Shanghai rebar lifted a little, as did SGX:

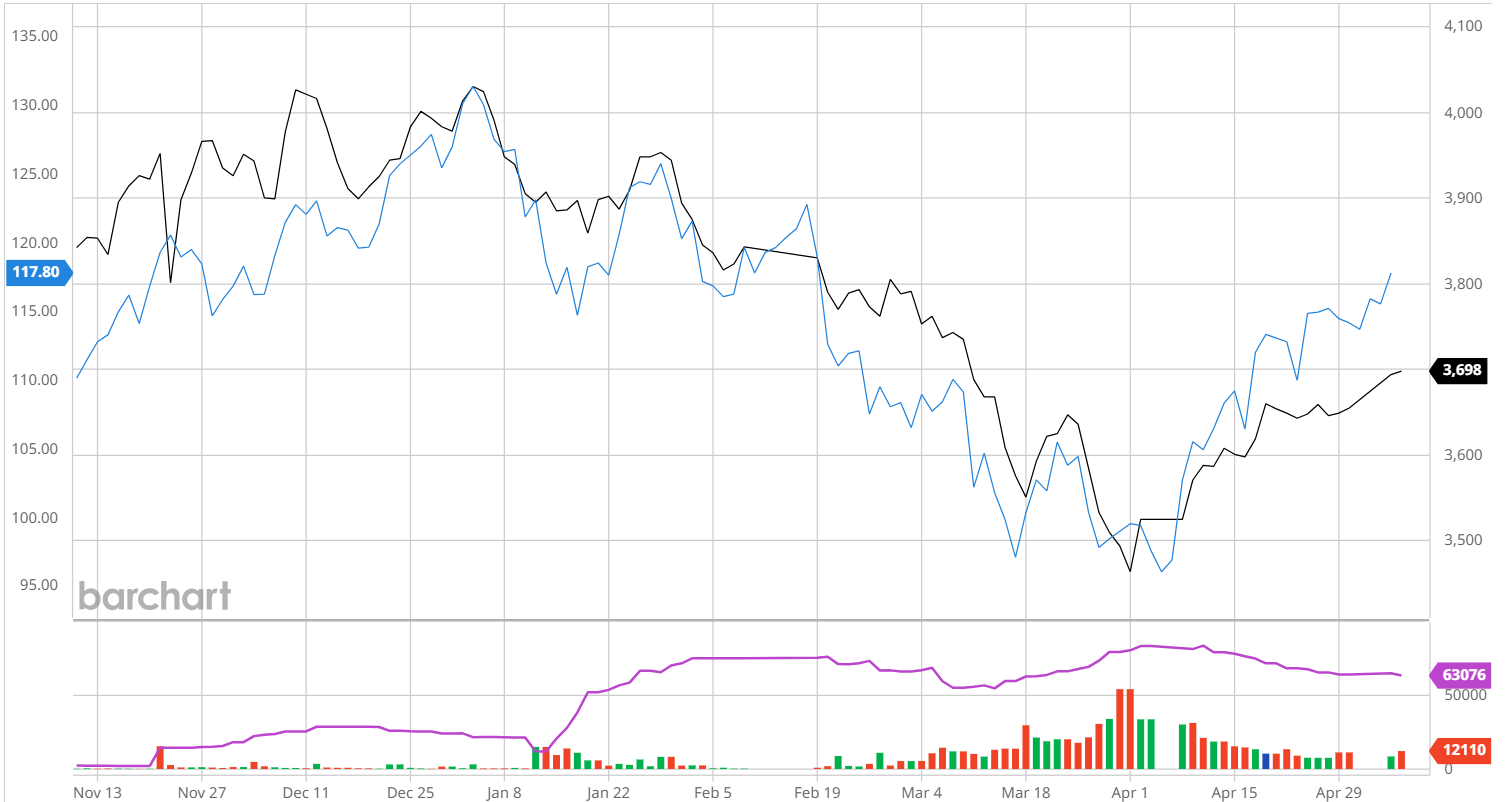

Dslian still lokks toppy:

Goldman is slowly turning bearish:

Goldman Sachs says iron ore demand will plateau over the next two years, with seaborne iron ore demand to lift barely in 2024 from 1.567Bt last year to 1.573Bt.

That will match supply exactly, leading the market to swing from a 17Mt deficit in 2023 to near perfect balance in 2024, with prices forecast to average US$110/t.

By 2025 seaborne iron ore demand will fall to 1.56Bt while seaborne supply will rise to a five-year high of 1.594Bt, leading to a 34Mt surplus, something that will be foreshadowed on GS’ numbers by a 44Mt surplus in the fourth quarter.

That comes with global crude steel production expected to lift only slightly from 1.856Bt in 2023 to 1.865Bt in 2024, below the 2021 record of 1.926Bt, and Chinese crude steel production expected by GS to fall below 1Bt for the first time since 2019.

But, then, GS is usually the last to know when it comes to iron ore. I predict 3% fall in output every year hence and massive increase in supply.

The usual scuttlebutt is ding the rounds:

China’s Politburo said in a readout on April 30 that authorities should conduct research on policies and measures to reduce housing inventory in order to prevent and diffuse risk in the real estate market, stoking hopes for further stimulus.

“There will still be a certain increase in demand in the future, and the supply and demand of iron ore will be strong,” analysts from information provider Shanghai Metals Market said in a note.

If Beijing buys and completes the project, then nothing has changed. If Bejing buys and demolishes, then iron ore is done as recycling surges.