The Office of the Chief Economist has done better with commodity forecasting since its institution replaced the Bureau of Research and Energy Economics (BREE).

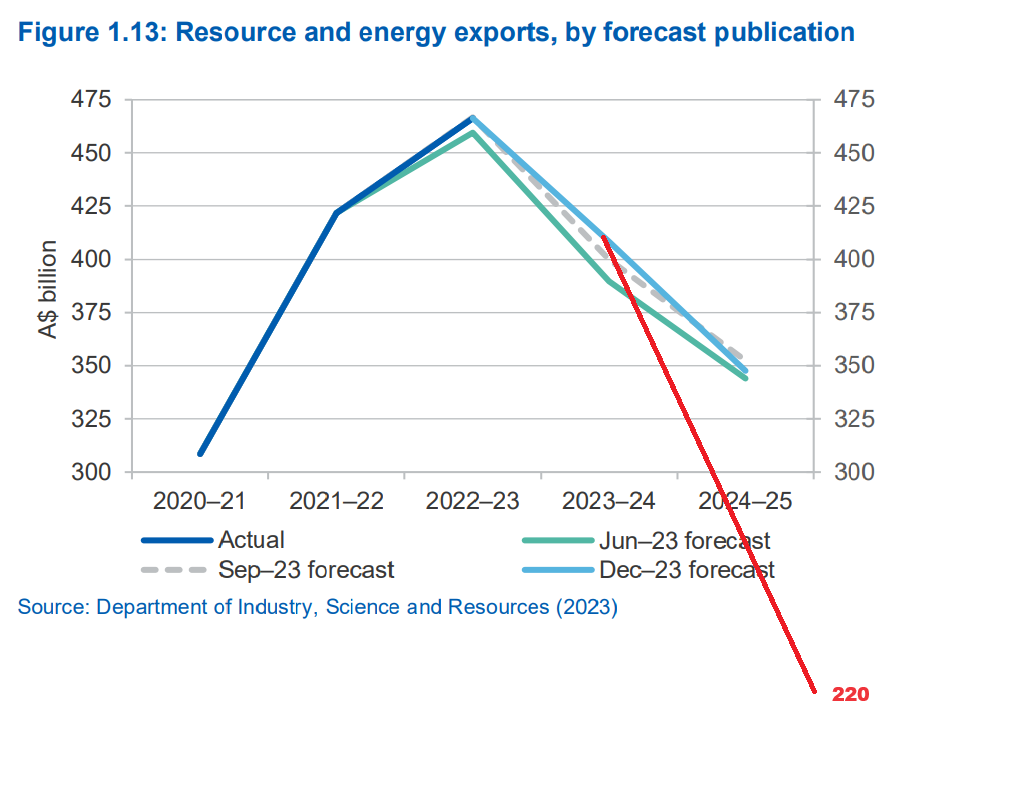

But I fear its latest update falls into the old BREE trap of being too bullish, even though it appears bearish to the naked eye:

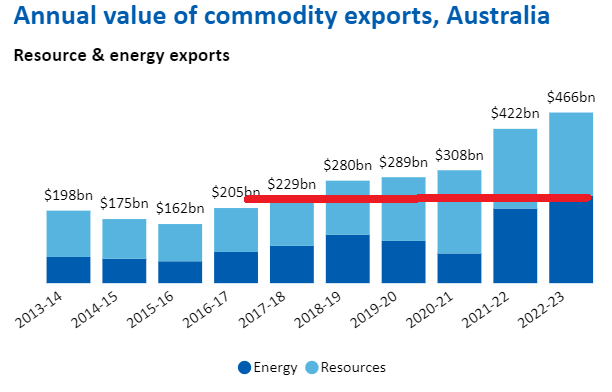

The profile for Australian resource and energy export earnings is little changed from the September 2023 Resources and Energy Quarterl (REQ) report, improving slightly in aggregate. Exports are forecast to be $408 billion in 2023–24, down from a record $466 billion in 2022–23 — when the fallout from the Russian invasion of Ukraine contributed to a major spike in energy prices. Exports are forecast at $348 billion in 2024–25 as prices soften and the AUD/USD lifts.

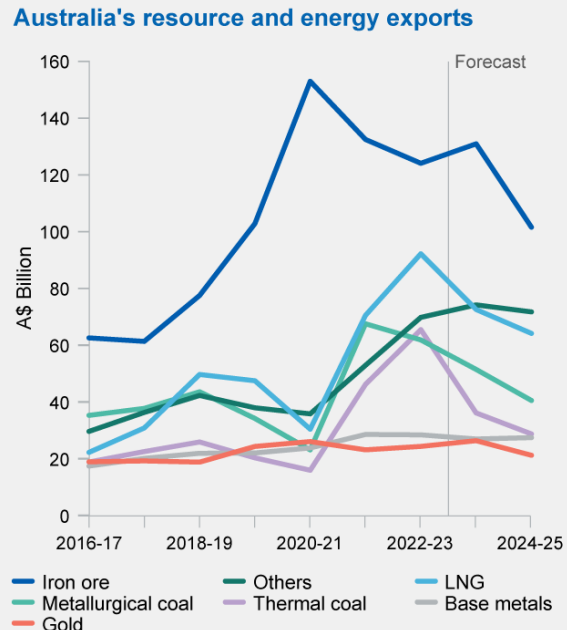

Running through the major commodities:

- The projected iron ore price is not low enough to knock out seaborne marginal production. $80 will be needed in 2024, and assuming the Chinese “competition cliff” steepness as it should, $50 is more likely to be used in 2025.

- Met coal will fall in tandem.

- Thermal coal also looks too high, especially since LNG is about to be glutted beyond belief.

If we plug my assumptions, we get about 90bn less revenue fr the next year.

And it will be much worse in 2026/27 as China keeps slowing and supply keeps coming for iron ore.

My total for that year is more like 130bn lower than the Office:

This would push Aussie dirt earnings back to about 2017 levels. Worse, this time, they would not rebound, given the structural nature of the Chinese construction winddown:

This will be a huge national income shock followed by a long period of stagnant income growth, hammering nominal growth, pound wages, crash inflation, and cut the budget to ribbons.

If we add mass immigration and AI job losses to an economy that runs on labour market expansion, it becomes the type of macro environment in which a nation can tear itself apart.

What we can say for sure, if it comes true, is that it is an economy requiring very low-interest rates and much lower AUD. But even that may not be enough if fiscal policy is that constrained.

We may need RBA yield curve control to prevent complete fiscal retrenchment and dust off universal basic income notions, or similar.

Those worried about inflation today need to start planning instead for how Australia will navigate its way through all of its luck running out at once in the next few years.