Robert Gottliebsen today posted an interesting article on Business Spectator providing an insight into why Australians are cutting back on retail spending:

Retailers have been looking closely at what is causing stress among Australians and among Australian consumers…

Those in lower income suburbs or in areas where there are many high mortgage/low deposit new houses, consumers are badly stressed by higher power, medical insurance, petrol and education costs on top of higher interest rates. Power charges are particularly stressful because homes have become totally geared to power consumption, particularly in hotter or cooler areas. These consumers have cut back their discretionary spending and retailers operating in those markets have suffered…

Then there is a second group of more affluent consumers who are being stressed by different forces. They cut back spending because the paper value of their sharemarket assets slumped and they were frightened that the value of their house, or house prices in general, would fall.

They are currently reacting to those stresses by saving like crazy and their savings have played a big role in boosting the banks’ deposit coffers.

Retailers like Myer and David Jones want the sharemarket to rise and want house prices to settle and begin to move up again so that these consumers will stop saving so much and restart spending…

That Australians are cutting back on spending and repaying debt is hardly surprising and is typical of an economy disleveraging after a housing bubble.

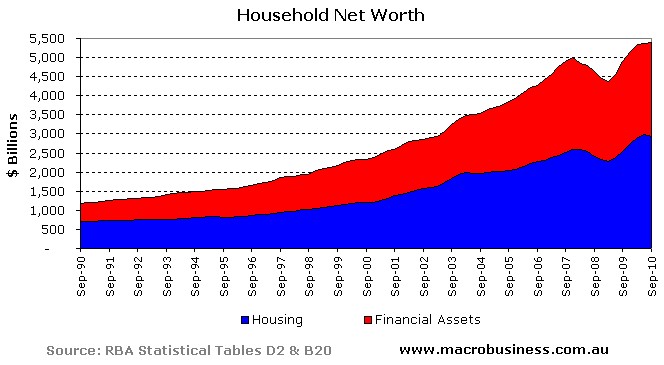

As explained previously in relation to New Zealand and the United Kingdom (but equally applicable to Australia), throughout the 2000s, when global credit conditions were benign, household debt levels and asset prices rose continually. These conditions made Australians feel richer (the ‘wealth effect’), spurring consumer confidence, spending and employment growth. This process can clearly be seen by the below charts.

First, consider the rapid rise in household net worth up until 2007. The bulk of this increase in wealth came from ballooning home values, which comprises the majority of Australian household net worth.

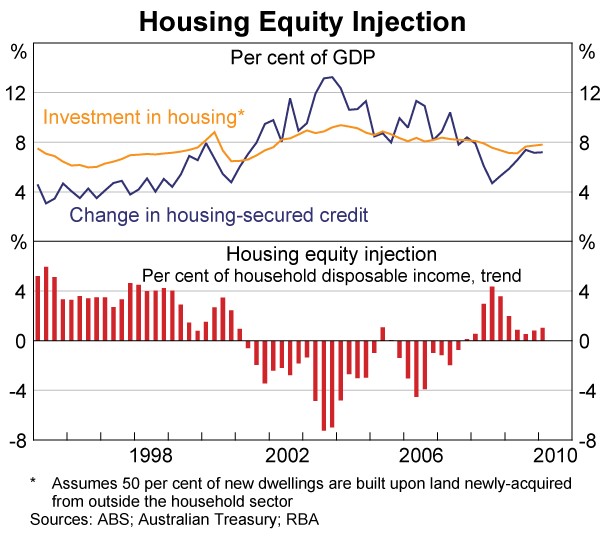

With house prices rising inexorably, Australians began using their homes as ATMs, withdrawing large amounts of their new found home equity between 2001 and 2008 (see below RBA chart). Much of this money was spent on consumption, thus further boosting incomes and employment.

However, the process of debt feeding asset prices feeding confidence, consumer spending and employment growth appears to have stalled now that house prices have flat-lined. Australians have, instead, begun reducing consumption and repaying debt, as evident by increased home equity injection (see above chart), higher household savings rates, and falling levels of debt-to-disposable income.

The golden era for retailing that was 2000 to 2008 is now over and the age of frugality has begun. And the headwinds facing retailers, the economy and asset prices will only grow stronger as the baby boomers retire and pare back their spending.

As I have shown previously, household spending peaks between the ages of 45 and 54, before falling sharply. A household in retirement spends less than half of what a 45 to 54 year-old household does (see below chart).

So with the population ageing rapidly and consumers already maxed-out on debt, the days of debt-fuelled consumption appear to be over. We best get used to the new normal.

Cheers Leith