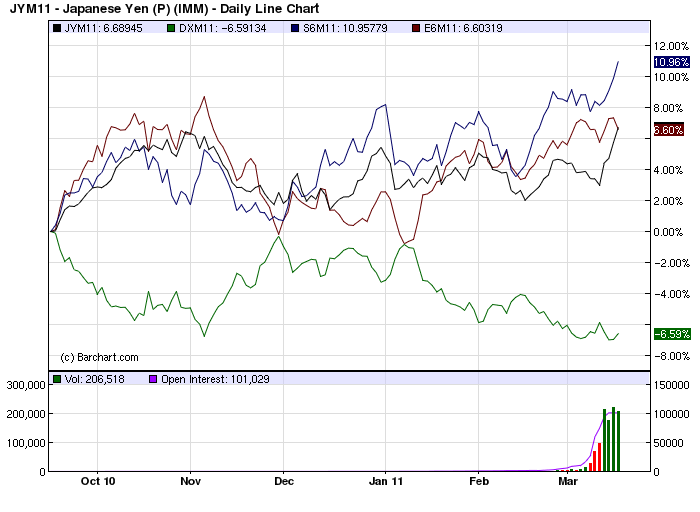

There’s more argument today that the Australian dollar is now a global safe haven currency, which, I must admit, agitates my innate cringe gene. Let’s see if there is any evidence. First, the following graph is the last six months of futures movements for traditional safe havens by percentage:

The $US is green, Japanese yen is black, Swiss Frank is blue and the euro is brown. With the clear exception of the $US, we have strong moves up. The $US is struggling because the Fed and its imminent QE programs are the lynch pin for the global economic recovery and the first and most important line of defence when Japan damages growth. As I’ve written before, bad news is good news. The others are all rallying strongly.

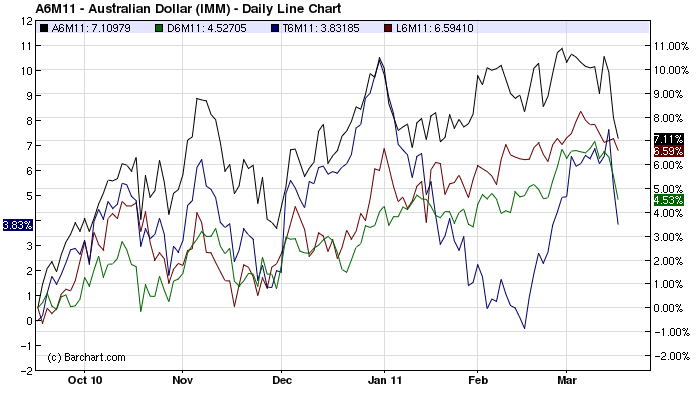

Next, lets look at a graph of global commodity currency futures and their percentage moves over the past six months:

That’s the Aussie in black, Canadian dollar in green, South African rand in blue and Brazilian real in brown. We’ve had more upside than all, and more downside than all but the rand. But what is most obvious is the converged nature of these currencies.

And remember, the recent falls are despite the ongoing weakness in the $US.

To me, this all looks like the lingering effects of strength in China associated currencies, as well as the ongoing effects of risk on/risk off and Fed frontrunning. Each of these is cyclical in nature, not structural.

And if you peruse today’s media, you will find the head of our sovereign wealth fund decrying the structural imbalances of the Australian economy.

My guess is we are in the grip of global monetary movements and associated sentiments, not a fundamental reappraisal of the structural soundness of the Australian economy and its currency.

The weird thing about the meme is its chest-beating pride. Becoming a global safe haven currency is the last thing we want. I mean, when the rubber does hit the road, don’t you want the automatic stabiliser of a falling currency helping you out?