Goldman with the note.

BOTTOM LINE:The Federal Reserve’s April 2024 Senior Loan Officer OpinionSurvey—conducted for bank lending activity over the first quarter of this year—reported that standards for commercial and industrial (C&I) loans tightened at a similar pace to the prior quarter, while a smaller share of banks reported tightening standards for commercial real estate (CRE) loans.

Demand for C&I loans in 2024Q1weakened on net by around the same as during 2023Q4.

On the household side,banks’ willingness to lend to consumers improved substantially. Credit standards tightened on net for most residential real estate loan categories but by less than in the previous quarter.

The portion of banks tightening credit standards decreased for credit card applications but increased for auto loans. Demand weakened for all residential real estate loan categories and weakened for credit card loans and autoloans on net by slightly more than in the previous quarter.

Lending standards for commercial and industrial (C&I) loans tightened again in 2024Q1 at a similar pace to the previous quarter.

According to the SLOOS, the share of banks tightening lending standards for C&I loans to large firms edged up from 15% in 2023Q4 to 16% in 2024Q1. The number of banks tightening lending standards for small firms also increased slightly from 19% to 20% on net.

As we discussed previously, while the SLOOS survey is phrased in terms of changes in lending standards, the index is more correlated with the level of financial conditions than changes in financial conditions.

Just as it is changes in financial conditions that matter for growth, it is changes in the SLOOS that matter for growth. 2. 14% of banks on net widened spreads of loan rates over the cost of funds for large firms (vs. 31% on net in the previous quarter), while 20% on net widened spreads for small firms (vs. 35% on net in the previous quarter).

Most banks continue to cite a worsening economic outlook as the main reason they tightened lending standards. For banks that tightened credit standards or terms for C&I loans or credit lines, 85% cited a less favorable or more uncertain economic outlook as playing a role (vs. 79% last quarter); 68% cited reduced tolerance for risk (the same as last quarter); 52% cited a worsening of industry-specific problems (vs.44% last quarter); 46% cited increased concerns about the effects of legislative changes, supervisory actions, or changes in accounting standards (vs. 43% last quarter); 31% cited a deterioration in their current or expected liquidity position

50% last quarter); 28% cited less aggressive competition from other lenders (vs. 61%last quarter); 27% cited decreased liquidity in the secondary market for these loans (vs.43% last quarter); and 19% cited a deterioration in their bank’s current or expected capital position as playing a role (vs. 36% last quarter).4. Demand for C&I loans weakened on net in 2024Q1 by around the same as during2023Q4. 27% of banks on net reported weaker demand for C&I loans for large and medium-market firms, compared to 25% in the previous survey. 23% of banks reported weaker demand for C&I loans from small firms, compared to 22% in the previous quarter.

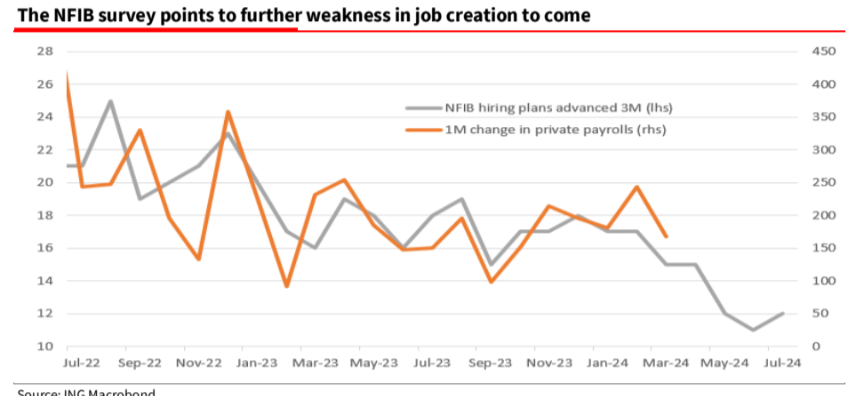

I am beginning to wonder if the hard landing (or at least a softish landing ) will resume shortly, led by SMEs

The NFIB data does lean a little Republican at times. But that chart is more like falling over into the election.