National treasuries and central banks usually move in lockstep on economic forecasts following consultation and coordination.

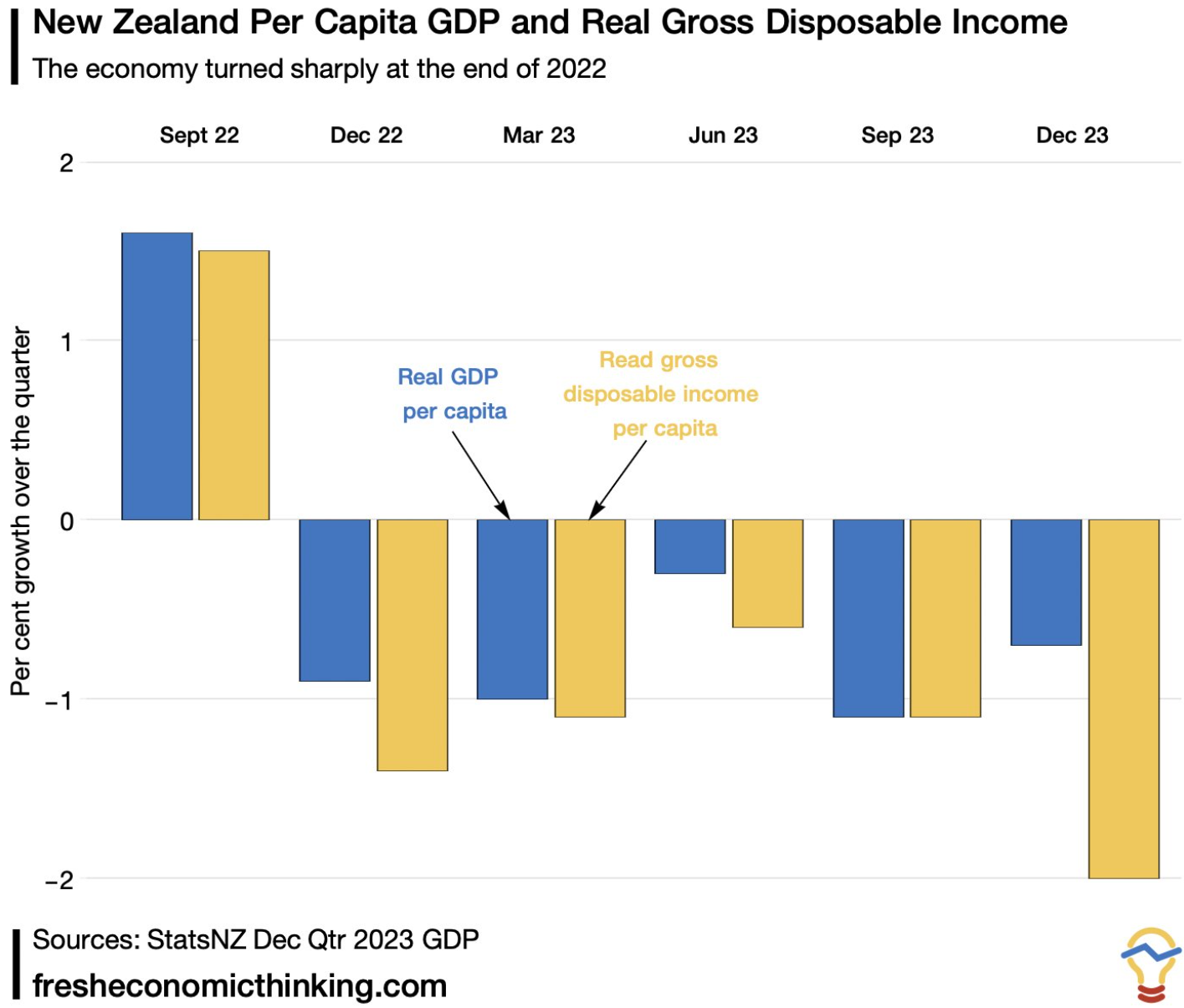

On Wednesday, New Zealand Finance Minister Nicola Willis unveiled the Treasury’s half-yearly update, which slashed the nation’s growth forecast to only 0.1% for 2023-24, from 1.5% in the prior half-year update.

This follows New Zealand’s Q4 GDP unexpectedly falling, alongside downward revisions to earlier data.

The Treasury also slashed its CPI inflation forecast to 3.3% in 2023-24, down from 4.1%.

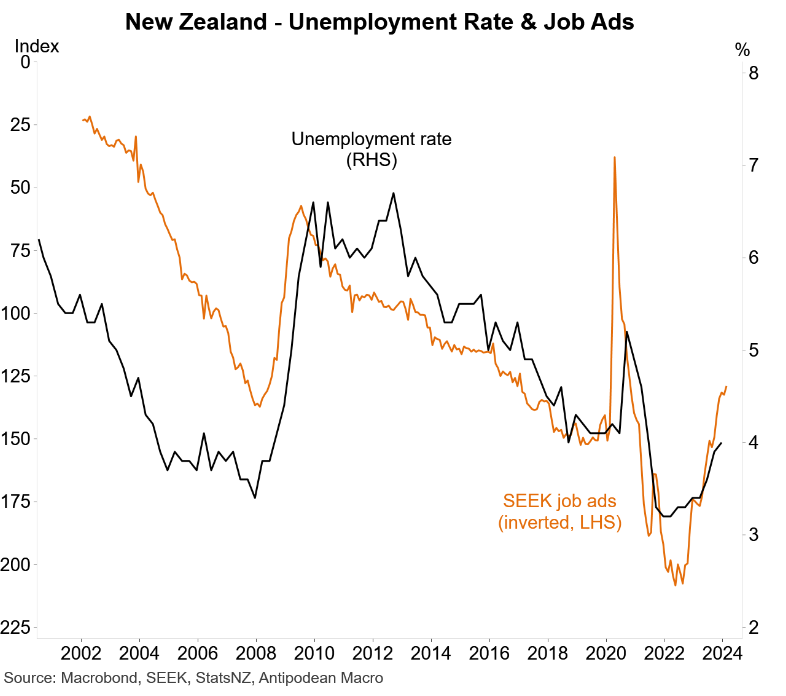

New data from Seek, published by Justin Fabo at Antipodean Macro, showed that the number of jobs newly advertised on SEEK declined in February, pointing to higher unemployment:

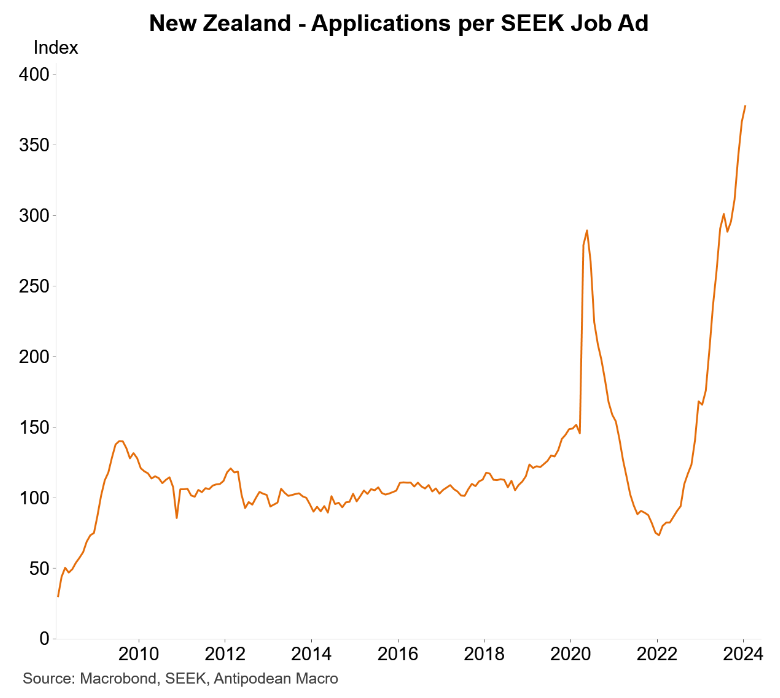

The number of applications per job ad also continued to rocket, reflecting falling labour demand (job ads) and strong supply (record immigration):

Based on the above information, it seems inevitable that the Reserve Bank of New Zealand will downgrade its inflation and growth forecasts, setting the path for rate cuts in the second half of the year.

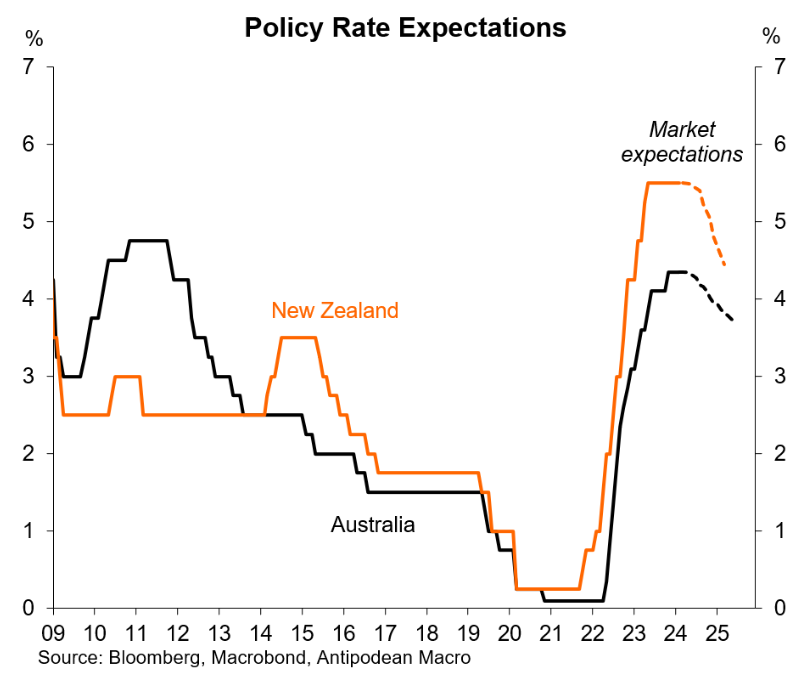

For what it is worth, financial markets are also tipping deep rate cuts beginning the second half: