Another one bites the dust:

A national building company that collapsed earlier this month owes $29.7 million to creditors.

News.com.au previously reported that a group of companies linked to a major building firm with construction sites spanning across four Australian states had gone into administration and had paused all work.

Rork Projects (Holdings) Pty Ltd, Rork Projects (QLD) Pty Ltd and Rork Projects Pty Ltd specialised in refurbishment for the past 26 years, with 63 current projects across NSW, the ACT, Victoria and Queensland.

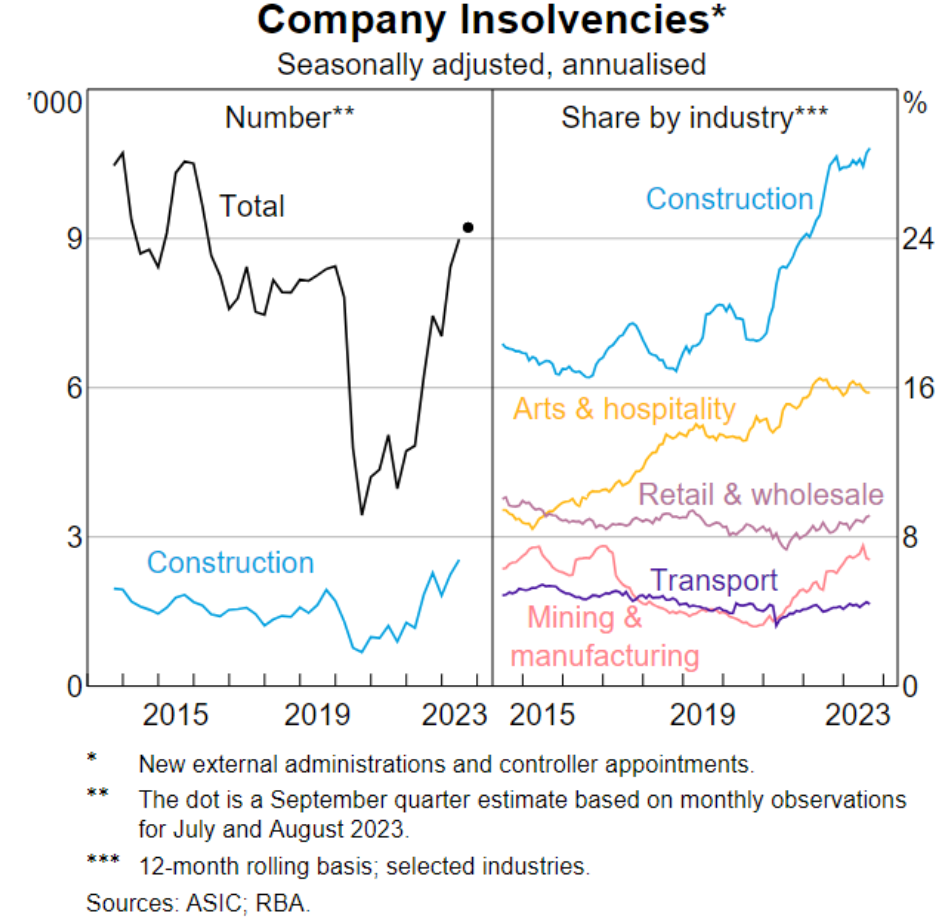

The mounting casualties are apparent in bankruptcy statistics:

I know there is phoenixing going on, but still.

Albo’s construction crisis is taking on the definition of a Chinese-style bust in which public trust in developers is crashing as well.

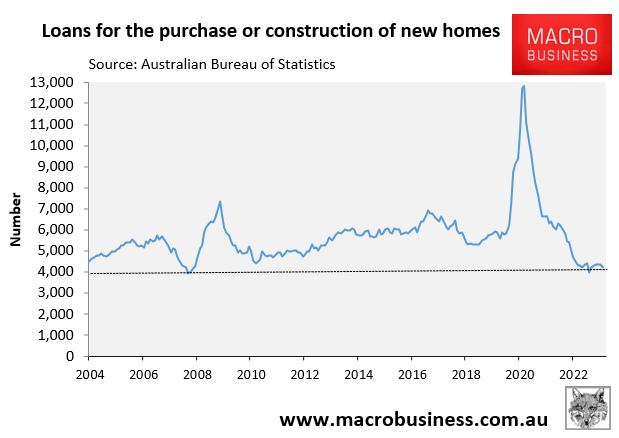

How else do we explain crashing lending for new dwellings?

This is pure macro mismanagement by the Albanese Government:

- overcook immigration to skyrocket infrastructure catch-up building costs;

- exacerbate by enabling an unnecessary energy shock to drive building materials even higher;

- bankrupt builders just as demand soars and

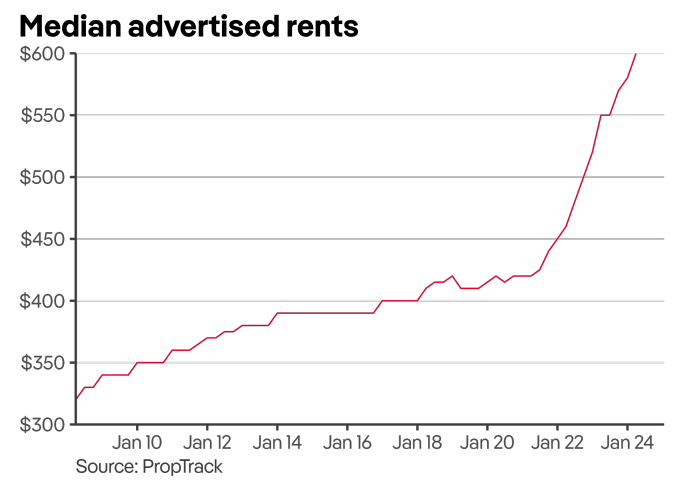

- trigger an unprecedented rental shock for low-income families, youth and the vulnerable.

At least the Chinese communists are using their crisis to make housing access cheaper and more accessible.

Labor is throwing its own support base onto the streets:

Advocates say almost 40-thousand children and young people came to them for assistance in the 2023 financial year… and close to half remained homeless afterward.

They’re meeting with the federal government today to ask for the funds… to help build more than 2-thousand homes for young people.

A neat 20 youths per dwelling.

Third World, indeed.