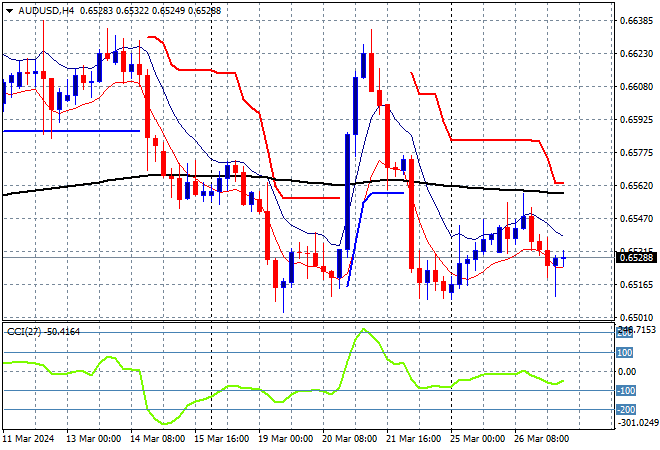

Asian share markets are still in mixed conditions without any large economic catalysts besides the usual macro concerns to push risk sentiment around. Last night’s mixed lead from Wall Street isn’t helping as the USD and bond yields continue their see-saw inversion. The still relatively high USD continues to weigh on the Australian dollar which remains depressed just above the 65 handle.

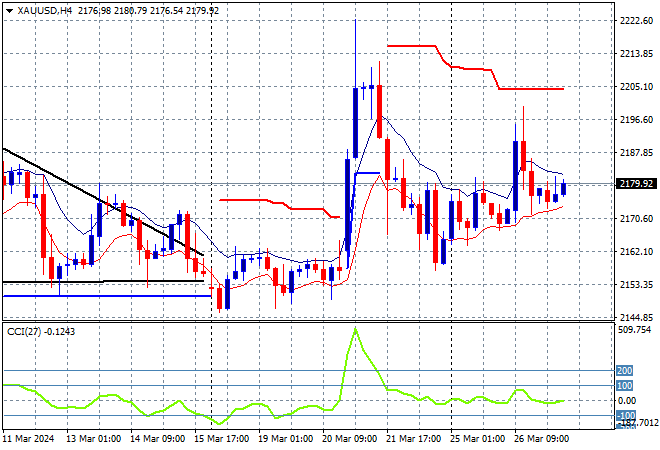

Oil prices are starting to reverse their recent breakout so while Brent crude remains well above weekly resistance, the retracement below the $85USD per barrel level is accelerating while gold has started to regain strength to move up to the $2180 level:

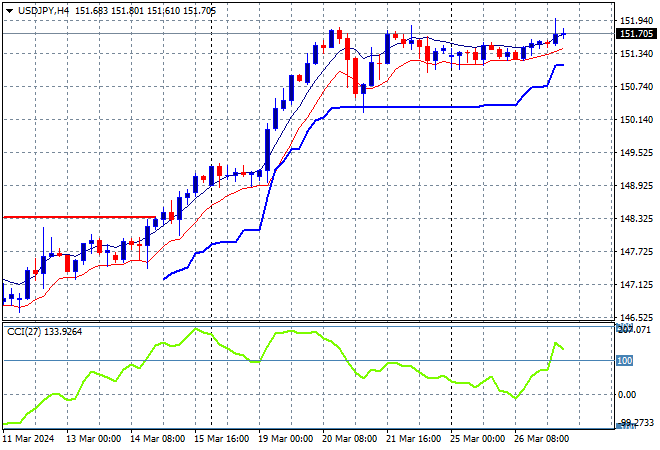

Mainland and offshore Chinese share markets are failing to make a comeback with the Shanghai Composite plunging more than 1% lower while the Hang Seng followed suit, closing nearly 1.5% lower at 16372 points. Japanese stock markets rebounded however, with the Nikkei 225 almost closing 1% higher at 40762 points while the USDJPY pair continues to climb slightly above the mid 151 level:

Australian stocks were the middle of the road performers following the monthly CPI print with the ASX200 closing 0.5% higher at 7819 points while the Australian dollar is just holding on above the 65 cent level after last week’s volatility:

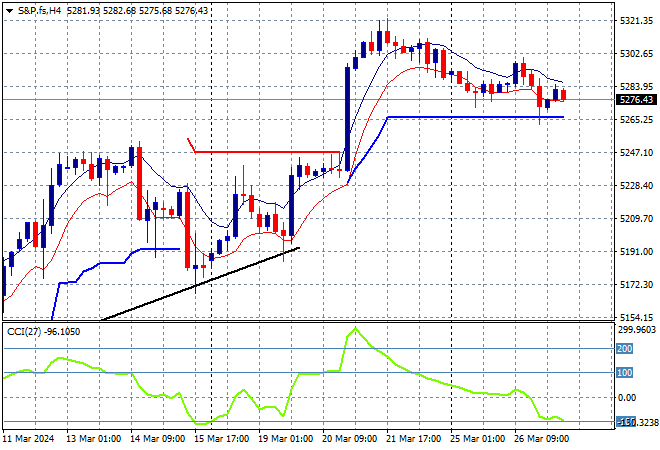

S&P and Eurostoxx futures are barely holding on to their Friday night moves as we head into the London session with the S&P500 four hourly chart showing price action retreating below the 5300 point level with short term support about to come under threat:

The economic calendar quietens down again with a few Fed speeches and tertiary releases.