Following on from my previous article, which discussed the adverse impact of Australia’s ageing population on consumption expenditure, I now want to turn to the likely impact of population ageing on asset prices.

Much of this analysis will again draw upon the Australian Bureau of Statistics (ABS) long-term population projections, which provides detailed estimates of Australia’s population under three scenarios:

- High growth scenario (Series A), which assumes an increase in the fertility rate, higher net overseas migration than existed in 2008, and an increase in life expectancy;

- Medium growth scenario (Series B), which largely reflected the trends in fertility, life expectancy at birth, and net overseas migration that existed in 2008; and

- Low growth scenario (Series C), which assumes low assumptions for fertility and net overseas migration.

The assumptions underpinning these projections are once again provided in the table below:

And the projected trajectory of Australia’s population under these assumptions is shown below:

Before we can undertake an examination of demographics and asset prices, we first need to know which age groups own Australia’s housing and financial assets. Thankfully, this information is provided in the latest ABS Household Wealth and Wealth Distribution survey, albeit for the year 2005-06. For the purpose of this analysis, I have assumed that the share of assets held by each age cohort is unchanged today from what it was in 2005-06.

First, consider the breakdown of housing assets by age group:

According to the ABS data, the Baby Boomers – those born between 1946 and 1965 – hold 45% of owner-occupied dwellings and 51% of other dwellings (i.e. investment properties and holiday homes). This is despite the Boomers representing only around 25% of Australia’s population. Moreover, those aged 65+ hold a further 21% of Australia’s housing wealth, taking the older cohorts’ (those aged over 45) share of Australia’s housing wealth to 67%.

It’s a similar story in relation to Australia’s financial assets:

Again, the Baby Boomers (45 to 64 years old) hold 54% of Australia’s financial assets, and those aged 65+ a further 22%, taking the older cohorts’ share (those aged over 45) to 76%.

Now that we have established which age cohort owns what, we can proceed to the analysis of ageing’s expected impacts on Australian asset prices.

My favourite Canadian blogger, Ben Rabidoux – who has conducted considerable research on the impacts of population ageing in Canada – recently alerted me to an interesting paper by the Journal of the American Planning Association (JAPA), which discusses the implications of the Baby Boomer’s retirement on American housing prices.

The JAPA’s key finding is that people become net sellers of real estate after the age of 65, while net buying of real estate is most pronounced between the ages of 25 and 35 – when young people typically leave home and form new households.

Regarding the impact of the impending retirement of the Baby Boomer generation – representing some 78 million people and around 25% of the American population – the JAPA makes the following assessment:

What have not been recognized to date are the grave impacts of the growing age imbalance in the housing market. If the elderly are more often home sellers, and are more numerous than the young who are buyers, a market shift could come on quickly after 2010, causing housing prices to fall. Even if prices remain flat, without the investment incentive young households will likely slow their entry into home ownership, worsening the imbalance between sellers and buyers. Once past the tipping point, market adjustments will cascade in virtually every community, as the ratio of seniors to working age adults will increase for the greater part of two decades.

With the JAPA’s observations about net buyers and sellers in mind, let’s see how Australia’s changing age structure is likely to affect Australian housing values under the three ABS population growth scenarios (again, thanks to Ben Rabidoux for providing the below analytical framework).

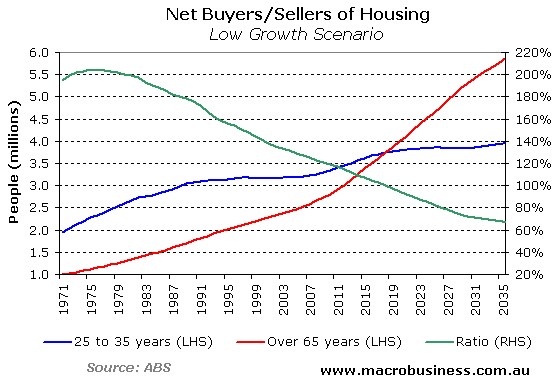

Net buyers vs net sellers: low growth scenario (Series C):

The below chart plots the actual (pre-2011) and projected (2011 onwards) population in the key household formation age group of 25 to 35 (‘net buyers’) against those of retirement age (65+ – ‘net sellers’), with the ratio of net buyers to sellers shown on the right hand side.

As you can see, the number of retirees (aged 65+) relative to those of key household formation age (25 to 35) is increasing rapidly, with the number of net sellers expected to overtake those of buyers by 2018.

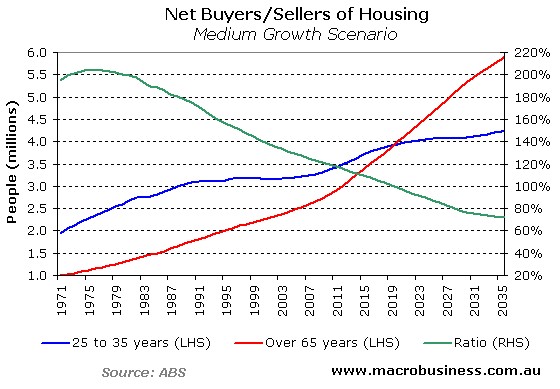

Net buyers vs net sellers: medium growth scenario (Series B):

It’s a similar story under the ABS’ medium growth scenario:

Again, the number of retirees (aged 65+) relative to those of key household formation age (25 to 35) is projected to increase rapidly, albeit more slowly than under the low growth scenario, with the number of net sellers expected to overtake those of buyers by 2019.

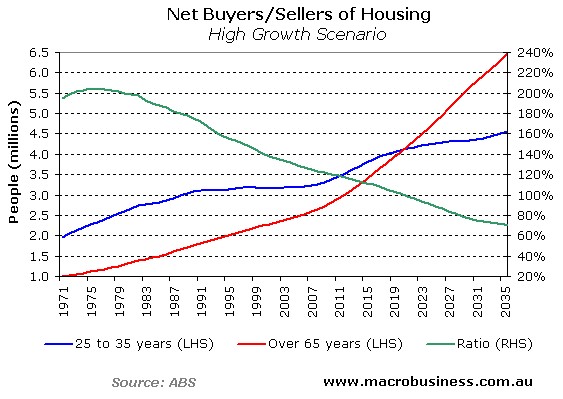

Net buyers vs net sellers: high growth scenario (Series A):

Under the ABS’ high growth scenario, the demographic selling pressure on Australian housing is delayed slightly:

Although the number of retirees (aged 65+) relative to those of key household formation age (25 to 35) is also projected to increase rapidly, the point at which net sellers are projected to out number net buyers is delayed until 2021 – three years after the low growth scenario.

What should become clear is that under each of the ABS’ scenarios, the age structure of the Australian population suggests that the demographic demand for housing is likely to slow significantly (albeit gradually) over the coming decades.

The impact of ageing on Australian financial assets is likely to be similar. With a higher proportion of Australians in retirement and drawing-down on their superannuation savings (rather than contributing to super), there is likely to be downward pressure on share and bond prices, and upward pressure on bond yields (long-term interest rates).

It should be noted, however, that these findings alone do not necessarily imply falling real asset prices, since prices are also influenced by other factors, such as income growth, which could compensate for the impacts of ageing. Rather, the purpose of this analysis is simply to highlight that Australian asset price growth will be more difficult to achieve over the next several decades, due to the demographic headwinds of ageing, than was achieved over previous decades.

I will add that constraints on credit growth are also likely to put a break on house prices going forward. Since household debt levels in Australia are already very high, there is limited capacity for households to increase their borrowings. In addition, the cost and availability of global credit is likely to tighten as: 1) the Baby Boomers reduce their holdings of financial assets, such as bank deposits and fixed interest investments, in order to fund their retirements; and 2) indebted foreign banks and governments seek increasing amounts of funding from global capital markets.

More evidence:

The above analysis supports a recent Bank for International Settlements (BIS) working paper, which examined the impact of changing demographics on asset prices (particularly housing) in 22 advanced nations over the next 40 years. The results suggested that ageing will lower real house prices compared to neutral demographics (i.e. where the age profile of the population remains constant) over the next 40 years in all 22 countries in the sample.

The below BIS chart, which shows the demographic impact on house prices over the past 40 years (1970 to 2009) and the next 40 years (2010 to 2050), is particularly relevant for Australia’s housing market.

According to the BIS, as the Baby Boomers reached working age and started buying housing from 1970, they helped to push-up property prices throughout the world. In Australia, over the past 40 years the Boomers increased real house prices by around 30% compared with what would have occurred had our age structure remained neutral. However, the ageing of the Baby Boomers is projected to reduce Australia’s real house price growth by around 30% over the next 40 years compared to neutral demographics. This is because the Baby Boomers will reduce their housing stock as they enter retirement by liquidating their investment property holdings and downsizing, thereby depressing house prices.

Further, the BIS suggests that the Baby Boomer generation has had a similar impact on financial assets, such as bonds and shares. As shown by the below chart for the United States, the Boomers have driven-down bond yields (left panel) and driven-up share price-to-earnings ratios (middle panel).

But, like for housing, financial asset prices are likely to come under pressure when the Baby Boomers retire and begin selling their assets to fund their retirement.

The impact of Australia’s changing demography on asset prices and investment is a topic that has to date received little attention from the commentariat. This is possibly because demographic shifts are inherently slow moving, so their impacts are gradual and tend to go unnoticed for extended periods of time. Nevertheless, these longer-term dynamics are significant and are likely to significantly alter the growth trajectory of asset valuations in the decades to come.

It therefore pays to consider Australia’s changing demographics when planning any long-term investments.

Cheers Leith