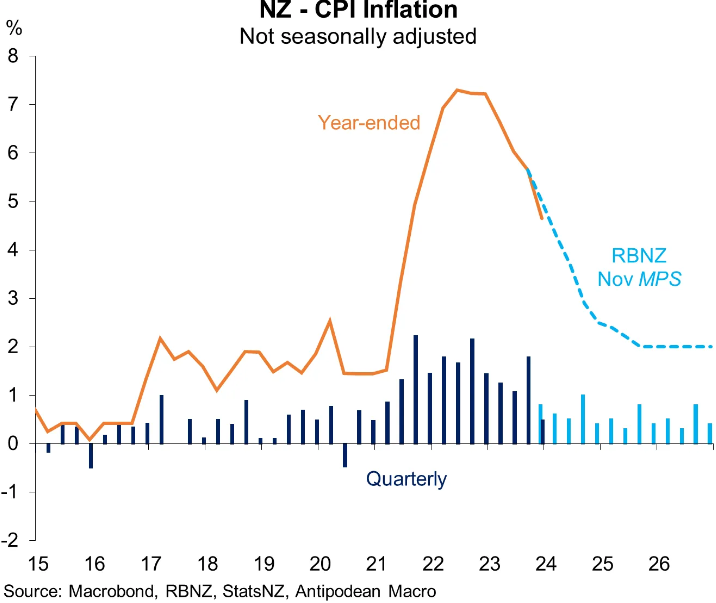

When New Zealand’s Q4 CPI inflation print came in below economists’ and the Reserve Bank’s projections, economists and markets predicted that the next move in the official cash rate (OCR) would be down.

Then, New Zealand’s Q4 labour market report printed slightly stronger than expected (albeit still deteriorating), leading many economists and financial markets to expect more OCR rate hikes in the coming months.

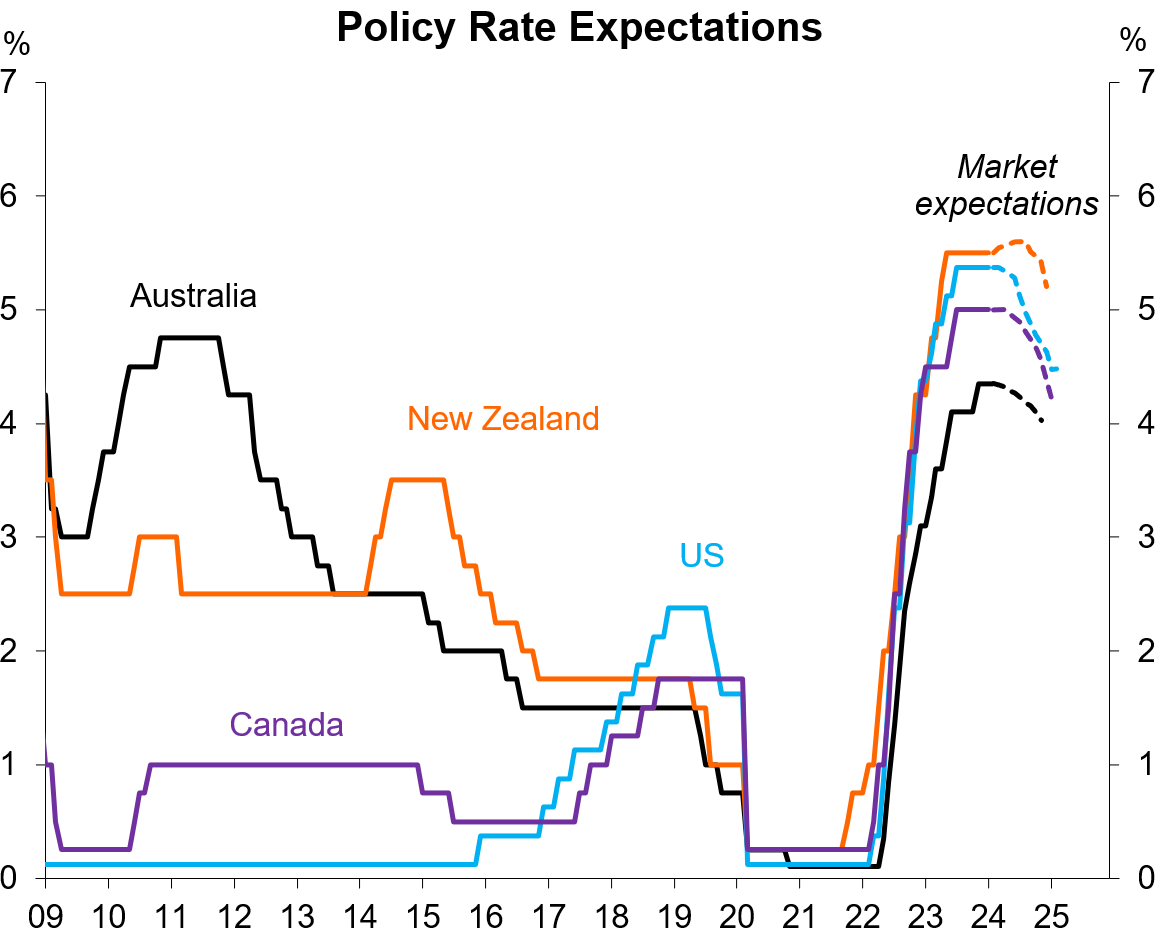

As shown in the next chart from Justin Fabo at Antipodean Macro, this has put New Zealand’s policy rate expectations at odds with those of other central banks:

Independent economist, Tony Alexander, last week brought some common sense to the interest rate debate, outlining why the Reserve Bank is unlikely to raise the OCR further.

“The problem for the rate rise pundits is that some of the Reserve Bank’s forecasts have also proved too high and the outcomes imply less inflation than they have pencilled in”, Alexander noted.

“For instance, they estimated that the NZ economy grew by 0.3% in the September quarter. In fact it shrank 0.3%. They also estimated that the CPI rose by 0.8% in the December quarter. In fact it rose by 0.5%”.

“It also pays to note that the Reserve Bank have emphasised that it is core inflation measures, which they focus on, and as one other forecasting group pointed out this week, some are falling faster than they shot up”, Alexander added.

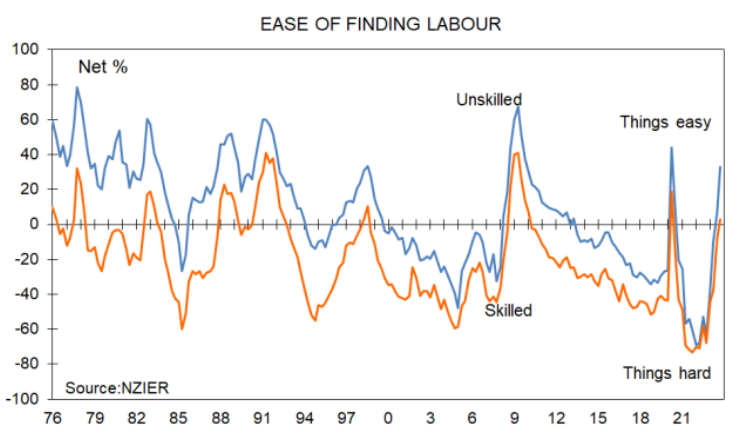

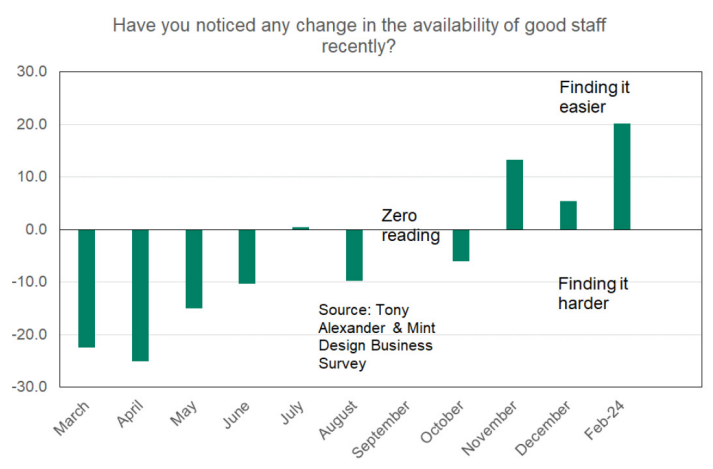

“The NZIER’s Quarterly Survey of Opinion for the quarter has shown businesses feel the availability of labour is the best it has been in 14 years”.

“Of significance also is the fact that the labour market lags changes in the economy’s growth rate”.

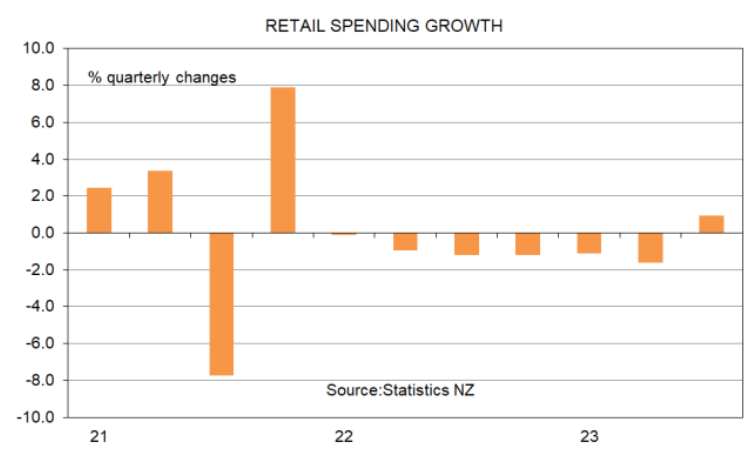

“Retail spending volumes have declined in six of the last seven quarters and consumer sentiment remains well below average levels”.

“It pays also to note that there is extra restraint on the economy yet to be felt as people keep rolling onto higher fixed mortgage rates”, Alexander said.

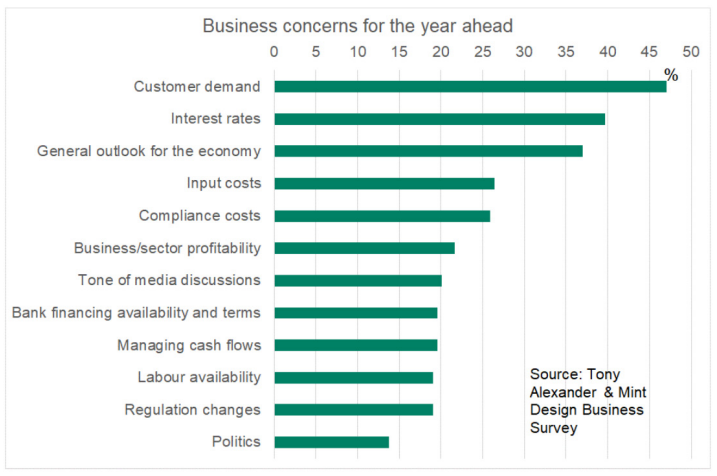

Tony Alexander’s latest Business Insights survey has thrown another spanner into the rate hike thesis, showing that New Zealand businesses are most concerned by: 1) customer demand, 2) interest rates; and 3) the general outlook for the economy:

“Given the pressure which the Reserve Bank is exerting on consumer buying through high interest rates these results are not surprising”, explains Alexander.

“High interest rates look set to remain an issue for the first half of this year at least”.

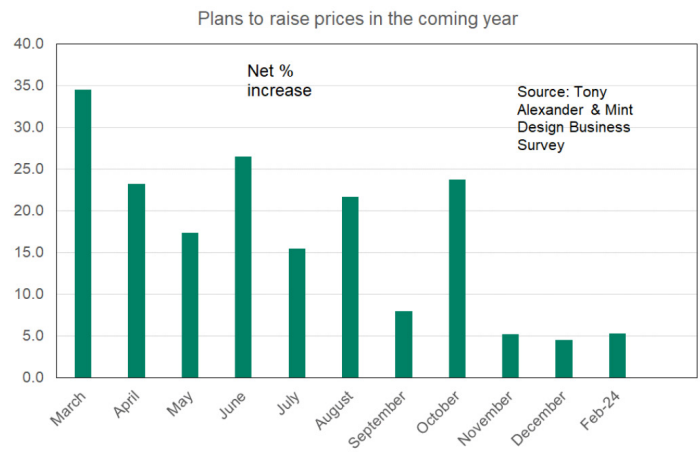

Importantly, there has also been a sharp easing in firm plans to raise prices this year, reflecting falling consumer demand and firm pricing power, as well as easing cost inflation:

Firms are also finding it far easier to find good staff:

None of the above seems conducive to the Reserve Bank hiking rates, does it?

Firms and households are coming under increasing pressure, which continues to build as cheap pandemic fixed rate mortgages expire.

The easing of inflationary pressures and the softening of the economy point to rate cuts in the not-too-distant future, not further increases.