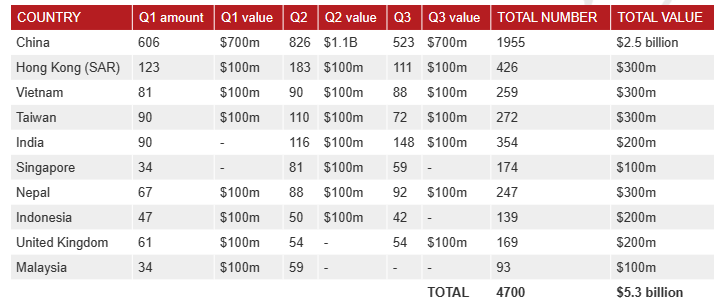

According to new data released by the Federal Treasury, foreign investors purchased over 4700 properties in the first three quarters of 2023 valued at 5.3 billion:

Source: The Daily Telegraph

Chinese investors led the way, purchasing 1955 homes worth an estimate $2.5 billion in value.

Simon Cohen, the founder of Australia’s largest residential property buyer’s agency Cohen Handler, noted that international investors rush to Sydney in droves because: “It isn’t just a beautiful city with prime real estate, it is a city with evidence of incredible investment returns”.

“Sydney is the perfect place for overseas buyers to park their money”.

“(But) some international buyers are offering millions over the market value and that affects the market in a bad way”, he said.

A fortnight ago, Domain reported on “Sydney’s run of ridiculously expensive secret sales” to Chinese buyers.

“Still with Sydney’s run of ridiculously expensive secret sales, the Killara home of oncologist Dr Sally Baron-Hay and Jamie Woodhill, of the Patrick stevedores founding family, has sold off-market for $15 million to little-known cash buyer Qiuqin Li”.

Anyone that denies that foreign buyers are inflating the market only needs to examine the absurd sale prices being achieved by some Sydney homes.

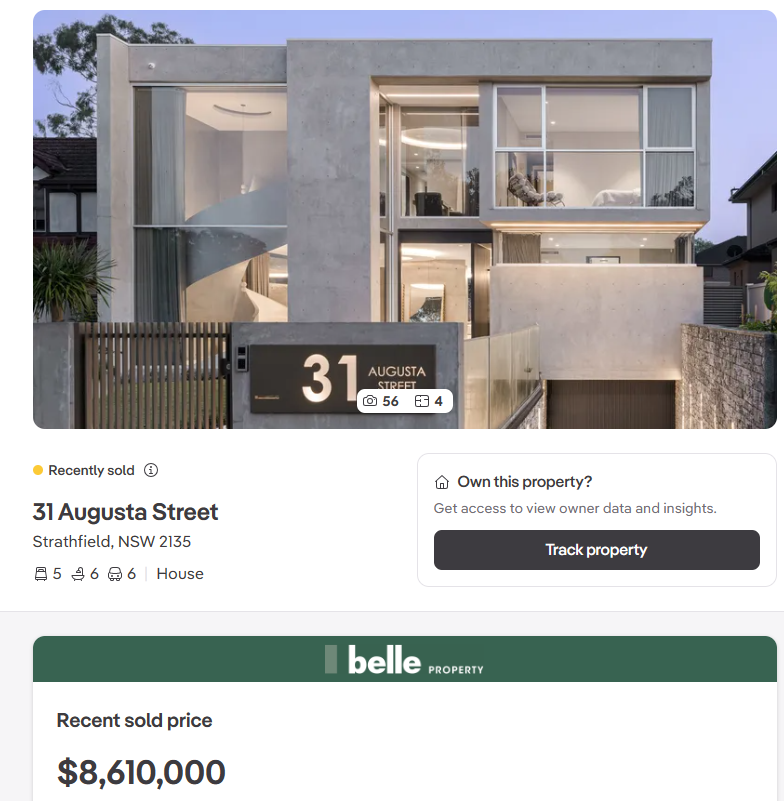

For example, consider the following record-breaking auction of a home on a 700sqm block in Strathfield, which sold to a Chinese buyer for $8.6 million:

Congratulations to the new buyers of this $8,610,000 home just a 30min stones throw inland from the Sydney CBD. The government eagerly awaits the $533k stamp duty check in the mail. pic.twitter.com/j2qVL7SJxK

— Reserve Bank of Property (@RBASHAGGER) April 20, 2024

Below is the house. It is nice. But not $8.6 million nice.

In a similar vein, the head of private Chinese-Australian property development company Megland Group, Xia Meng and her partner Weixi Xie, purchased the below waterfront house in Five Dock for $10.35 million:

It is a similar story elsewhere in Australia.

In March, The AFR reported on a Chinese FIRB-approved temporary migrant that outbid locals by $1 million for a Miami-style mansion in Mermaid Waters:

A Gold Coast real estate agent described the boom in Chinese cash buyers, which is lifting prices.

“I have noticed in the last six months the influx of Chinese buyers at auctions and buying has been as high it was pre-COVID. They’re definitely getting access to cash and repatriating it to Australia”, the agent said

“They seem to be getting it out more easily than I originally thought. I thought it was lot more complicated”

“There are multiple cash buyers we’re seeing. I’m only talking about the luxury end of the market”.

David Bassanese also questioned why Australia does not impose stricter rules on foreigners buying local homes:

The article that Bassanese alluded to was instructive.

“Wealthy Chinese buyers are taking private jets to Melbourne to purchase mansions in Toorak – the city’s most expensive suburb – on the spot, says Toorak buyer’s agent Alex Bragilevsky”.

“Mr Bragilevsky… says 90% of the work he now does is for Chinese buyers”.

“I’ve facilitated $135 million of real estate deals [in Toorak] in the past six months”, he told The AFR. “All these buyers were Chinese”.

“The Chinese will pay over the odds for single dwellings”, he said.

PropTrack research director Cameron Kusher played down concerns, arguing that foreign buyers do not impact first home buyers.

“International investors are buying up higher-end property, out of reach of first-homebuyers”, he said.

“International investors are not impacting the lower end of the market”.

“Australia is a popular destination for international investors, but these overseas buyers are not impacting the market”.

Rubbish. As shown in the table above, the average purchase price was $1,127,659. Therefore, foreign buyers are not just buying up trophy homes (although there is certainly some of that).

Second, if a foreign buyer purchases an above-median priced home, it will force would-be local buyers down the price ladder, adversely impacting first home buyers.

As David Bassanese asked above, why does Australia allow temporary migrants to purchase established homes?

Moreover, why is Australia running the most aggressive immigration policy in our history in a supply-constrained market?

Australian real estate has become a magnet for global buyers, particularly wealthy Chinese.

As a result, Australian homes are no longer for Australians.