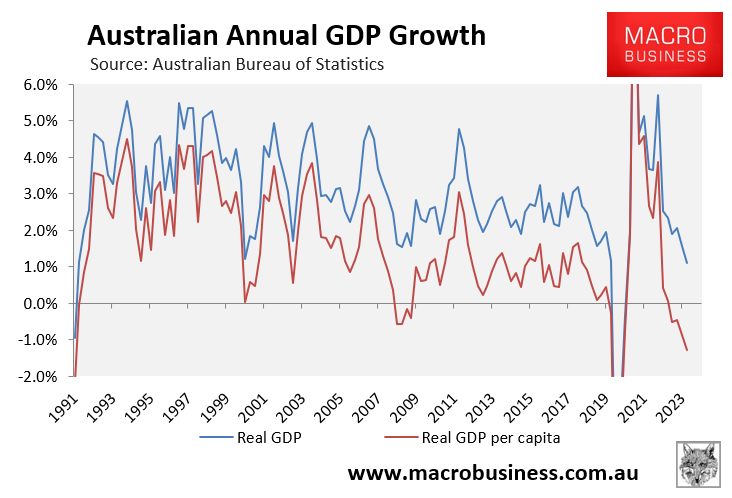

Recall that the Q1 2024 national accounts revealed that Australia’s headline and per capita economic growth fell to their lowest level since the early 1990s recession:

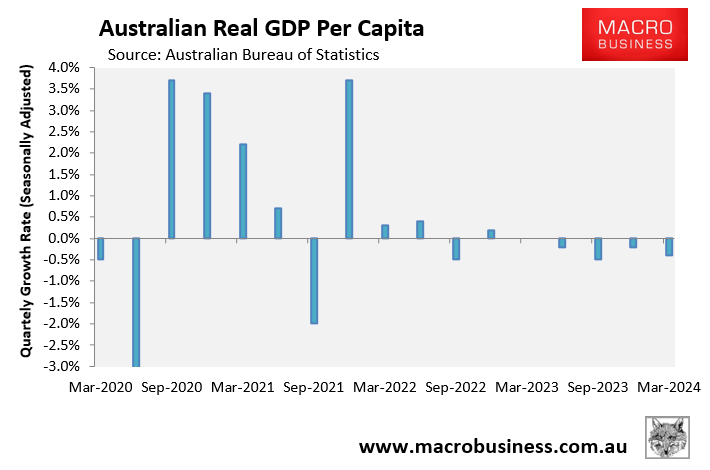

Real per capita GDP growth fell for the fifth consecutive quarter to be 1.3% lower than December 2022:

Australia’s real per capita GDP in Q1 2024 had also fallen to the same level as December 2021, meaning Australians have experienced zero improvement for nine quarters.

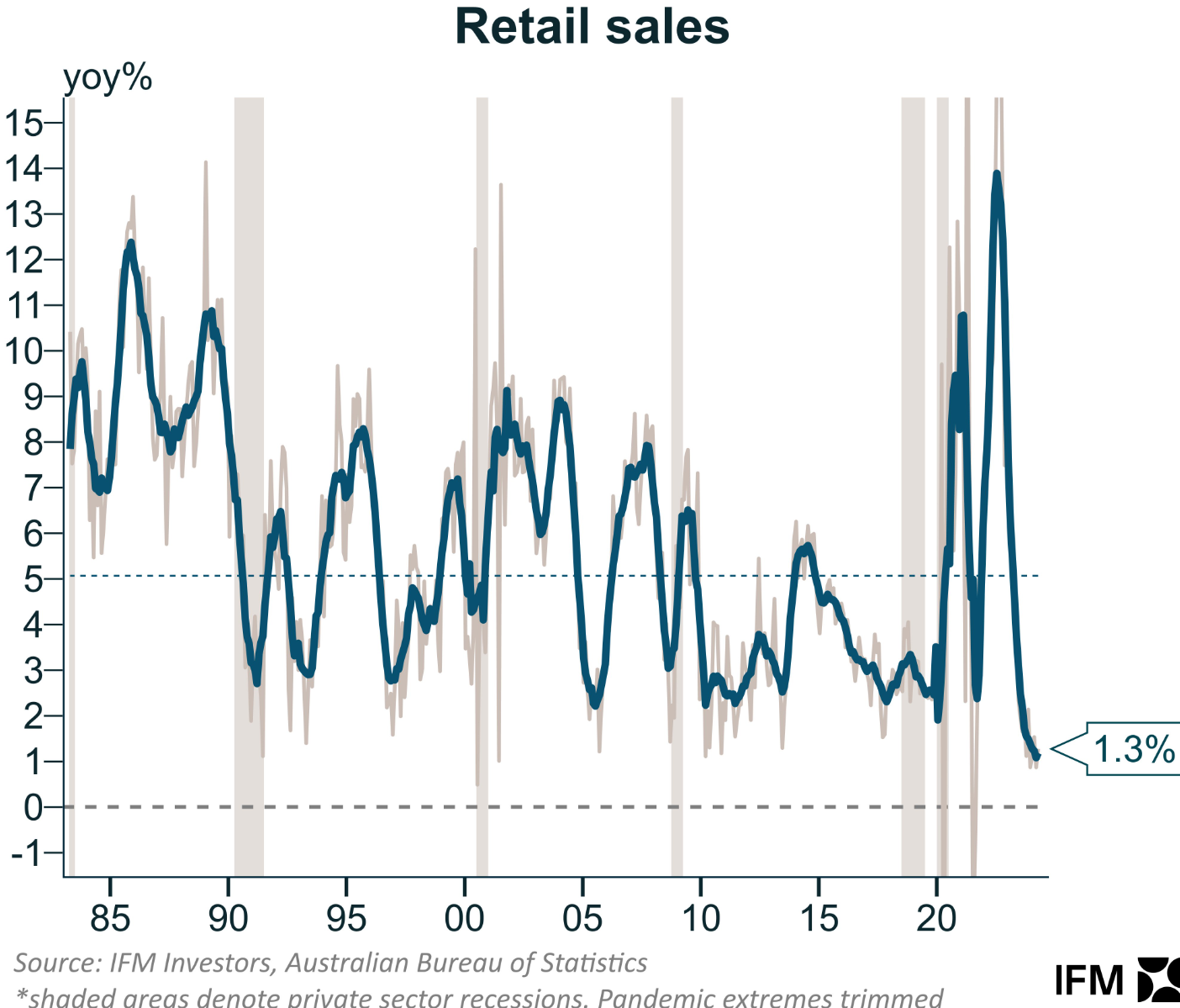

The decline in GDP is reflected in retail sales, which also fell to their lowest level in more than 30 years outside of the pandemic lockdown:

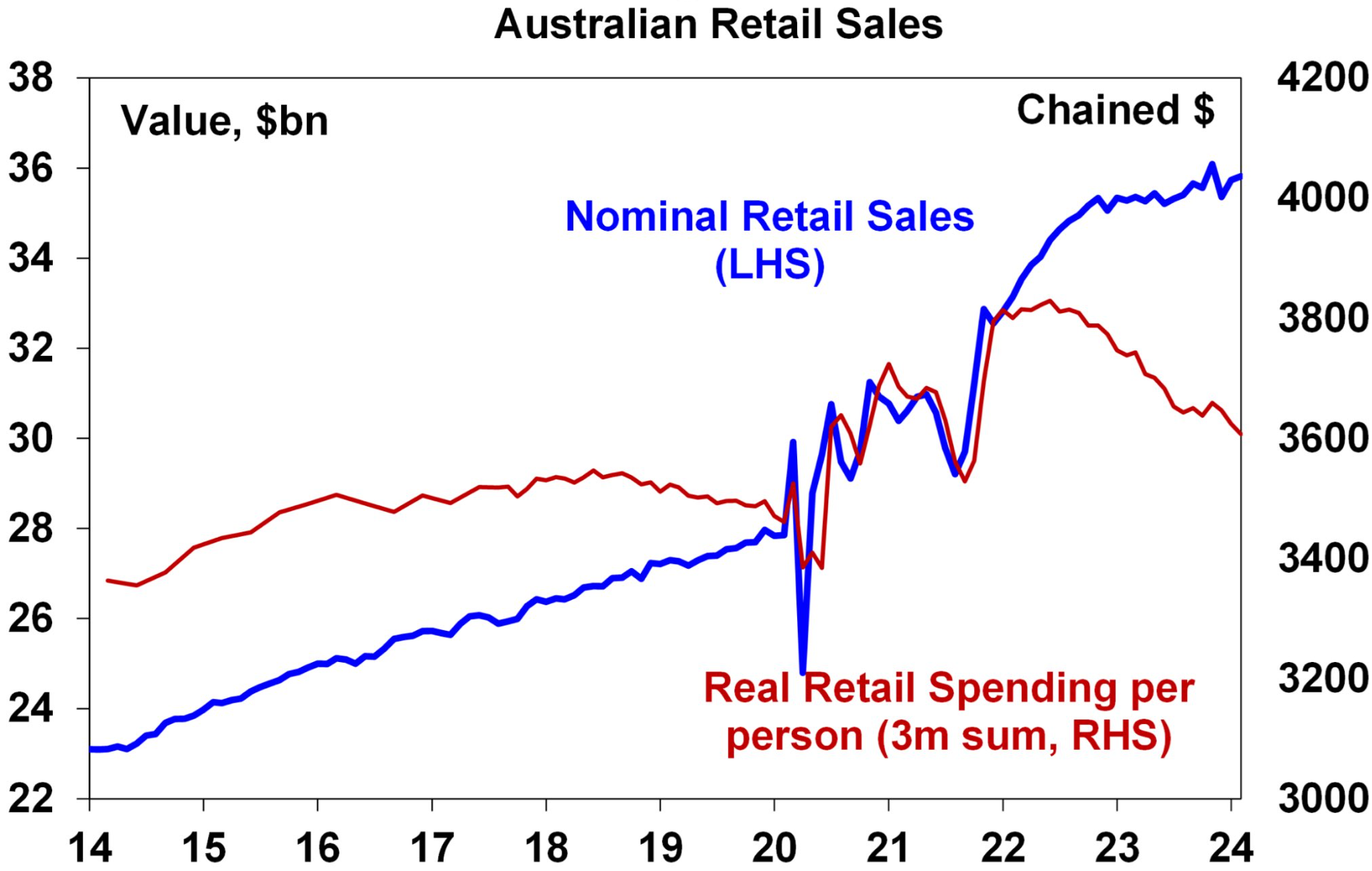

In real per capita terms, retail sales had plummeted by around 4.5% in the year to April:

Source: AMP

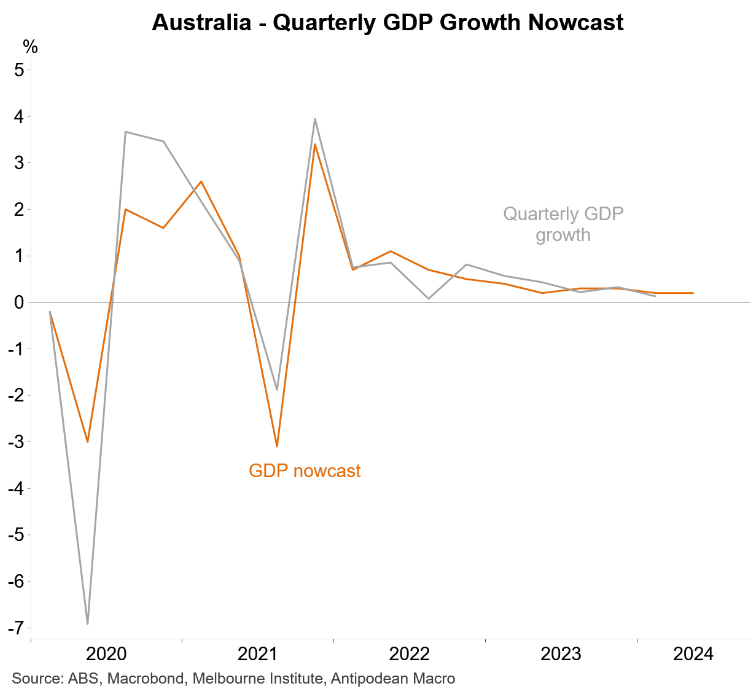

On Thursday, the Melbourne Institute published its Nowcast for Australia’s GDP growth, which is presented below by Justin Fabo at Antipodean Macro:

The Melbourne Institute Nowcast estimates that Australia’s GDP growth is tracking at 0.2% for the June quarter, which is well below the circa 0.5% population growth anticipated.

Accordingly, Australians are set to endure a sixth consecutive decline in real per capita GDP when the ABS releases the Q2 national accounts.

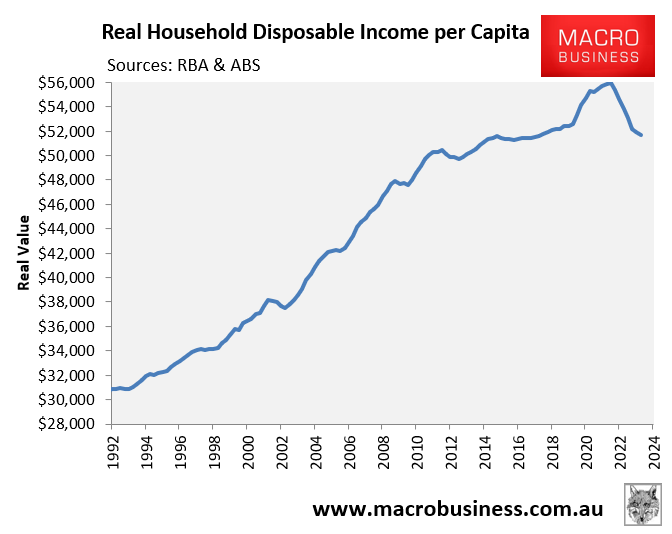

This decline in GDP is being driven by the household sector, which continues to struggle with high interest rates, rents, energy prices, personal income taxes, real wage declines, and general cost-of-living pressures.

The pressure on households is best illustrated by the sharp fall in real per capita household disposable incomes, which have declined by 7.6% from the June 2022 peak in annual terms to be tracking around 2018 levels:

While the household sector will receive some relief from the upcoming Stage 3 tax cuts, much of this relief will be undone if the Reserve Bank chooses to raise interest rates.