Let me run you through some of the supposed reasoning for the ongoing iron ore bear market rally:

“The issuance of the special bonds is expected to speed up ahead, while the improvement in steel demand may sustain as construction steel consumption will continue to recover and the manufacturing sector-led steel demand will likely remain resilient.”

Special bonds are typically used to fund infrastructure projects.

The state planner said on Tuesday it would guide local governments to accelerate the progress of project construction and fund use, with analysts at Zijintianfeng Futures anticipating hot metal output to pick up further in the coming weeks.

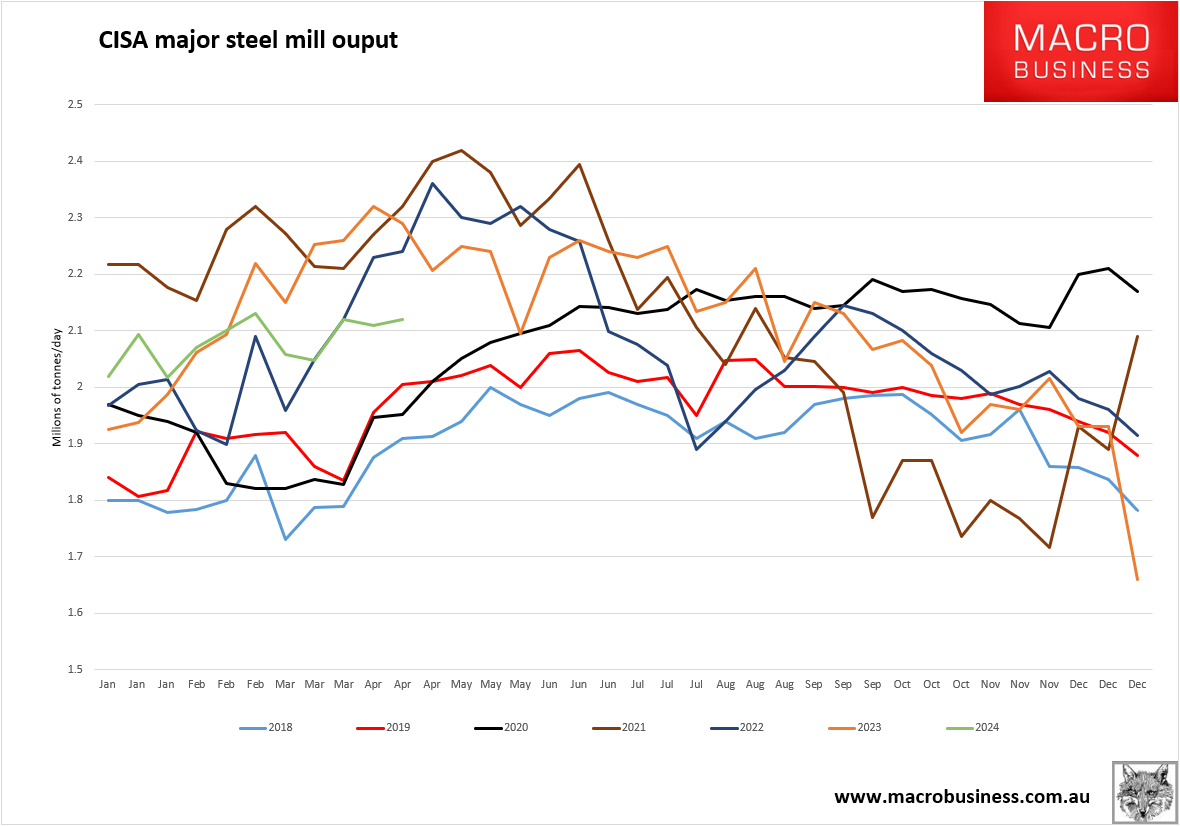

Daily crude steel output among key member mills of the state-backed China Iron and Steel Association (CISA) rose by 0.33% from the previous 10-day period to about 2.12 million tons during April 11-20.

Sentiment was also boosted after Australia’s Fortescue, the world’s fourth-largest iron ore supplier, on Wednesday logged a bigger-than-expected decline in third-quarter iron ore shipments, following a derailment of ore cars and weather disruptions that led to a slight cut in its outlook for annual shipments.

From the top, then:

- special bonds will be needed or demand will fall even more than it has;

- ditto LGFVS

- CISA output is down 7.2% year on year in mid-April and showing no sign of the typical seasonal acceleration:

- Despite lower output, CISA mill steel inventories are up year on year amid lower end-user demand.

- CISA ouptut data is tracking down 2.8% year to date, equating to a fall of 30mt+ steel output in China this year. 50mt less iron ore demand versus 2023.

- FMG missing Q1 targets, like RIO and BHP, means accelerating output for the next three quarters to catch up. Add the new 35mt Onslow hub, opening in a month, and the apparent iron ore supply from Australia alone is about to lift 100mt annualised versus Q1.

Then there is this priceless snippet:

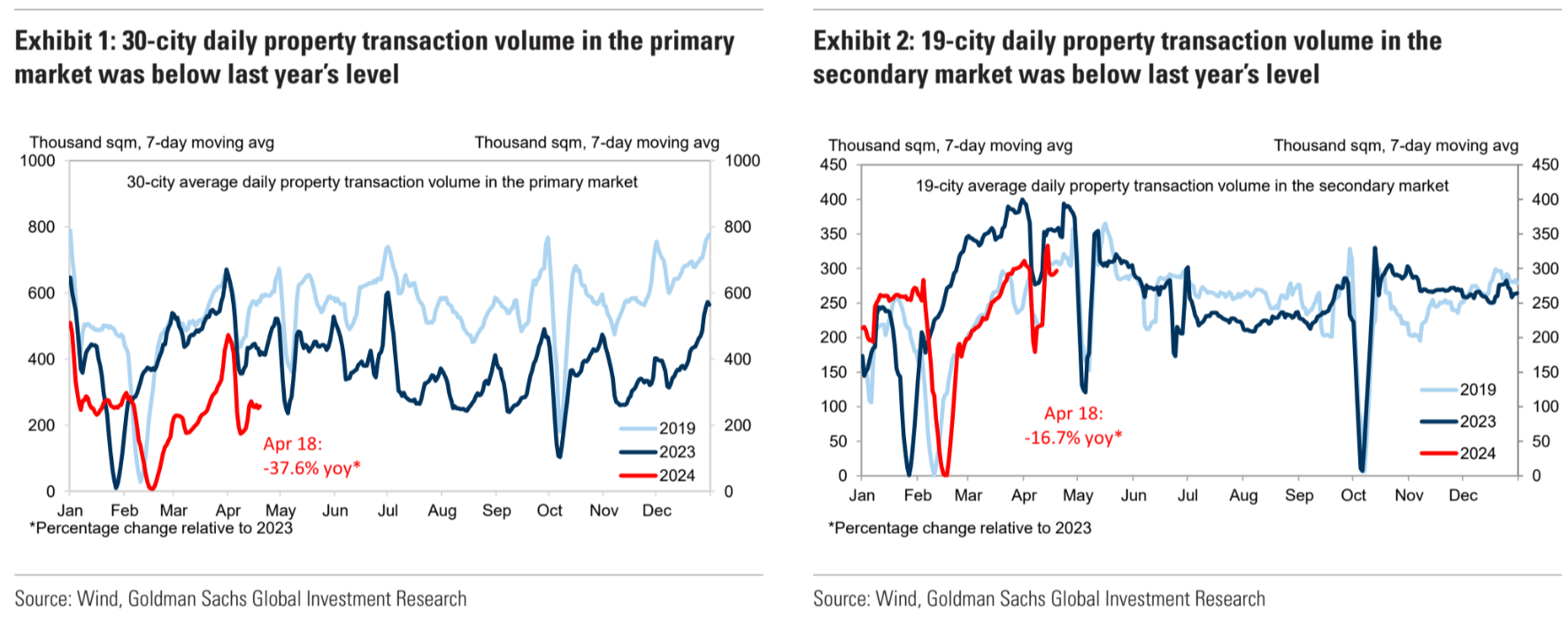

Some optimism over China’s property market also buoyed sentiment. The real estate market is seeing persistent demand and has abundant room for development, driven by improving living standards and urbanization, the official Economic Daily said in a commentary.

More help for property owners emerged in Shenzhen in southern China. Thirteen developers agreed to allow homebuyers to cancel purchase agreements if they fail to sell their existing residences within 90 days.

Sales are not lifting, and the cancelled building agreements do not mean more construction:

In short, everything quoted as a bullish reason for what is nothing more than speculative buying is a fundamental negative for the iron ore price.

When you get this level of stupid being roundly quoted as wisdom, it’s a good signal we’re near the top:

Dalian Commodity Exchange said on Wednesday trading volume of opening long and short positions on iron ore futures contracts to be delivered in May and September of any non-futures company member or client shall not exceed 500 lots from April 26.

The trading volume of opening positions on the other iron ore futures contracts shall not exceed 2,000 lots on any single day, the bourse added.