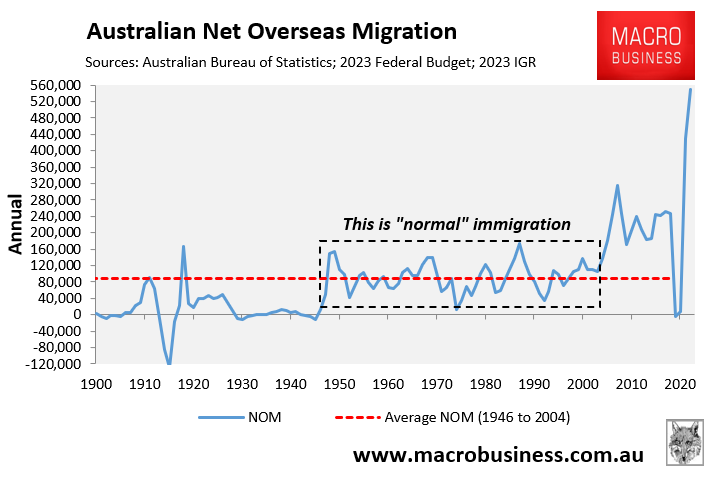

At Tuesday’s monetary policy conference, RBA governor Michele Bullock claimed that the federal government’s extreme immigration has had minimal impact on CPI inflation.

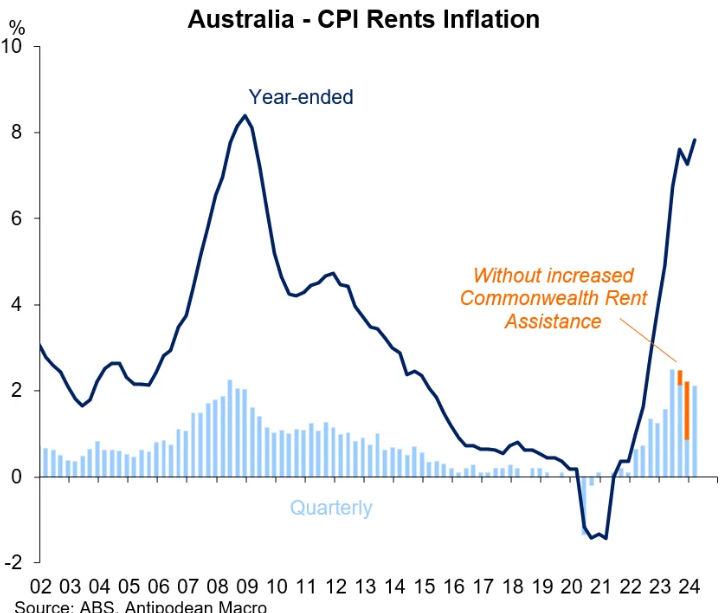

Bullock claims that while immigration has driven up housing inflation (accounting for 22% of the CPI basket), it has also lowered wage growth. So, the impact on inflation has been muted:

Transcript:

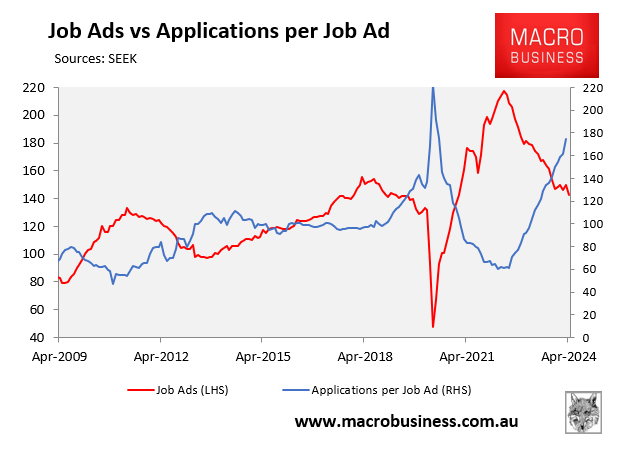

“New migrants add to demand and there’s been that element of it. They are certainly adding to pressure on the housing market. We know that. But on the other hand, they’ve added to labour supply”.

“One of the biggest complaints that I used to hear from businesses during the pandemic and during the border closures was they couldn’t get people. They couldn’t get staff”.

“And even as we we coming out of those circumstances, you’ll remember the labour market was so tight – businesses just could not get workers. So, they’ve added to the supply side of the economy as well”.

“So, I think our judgment is that, on balance, it really hasn’t added dramatically to inflation, with the exception that it has put big pressure on the housing market and that’s obviously working its way out in rents”.

Even if Bullock is correct, which I don’t believe she is, this is an unmitigated disaster for working-class Australians.

Their wage growth has been lowered through immigration, while their living costs – most notably rents – have been driven higher.

Full employment and low inflation are the two obligations the RBA has. Extreme levels of immigration are not its business and it works against both.