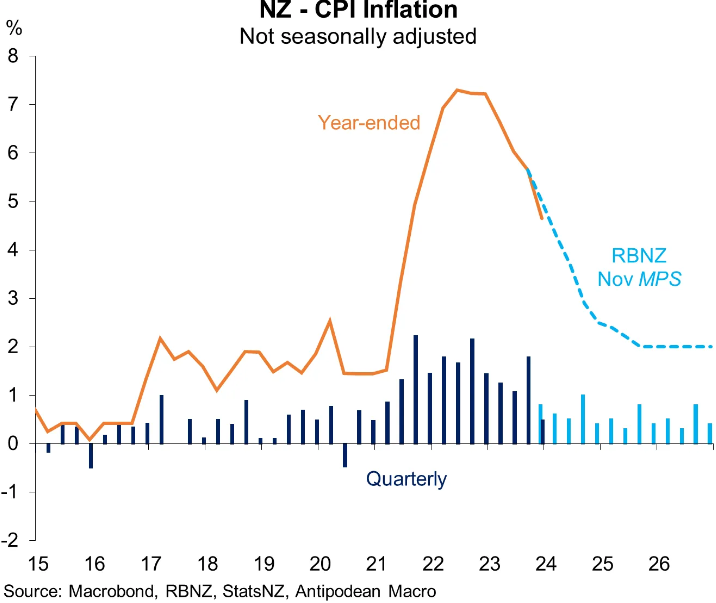

Last week, it was looking as if the Reserve Bank of New Zealand could soon commence an easing cycle based on softer-than-expected inflation:

However, Reserve Bank chief economist, Paul Conway, then hosed rate-cut expectations, stating that the run of soft inflation and economic data did not imply that rates will be cut, nor that there is less inflation in the economy.

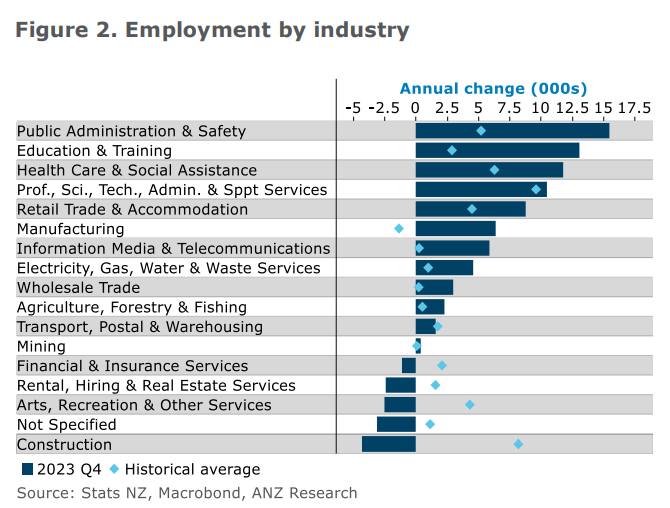

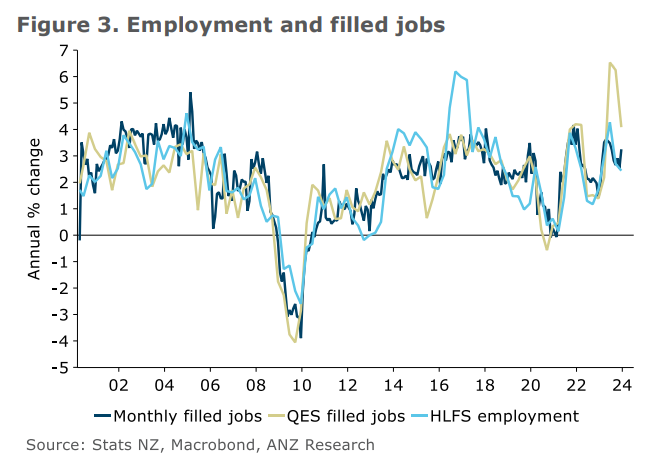

On Wednesday, Statistics New Zealand released employment data that was stronger than expected.

Accordingly, ANZ economists now believe that rate hikes could be back in play when the Reserve Bank meets later this month.

Below are key highlights from ANZ Research’s note.

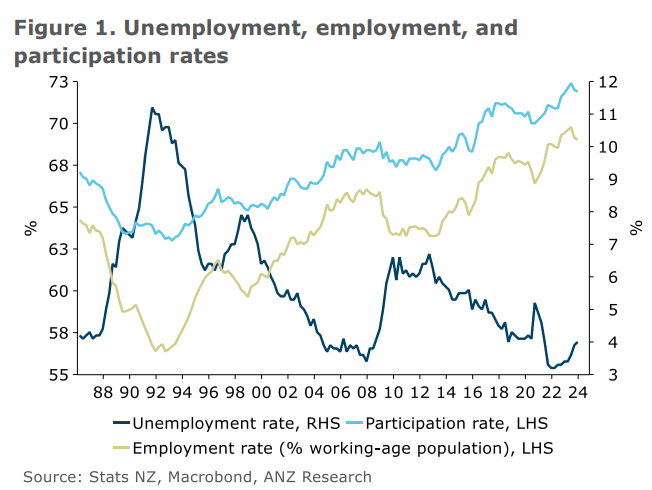

The Q4 labour market data came in stronger than we or the RBNZ were anticipating. The unemployment rate rose from 3.9% to 4.0%, below our forecast of 4.3% and the RBNZ’s forecast of 4.2%.

The underutilisation rate rose 0.3%pts to 10.7% and the underemployment rate rose 0.7%pt to 4.5%, signalling spare capacity continues to emerge, albeit more gradually than expected.

Employment rose 0.4% q/q, stronger than our and the RBNZ’s expectation of a 0.2% q/q lift.

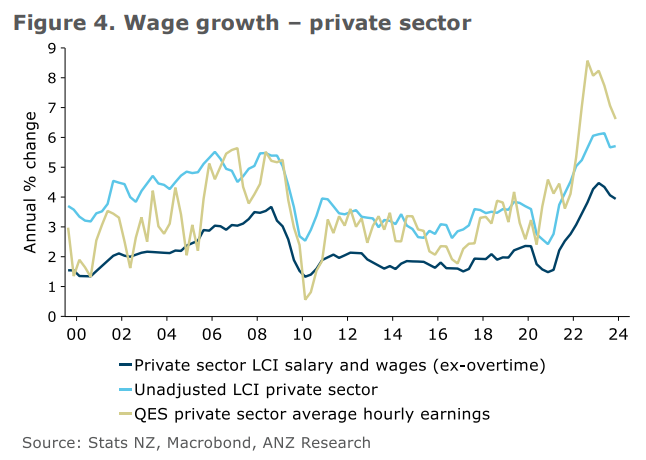

Annual wage growth eased, but by less than we and the RBNZ expected for the key Labour Cost Index measure, and still has a way to go to be consistent with inflation sustainably at target.

Private sector labour costs (productivity adjusted, ex-overtime) lifted 1.0% q/q (3.9% y/y), above our forecast of 0.8% q/q (3.9% y/y). Private sector average hourly earnings (ordinary time) rose 0.5% q/q (6.6% y/y), below our and the RBNZ’s forecast, but this measure is less closely watched.

All up, loosening in the labour market should support a moderation in domestic inflation over 2024, but progress has been a little slower than we and the RBNZ had anticipated.

Our estimates of the RBNZ’s labour capacity suite ticked up slightly, rather than the anticipated loosening.

Forward-looking indicators are mixed but overall suggest ongoing loosening. But the fact is, since the “itchy-trigger-finger” November MPS the RBNZ has had small but unwelcome upward surprises on consumption growth, non-tradable inflation, QSBO capacity indicators, the labour cost index and now labour market capacity indicators.

It’s not been one-way traffic, and things are moving in the right direction overall. But the RBNZ made it clear in November that the right direction of travel isn’t sufficient.

A 25bp hike later this month has become a very real possibility, and RBNZ Governor Orr’s speech on 16 February could raise the market-perceived probability of a hike further (now around 20%, up from 5% before the data)…

While the overall vibe of today’s data was in a hawkish direction, the detail was mixed, and the RBNZ could take a glass-half-full or half-empty view of it.

Slack continues to emerge across the labour market and wage growth is moderating, which will contribute to an easing in domestic inflation across 2024, but at a slower pace than anticipated – and the RBNZ made it very clear in November that their patience was limited…

On balance, we still think the weakening forward indicators will keep the RBNZ from hiking in February, although the chances of a hike have certainly risen with the small upward surprises in the starting point for not only the labour market, but also non-tradable inflation and consumption in earlier data.