This is a reply to Rotten Apple’s post about the “trouble” with the Australian fund management industry. The author of this article is a co-founder of an Australian-based private investment company, Empire Investing, and a former financial adviser and portfolio manager for a boutique financial services company.

It’s all Absolutely Relative

Let me start with a couple of report cards to get some perspective.

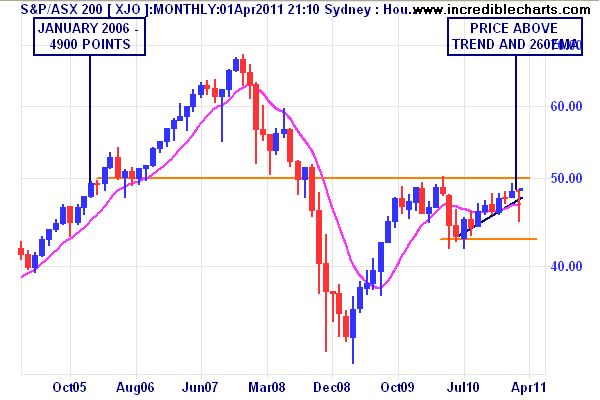

Report 1: in calendar year 2010, the S&P/ASX300 Accumulation Index (a broad measure of the Australian stock market that includes dividends) delivered a return of just 1.9 per cent. According to Morningstar, the average fund manager underperformed this index, with less than 20% of the domestic share fund managers able to beat the index. The average “large-cap” manager returned 0.05 per cent.

Report 2: according to the latest Standard and Poors (S&P) Indices Versus Active Funds Scorecard (SPIVA(R)), this benchmark outperformed 71 per cent of active Australian share funds.

Report 3: at least 80% of active Australian Bond funds have failed to meet their relative benchmark, the UBS Composite Bond Index, over periods of 3 years or more.

Report 4: the only area of decent outperformance are the small-cap funds, which are more likely to outperform their benchmark index, the S&P/ASX Small Ordinaries. Over the last 5 years, 70% of small-cap funds have managed to do better than the index, with the outperformance averaging 2.4% p.a. However, this is a relative outperformance for an index that has given overall negative returns so even the small-caps have lost money over the last few years.

So how does all this underperformance show up in our superannuation funds? Well according to APRA’s latest Annual Superannuation Bulletin (released in January), the Rate of Return (ROR) for all super funds that are not self-managed has been 8.9% for the financial year to June 2010. This compares to a 9.4% increase in the S&P/ASX200 Index.

More importantly, the average annual ROR over the last 10 years has been 3.3% – or 2.5% p.a for the retail subset. Ouch. This could explain why retail super funds have seen a nominal decline in assets under management (AUM) since 2007, whilst self-managed super funds have grown their assets by over 21% in the same period.

Lies, Damn Lies and Statistics

Too many stats? Right you are – so here are the take home messages.

First some active fund managers will beat the index – however this is a distinct minority (20%) in the case of the larger managers – where most retail investors have their capital. Most small cap managers do a better job than their index – but their long term returns barely beat bonds and term deposits.

Second, all of the indices followed by equity managers have had negative nominal returns in the last 3 years. So even “out-performing” funds can be losing you money.

Third, non-SMSF super funds have averaged 2-3% p.a below what you can get in a good term deposit or 10 year Australian government bond, the worst performers being retail funds.

A Troubling Problem

So what’s the trouble? Or problem – I won’t demean it by calling it an “issue”.

Providing relative returns to investors in all market conditions whilst not considering the preservation of their capital is the No.1 problem with the funds management industry.

Every other problem pales into insignificance unless this is addressed. I’ll consider the second part, risk management, in a later post.

There are 5 issues I want to talk about:

- Why active fund managers should only be absolute return focused

- Alternative performance benchmarks to index following/tracking

- Alternative transparent remuneration/fee models

- The concept of Managers as Partners and why this is the best management structure

- Suggested reforms to the system.

Active can only be Absolute

The research is in, the empirical facts stare us back in the face: the majority of active fund managers cannot outperform their benchmark index. Only a minority have the ability to gain non-relative or absolute returns. At least 70% of the large cap equity fund managers should just convert into Index Exchange Traded Funds (ETF) or Vanguard-style passive index funds.

Or from a client’s perspective, at least 70% of you reading this should go see your financial planner and ask why you are paying 2% per year to get less than the index, an index which you can invest yourself for less than 0.5% a year.

I’ll talk about how I used index funds to create low admin cost portfolios for clients and planners, changing the composition dynamically (e.g upping emerging market exposure, reducing Aussie equities etc) thus cutting out the active manager, in a later post if there is any interest.

Rotten Apple hit it on the head when he said:

Much of the fund management industry is still in thrall to the bizarre concept of “relative returns”. For example, if you are a large-cap US equities fund manager, your returns will generally be measured against a benchmark such as the S&P 500. The fund manager will try to roughly match the composition of this benchmark, while overweighting (or underweighting) certain stocks that he or she thinks will outperform (or underperform) the market. But this kind of approach leads to a very strange conception of risk, and it generally results in mediocrity.

This mediocrity is exarcebated by the guaranteed, multi-million dollar flow of weekly superannuation contributions into a gross, complex system that has grown out of the simple notion of saving for retirement. This system has created a safe, conservative environment for fund managers and their salesmen – the financial advisors mainly working at the big four bank’s wealth management arms. Large commissions and bonuses are obtained by an industry that “benchmarks” their performance to an index almost everybody else in the business is also following.

Only a small core of contrarian (usually small or micro cap, or macro- based) managed funds break this mold and attempt to gain the returns that really matter: absolute.

So what is absolute return? In essence, it means that year in year out, the fund makes a real return, i.e above zero. The best of this bunch beat the banker, the taxman and inflation. This absolute return should also be reflected in times of boom (e.g 2004-07), bust (2008-09) and sideways markets (2009-10). It should also be attained during periods of inflation, deflation, commodity cycles and high volatility/uncertainty. This is what you are paying a manager for: to get the best possible return on your scarce capital, at the lowest risk.

An alternative to relative benchmarking

So what should fund managers use as a benchmark if at all? How can you compare yourself to others to ascertain remuneration and provide investor’s with a transparent choice?

In my view, funds should provide two clear benchmarks.

- A minimum standard (watermark) equivalent to a time-appropriate savings rate and

- A “Required Rate of Return or RRR” as the performance benchmark.

The former, for Australian equity managers at least, should be based on the 5 or 10 year Australian Government bond yield. Funds not attaining this standard should not charge any fee as they failed to provide returns above a risk-free bond. This watermark can be adjusted yearly or quarterly, in line with the bond yield.

The RRR performance benchmark is based on the absolute return principle: as managers, you are employed to attain after-tax returns than exceeds savings and inflation. This means that fund managers should treat their capital allocation decisions like any other business does – by investing only where returns are above your own RRR.

In today’s relatively high inflationary and tax environment, I equate an appropriate RRR to about 10-12% per annum for retail investors. Super funds, due to their very favourable tax treatment, should aim for 7 to 9% over the long term.

For more information on how this RRR is developed, click here.

Management Remuneration

What about remuneration? Those industry super ads – whilst somewhat disingenuous – are a good illustration of the impact of fees. Fees are typically asset based, which encourages building AUM, and they usually apply regardless of performance.

We have considered remuneration structures extensively at Empire Investing, and when we establish a managed fund in the near future, we will likely use the following (or a variation thereof):

- If performance fails to attain the watermark – as explained above – no fees are charged.

- If the watermark is passed, but the benchmark RRR is not attained, a flat admin fee is applied (approx. 0.3 to 0.5%)

- If the RRR is attained, the admin fee plus 30-50% of all returns above the RRR are paid as management fees.

As an example, if the RRR benchmark is 10% and fund returns 15%, then the fund manager is paid 1.8% (including 0.3% admin fee) and the investor gets 13.2%. Transparent and easy to explain: the manager and investor shares in the risks and rewards.

Managers as Partners

Before rampant financialisation allowed the creation of mega-banking conglomerates, commercial and trading banks used to be separate entities owned by partners who managed the business. This robustness – whereby the owners and managers shared in the risks and rewards – encouraged a culture of prudential risk taking whilst maintaining a high reputation and a consideration of succession planning.

Fast forward to today, and the majority of managed funds are owned by the big four banks, fronted by salesmen, who work tirelessly to build AUM.

Only a few funds operate in a manager/partner like manner – sometimes called “boutique”, usually run by dissatisifed former mainstream fund managers. In a recent Lonsec report, 90% of annual management staff departures were from mainstream fund managers, with many leaving to join the boutiques, or start their own.

When an analyst or manager has a sizeable capital stake, their behaviour will differ significantly to your typical financial salesman. Hugh Hendry, a UK absolute return fund manager of “I would recommend you panic” fame, calls this the “pencil in the back”.

Possible Reforms

- Increase basic financial literacy of the wider population – practical finance should be an integral part of all school curricula, so concepts like compound interest and opportunity cost are widely understood.

- Eliminate non-performance asset based fees for active fund managers. Only Index ETF’s/passive managed funds should be allowed to charge such a fee, based on administration costs.

- Active fund managers should disclose and justify appropriate benchmarks, based on a Required Rate of Return (RRR). They should be free to set whatever fee they like above the lower watermark, but may not charge any administration or performance fee below that threshold.

- Introduce a capitalisation floor , whereby the core team of analysts and managers, in aggregate, must own a minimum amount of Funds/Assets under management (I would suggest 5% as a minimum).

- Introduce cross ownership rules in financial industry. Banks cannot own wealth management arms, which cannot own superannuation funds and so on.

Our funds management industry may be broke, but it doesn’t mean we can’t suggest possible solutions. Even if we are just wailing at a wall. As regular commenter BB has pointed out this is probably just an academic debate, and like my Research Bonds idea, these reforms will probably never be enacted or considered. I will probably cop a lot of flack from professionals within the industry and my former financial planner colleagues for writing this article. But the reasons above are the raison d’etre for the creation of our investment company.