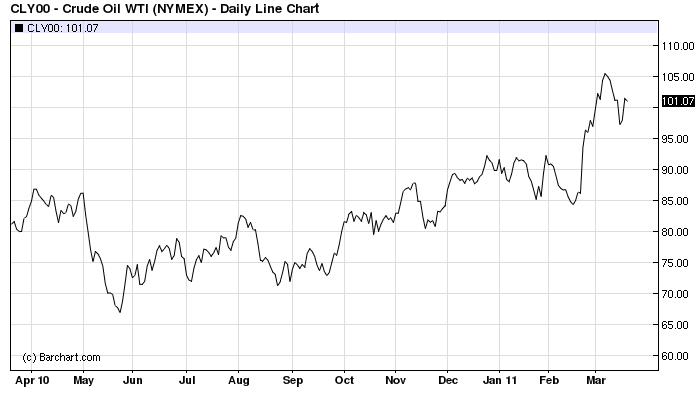

As Deus Forex Machina likes to say, disagreement makes a market so let’s rip in. Gotti asks:

Why should oil prices rise in response to the latest turn of events in Libya? We are already seeing Middle Eastern countries, lead by Saudi Arabia, the UAE and Kuwait, lift production to compensate for Libya. The big oil producers are enjoying the higher prices and production which, in the case of Saudi Arabia, will help fund the extra spending being used to quell unrest. There is going to be no shortage of oil unless the Middle Eastern unrest spreads to the major oil producers lead by the Saudis.

The simple answer is that speculators see a danger in Saudi Arabia and other oil producers so they are currently driving the market upwards.

That’s true. Gotti is describing a risk premium that’s been built into the supply of oil. And no doubt speculators are playing a major role. But Gotti doesn’t ask what the signals are that these speculators are following. The FT’s Javier Blas described the return of the oil risk premium in January:

After a two-year hiatus, the oil market has rediscovered the geopolitical risk premium.

For most of 2009 and 2010, traders ignored sparks in the Middle East, as global production spare capacity was more than enough to cover any potential shortfall. But as demand hits record levels, the market is paying more attention to geopolitics.

To be sure, the market’s anxiety about the Middle East – which accounts for 30 per cent of global oil production – or other potential hotspots, including Nigeria, is not near the panic levels seen between 2005 and 2008. The cushion of spare crude oil production capacity is still large enough to handle most disruptions.

Opec’s idle production hit a record low of 1m barrels a day in early 2006 as global demand surged. Then, the oil market reacted with panic to geopolitical events as spare capacity was not enough to cover even small disruptions in supply.

As the financial and economic crisis reduced oil demand worldwide, the cartel’s effective idle capacity surged to a peak of more than 6m b/d in early 2009, cushioning the oil market. Since then, however, spare capacity has started to drop as demand has risen. Oil demand surged by nearly 3m b/d last year, the second largest increase in 30 years. The International Energy Agency, the rich countries’ oil watchdog, estimates spare capacity fell last month below the key 5m b/d mark for the first time in two years.

So, the premium is not about how much oil is being pumped but how much that can be pumped.

Moreover, the notion that the MENA crisis itself is subsiding is problematic too. Bahrain is likely to settle, or, at least, be settled. And I do not foresee trouble coming from Iran. But the blood is still up across North Africa and a multitude of power vacuums have opened up in Tunisia, Egypt, Libya and Yemen. We don’t yet know who is going to fill them.

The West’s involvement in Libya is another risk variable that might inspire further rebellion, for democracy, or against it.

On top of that, look at the below index from Reuters, which lists countries at risk:

You can take or leave the parameters of the list. But it’s hard to ignore the fact that oil a key export of 8 of the top 10.

Back to Gotti:

Meanwhile the so-called “safe haven” money which rushed to the US on the back of Japanese nuclear threat and Middle Eastern turmoil is now flowing back into world markets. These flows have put downward pressure on the American dollar but have also propelled Wall Street and boosted the Dow Index once again above 12,000.

As part of that trend the Australian dollar is again above parity with the US currency. On top of all of this, there is takeover speculation in the US that is fanning activity.

In other words it’s “back to normal”.

To adversely change that pattern will require a serious deterioration in one or two of the current trigger events – the Middle East, China, the Japan nuclear situation, European banking or the US economy.

The sharemarket speculators cannot see that happening at the moment although the oil price speculators are still punting that Middle Eastern troubles are far from over.

In my view, this is a misunderstanding of exactly what constitutes “normal”. As Gotti intimates, the new normal is one in which Bretton Woods II is slowly unwinding via a weak $US. The US can no longer rely upon consumption alone to grow and is growing its exports very strongly. In such a circumstance, the $US must continue to to be weak at best and fall if possible , as Gotti says. But that is an intrinsic upwards pressure upon the entire commodity complex, including oil. This has been clear since September last yearwhen QE2 became a certainty:

Back to Gotti:

Global economies are far stronger now than they were when the oil price last reached its current levels so the impact of the current spike will be much less. Nevertheless higher oil prices act like a tax, diverting spending from discretionary areas. Higher inflation over the longer term can cause central bankers to lift interest rates to lower inflation which creates a double taxation on the discretionary spending of people with high mortgages.

But it’s manageable unless there is really an oil shortage rather than speculator driven price rises. The key to global market swings in the current environment is what is happening in those trigger areas. As long as they remain relatively benign (including no oil shortages) markets will be robust.

As we know events in these trigger areas can change rapidly. But in the normal course the next crisis is due when the current round of stimulus measures in the US end around June. With the Dow above 12,000 the markets clearly expect a gradual wind down and no sudden impact from the withdrawal of stimulus.

I would say rather that the jury is still out on whether the wind down of QE2 will go smoothly. If it goes badly, QE3 will be back the moment the market tank effects growth.

However, my guess is that it will go better than many think. If it does, the US will still have its zero interest rate policy and the great unlikelihood of raising rates until at least 2012. In today’s newly liberated AFR, Glen Mumford points to an OECD report that advises against hurrying to raise rates into the oil spike.

Anyway, it’s a near certainty that other nations will raise rates ahead of the Fed, such as the ECB, which will keep downwards pressure on the dollar, and upwards on oil.

We could see an oil pull back as the struggles in Japan hit growth and if the Libyan campaign goes well. But the only thing I can see correcting oil for any period is a marked slowdown in China. And that would hit everything.