Get ready for an outright recession if this comes true:

After several months of hotter-than-expected data, Mr Hogan has jettisoned his forecast for the RBA to stay on hold until early 2025 and then deliver a rate cut.

Instead, the veteran economist now expects 0.25 of a percentage point rate rises at the RBA’s August, September and November board meetings. That would take the cash rate to 5.1 per cent.

“Everything points to the fact that 4.35 per cent isn’t the right level for the cash rate,” he told The Australian Financial Review.

Mr Hogan deserves a hearing. He has done better than most in recent months, including myself. And after four months of no inflation progress, Albo’s crushflation looks sticky.

However, there are a couple of flies in Mr Hogan’s ointment.

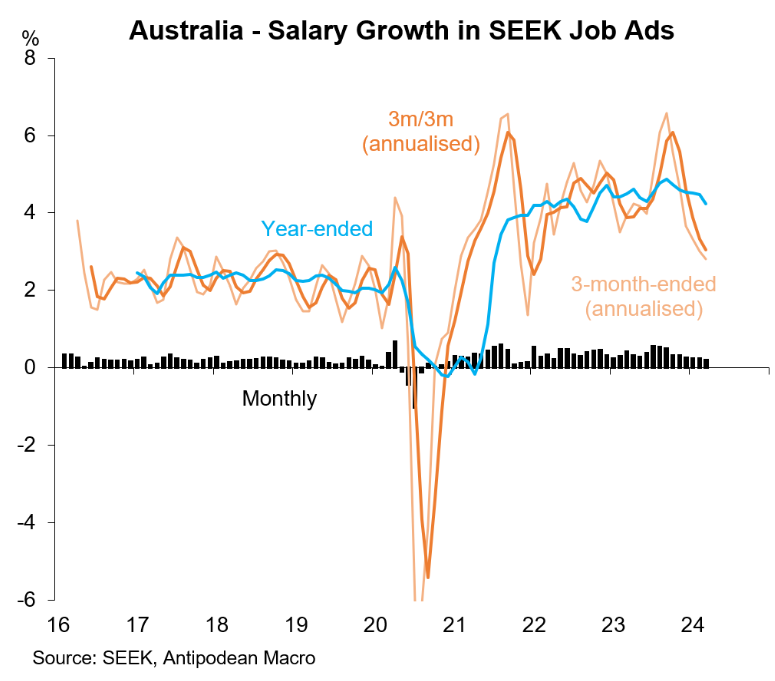

The first and largest is falling wage growth. All leading indicators show it is upon us. SEEK suggests we are already deep into the 3% range and decelerating towards a 2-handle fast:

This makes sense in Albo’s Great Crushflation. Everything is in shortage except cheap foreign labour.

Services inflation will hit affordability constraints as wages fall and roll lower in concert. Even rents traditionally follow this pattern, hence the old saying “you can’t leverage rent”.

Second, with little prospect of rate cuts in 2024 now, the consumer will not come out of her bunker. House prices may also slow.

Third, goods deflation is still rampant as a substantial offset.

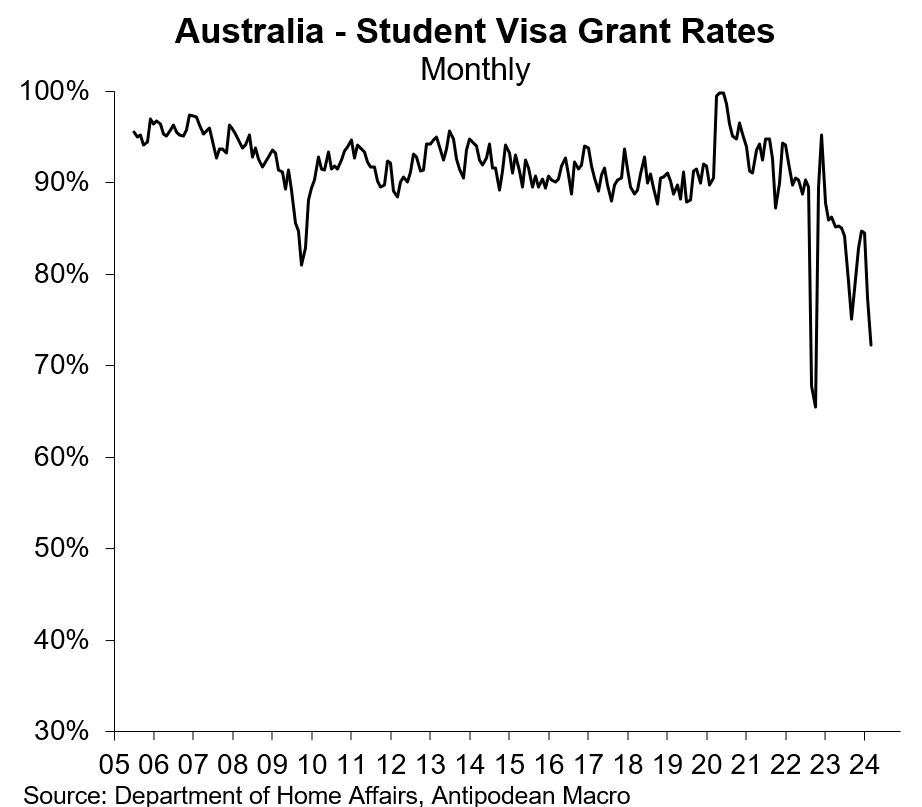

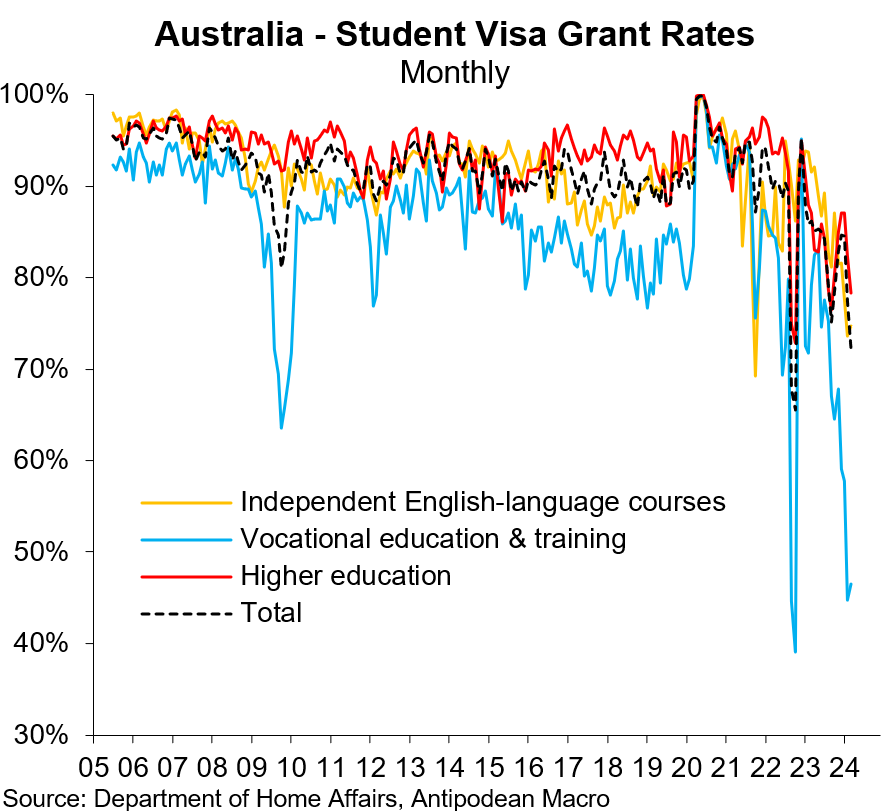

Fourth, even Albo the Destroyer must see he has to slash immigration with great urgency now. It has begun but must accelerate dramatically. Justin Fabo:

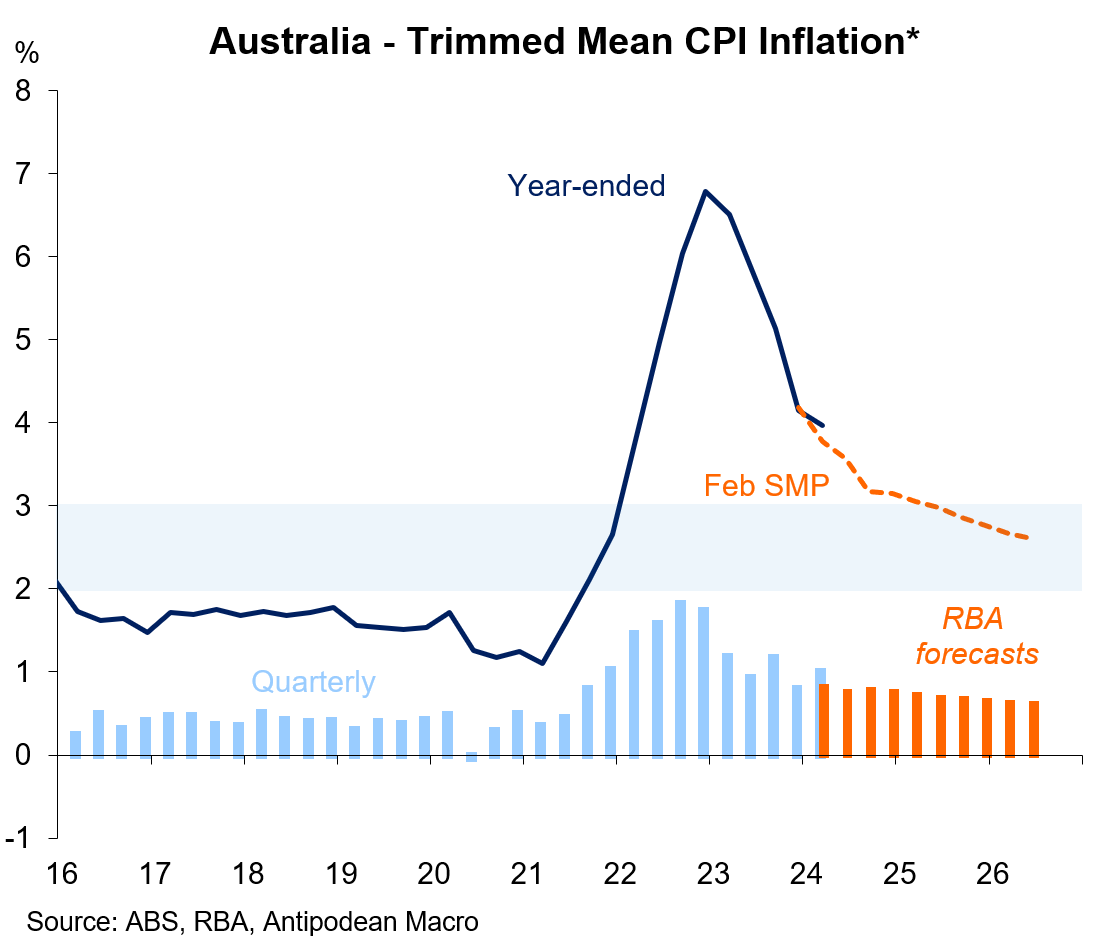

Finally, the RBA’s outlook is still roughly on track:

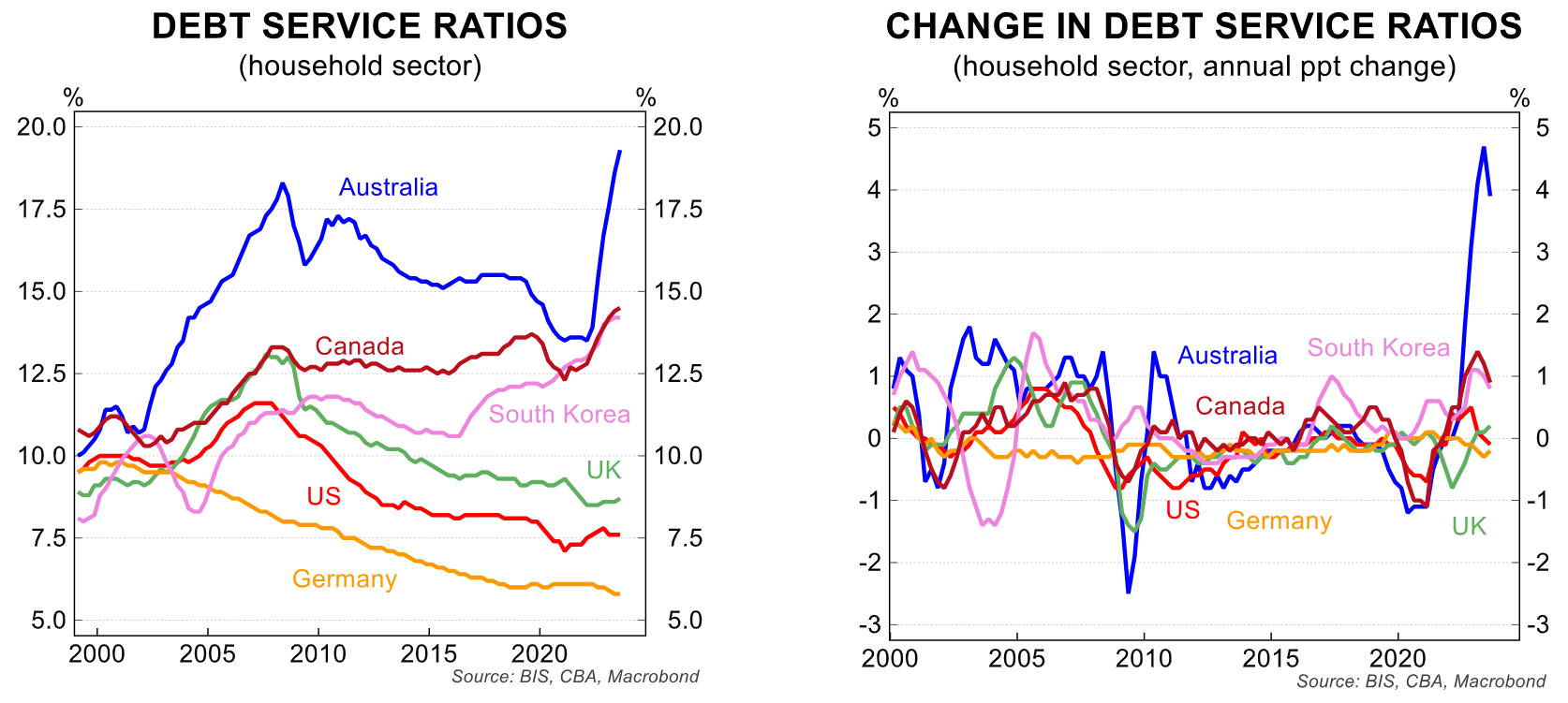

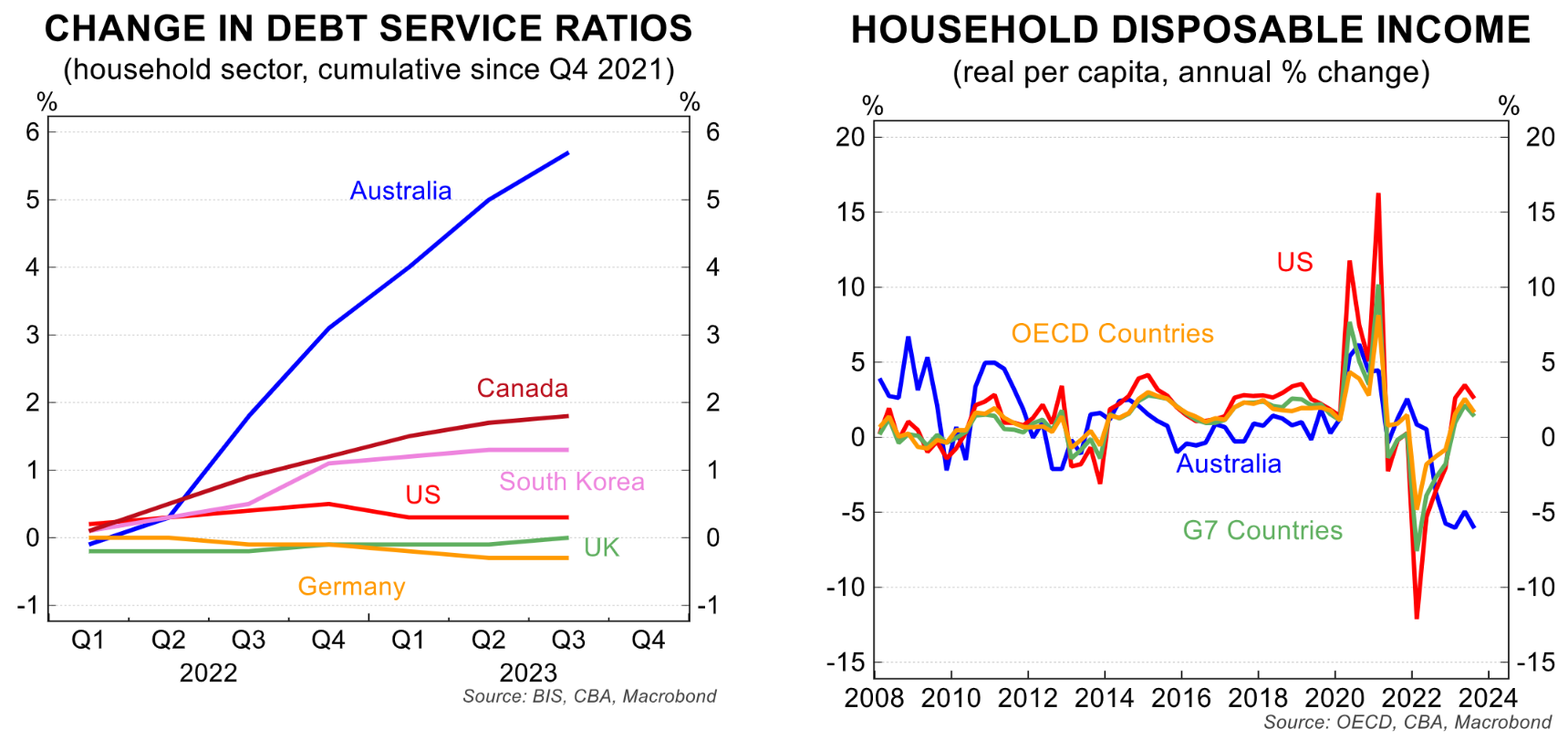

I don’t think the RBA is off track enough to pivot to the total destruction of household well-being:

After a dovish December, I got cocky. Mr Hogan may have caught the same disease.