In this week’s post, I’ve undertaken a detailed analysis of one of the key macro factors I believe will exert significant downward pressure on Australian asset values, in particular housing, over the next decade: the retirement of the Baby Boomer generation.

But before I launch in, here’s an overview on what I have said previously about this issue on this blog.

A quick recap

I have touched on the impact that the Baby Boomer’s retirement would have on asset prices in previous posts, but never in great detail.

For example, in Bringing it Home (July 2010) I contended that the Baby Boomers were behind Australia’s infatuation with investment property speculation, which has driven demand (and prices) up for housing. I then claimed that the Baby Boomers would turn from net buyers to net sellers of investment properties once they entered retirement:

Investor appetite for housing began to grow in the 1990s as the Baby Boomer generation began to reach peak earnings age (45 to 55 years). They began buying up investment properties en masse as a way of both minimising their tax (via negative gearing) and ‘saving’ for retirement…But with the Baby Boomers soon to enter retirement, it follows that their appetite for investment properties will shrink, thereby removing one of the key demand-drivers of house price growth. Further, because higher investment yields can be earned by placing their funds in a bank term deposit than can be earned via rent, it is likely that many Baby Boomers will sell their property investments to fund their retirements. This process of property divestment is likely to accelerate once the Baby Boomers realise that there is little prospect of continued high capital appreciation…

And in Blowing Bubbles (May 2010), I argued that the Baby Boomers had also driven prices up for owner-occupied dwellings:

…The Baby Boomers reaching peak earnings age from 1990 is also likely to have significantly increased demand (and prices) for owner occupier homes, since many in this demographic would have traded-up to their most expensive (‘peak’) home over this period…

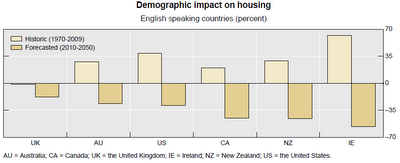

My hypothesis that the Baby Boomer’s impact on asset values would soon turn from positive to negative was then supported by a recent Bank for International Settlements (BIS) working paper, which examined how demographics are likely to affect asset prices, in particular housing, in 22 advanced nations over the next 40 years. I summarised this BIS study in August, the key finding of which is shown in the below chart:

According to the BIS, as the Baby Boomers reached working age and started buying housing from 1970, they helped to push-up property prices throughout the world. In Australia, over the past 40 years the Boomers increased real house prices by around 30% compared with what would have occurred had our age structure remained neutral. However, the ageing of the Baby Boomers is projected to reduce Australia’s real house price growth by around 30% over the next 40 years compared to neutral demographics. This is because the Baby Boomers will reduce their housing stock as they enter retirement by liquidating their investment property holdings and downsizing, thereby depressing house prices…

The Baby Boomer generation has had a similar impact on financial assets, such as bonds and shares… But, like for housing, financial asset prices are likely to come under pressure when the Baby Boomers retire and begin selling their assets to fund their retirement [Population Ageing is Bad News for the Housing Market, August 2010].

Finally, in CBA: Desperately Seeking Housing Affordability (September 2010), I cautioned against the increasing debt loads of the Baby Boomers, arguing that this increased debt could lead to selling pressure once they retire:

…The rise in debt levels of the older cohorts (over 55’s) is a significant risk to the housing market, since these people are approaching retirement and many will likely need to sell their housing investments or downsize in order to fund their lifestyles once they retire (putting downward pressure on prices).

Now for the detailed examination.

Australia’s population getting older:

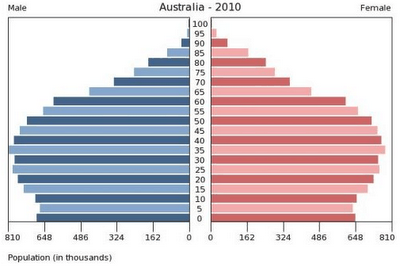

Let’s start by examining Australia’s population pyramid (taken from here), which is similar, albeit younger, than other mature economies:

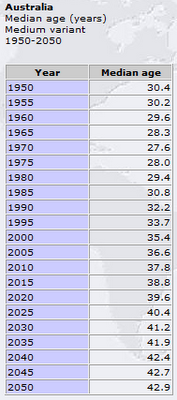

Australia’s population is ageing: according to the United Nations, the median age in Australia increased from 28 years in 1970 to 38 years in 2010. And Australia’s population will continue to age into the future, with the median age reaching 43 years by 2050 (see below table).

Now let’s turn to Australia’s Baby Boomer generation – defined by the Australian Bureau of Statistics (ABS) as those born between 1946 and 1965. This population cohort comprised around 5.6 million people at end-2009, or 25% of Australia’s population.

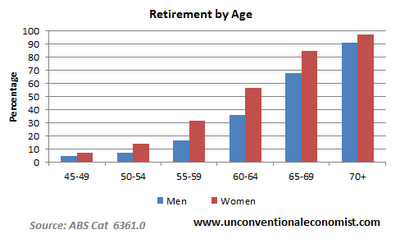

Some simple math tells us that next year, the oldest members of the Baby Boomer club turn 65, marking the traditional end of their working years, whilst the youngest Baby Boomers turn 46. In actual fact, however, many Baby Boomers will retire before 65 – around one-third of men and one-half of women – whilst a smaller proportion will continue to work beyond this age (see below chart).

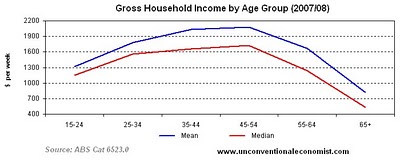

Now consider these facts: according to the ABS, household income peaks between the ages of 45 and 54, before dropping sharply (see below chart).

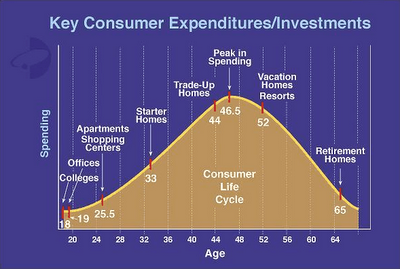

At the same time, according to world famous demographer HS Dent, spending increases until age 46 and then begins to decline, whilst saving and debt repayments accelerate until the end of one’s working life (see below chart).

Putting these observations together produces a hypothesis of the Baby Boomer’s financial habits. That is, the oldest members of the Baby Boomers reached their peak earnings years (45 to 54) from around 1990. Over the next 20 years, as the younger members of this group followed, the Baby Boomers collectively moved into the wealth accumulation phase of their working lives, whereby they began investing heavily in houses (both owner-occupied and investment) and financial assets (e.g. shares and superannuation).

Now the first members of this group are entering the retirement phase, whereby assets will be divested or drawn-down to fund their lifestyles. This ‘draw-down’ phase will build over the coming decade as the younger members of the Baby Boomer cohort follow their older members into retirement.

Now let’s examine whether this hypothesis is supported by the data.

Household finances and net worth:

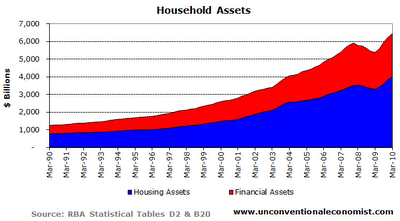

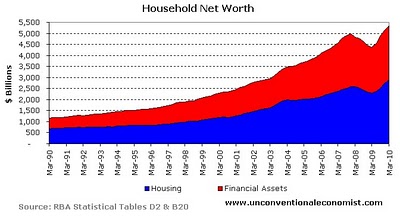

Let’s first consider Australian household’s total assets, split-out by housing and financial assets (e.g. shares, superannuation, cash and bonds). For the purpose of today’s article, I have ignored ‘consumer durables’ (e.g. cars, furniture and electronics) from this analysis since I do not consider them to be true assets (i.e. they typically do not appreciate in value and/or produce an income or imputed income).

You will notice from the above chart that the overwhelming majority of Australian household’s assets – 62% as at March 2010 – are held in property versus only 38% in financial assets.

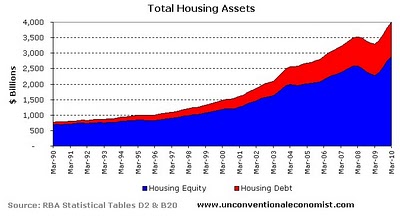

However, not everyone owns their properties outright. In fact, there is around $1.1 trillion of mortgage debt supporting around $4 trillion of housing assets (see below chart).

As such, housing’s share of household net worth (household assets minus liabilities) is 54% (see below chart).

So the popular perception that Australians are obsessed with property is certainly supported by the aggregate data, which shows that just over half of household’s net worth is tied-up in housing.

Baby Boomer breakdown:

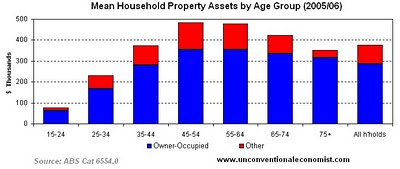

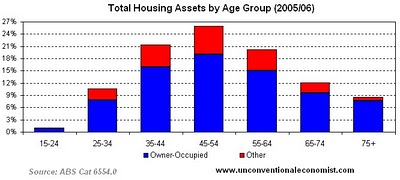

Now let’s turn to the Baby Boomers, starting first with property. The below chart shows the average property holdings by age group. Unfortunately, due to the glacial pace at which the ABS updates their data, the latest available information is for 2005/06 (i.e. four years old).

As you can see, Baby Boomer households – those in the 45-54 and 55-64 age groups – hold the highest proportion of housing assets, both owner-occupied and other (i.e. investment properties and holiday homes).

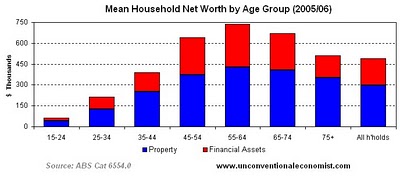

When mortgage debt is deducted and financial assets added to the equation, the older Baby Boomers – those aged 55-64 – hold the highest net worth (see below chart).

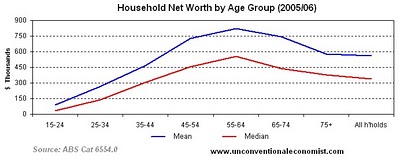

However, reflecting the fact that a small number of high net worth Boomers drags-up the average, the median (middle) Baby Boomer’s net worth is substantially less than the average (see below chart).

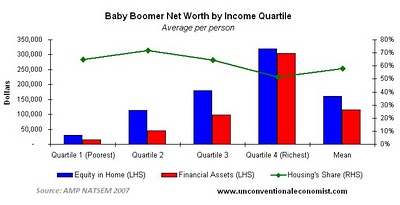

Finally, reflecting the difference between the median and average holdings, the below chart shows the Baby Boomer’s housing and financial net worth split-up by income quartile (i.e. poorest to richest) as well as the proportion of net worth held in property.

As you can see, the median (middle) Baby Boomer – those in the middle of the 2nd and 3rd quartiles – hold around two-thirds of their net worth in housing. Further, the median individual Boomer only held around $72,000 of financial assets in 2005 – certainly not enough to fund a decent retirement.

A pain in the assets:

Now having examined the household and individual financial position, let’s turn to the aggregates. The first chart shows the total percentage of housing assets held by each age group.

Despite representing only 25% of Australia’s population, the Baby Boomers collectively hold 45% of owner-occupied dwellings and 51% of other dwellings (i.e. investment properties and holiday homes). However, since the older Boomer cohort (55-64 year-olds) are relatively small (accounting for 11% of the population), they hold a smaller (20%) share of Australia’s housing assets. By contrast, the younger Boomers (45-54 year-olds) hold 26% of the housing assets, reflecting their larger (14%) share of the population.

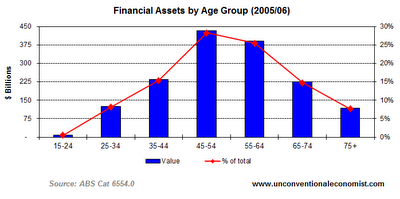

It’s a similar story when it comes to financial assets, with the Baby Boomers holding 54% of the total (see below chart).

Why it matters:

The Baby Boomers, which represent one-quarter of Australia’s population and own one-half of the nation’s wealth are headed into retirement. With the oldest Boomer turning 65 in 2011, this shift to retirement officially begins next year, although many have/will retire before this age. This shift to retirement will gain strength throughout the decade as more and more Boomers exit the workforce.

Most Baby Boomers are heavily exposed to property and hold very little in the way of financial assets – certainly not enough to fund a comfortable retirement. It is, therefore, highly likely that many Baby Boomers will look to free-up the equity in their housing assets to finance their lifestyles. There are several ways to do this:

- sell investment properties and/or holiday homes – as shown above, the Baby Boomers hold half of the nation’s non owner-occupied homes;

- Downsize – sell the large family home, buy a smaller/cheaper residence, and pocket the difference;

- Sell and rent; and

- A reverse mortgage – effectively a loan whereby the bank provides 40% of the home’s equity, with the principal and interest repayable upon the death of the mortgage holder or sale of the residence.

Of these four options, I believe that the first and second – that is, the sale of investment properties/holiday homes and downsizing – will be the most commonly used by the Baby Boomers to free-up cash.

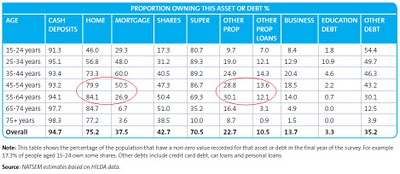

As shown in the below table, around 30% of Baby Boomers hold second homes and around 13% have loans over these properties.

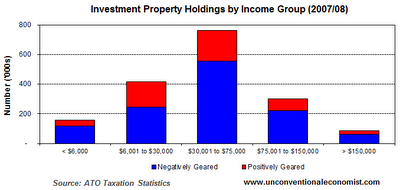

Further, based on Australian Taxation Office (ATO) data, around 75% of property investors are middle-income earners and 70% are negatively geared – i.e. losing money and investing purely for capital gain (see below chart). Many of these negatively geared property investors would be Baby Boomers.

The Baby Boomer’s appetite for negatively geared investment properties, and their inflationary impact on house prices, has even been acknowledged by the RBA. For example, in a recent ABC Radio report, Deputy Governor, Ric Battellino, had this to say:

You see if you look at the composition of debt across the country, it is the higher income older generation that are driving the gearing up. And in the course of doing that, they’re crowding out the new entrants into the housing market.

As I have said previously, the Boomers will soon switch from net buyers to net sellers of investment property. Once they retire, many Baby Boomers will look to sell their property investments due to their low yields (around 3% after costs) and, in the case of Boomers that are negatively geared, the inability to claim tax deductions against other income once they cease working. The incentive to sell-out of their investment properties will intensify once the Boomers realise that there is little prospect of continued high capital appreciation.

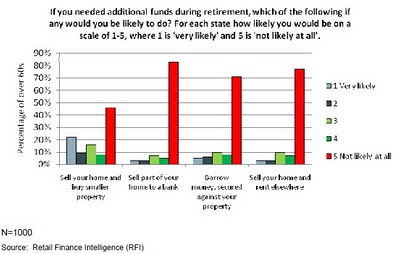

Regarding the second option – downsizing – a recent survey of people aged over 60 found that 22% are “very likely” and a further 10% “likely” to sell their home and buy a smaller property to fund their retirements (see below chart). By contrast,there was very little support for my third and fourth options of selling and renting, and taking-out a reverse mortgage.

Selling an expensive home and buying a cheaper home will put downward pressure on house prices, particularly large family homes. The impact is akin to the effect that selling $1 billion of BHP shares and buying $500 million of Rio shares has on the ASX 200 share index – i.e. it drags it down.

Why the mainstream are wrong:

Most mainstream economists and property ‘experts’ do not accept that changing demographics will adversely affect Australia’s asset values, in particular housing. In the case of housing, they instead espouse Australia’s strong ‘underlying’ or ‘pent-up’ demand, arguing that projected high rates of growth in the 25 to 34 year age bracket will lead to high rates of household formation and, therefore, continued house price appreciation.

In their recent housing report, Westpac focuses on the projected growth in the first home owner age group but ignores the rapid projected growth of the 65+ age group. Yet it is this group (the Baby Boomers) that holds nearly half of Australia’s housing assets and it is they that will reduce their asset holdings over time to fund their retirements, depressing prices. It is also the Baby Boomers that accounted for much of the growth in housing values over the past two decades as they reached peak earnings age (45-64) and accumulated significant real estate holdings over this period.

In any event, underlying demand is a poor predictor of house price growth. In 2006, at the height of the Californian housing bubble, strong underlying demand and housing shortages were being espoused as a reason for continued house price growth. Prices in California have fallen more than 30% since. Similarly, in June this year, a US real estate economist released analysis suggesting the USA is “not building enough homes to keep up with potential demand… This pent-up demand could get unleashed on unprepared markets, causing shortages and rising local prices”. Yet sales and prices are still falling and will remain depressed for years to come.

Make no mistake, the shift of the Baby Boomers from the wealth accumulation phase into the draw-down phase will put lasting downward pressure on asset prices, just like the BIS said. So-called strong underlying demand from 25-34 year-olds is highly unlikely to offset this effect.

Cheers Leith