The claim that Australian home prices will stagnate whilst incomes catch-up is a prediction commonly made by housing commentators.

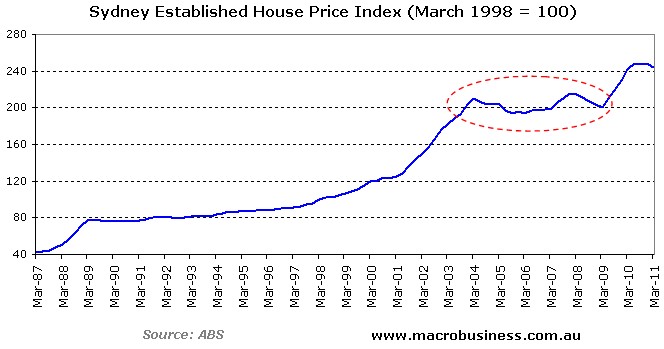

And this view is not without precedent. Between 2004 and 2009, Sydney home prices remained relatively flat, meaning that prices fell in both inflation-adjusted and income-adjusted terms (see below chart).

It behooves us then to assess the prospects of this happening a second time around. If we assume that Australian home prices will stagnate rather than fall, then how long would it take before valuations are restored to their pre-bubble level?

In order to answer this question, we first need a robust metric that measures the change in housing valuations over time. A simple but effective measure is to chart the total value of residential housing against GDP, whereby a low ratio implies possible undervaluation and a high ratio suggests overvaluation.

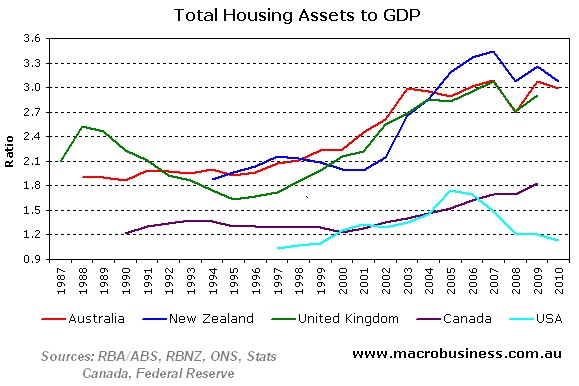

In order to get a sense of how valuations in Australia compare internationally, I have charted below the total value of residential housing assets against nominal GDP in Australia, Canada, New Zealand, the United Kingdom, and the United States.

As you can see, Australia’s ratio of housing assets to GDP – currently around 300% – is amongst the highest in the Anglosphere.

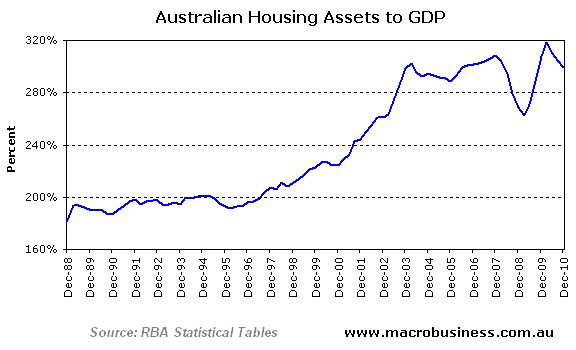

Next I have used quarterly data instead of annual data, and charted the ratio for Australia only:

As you can see, Australia’s ratio of housing assets to GDP was relatively steady, hovering at around 200% between 1988 and 1997. From this point onwards, the ratio escalated to around 280% in 2004 before levelling off. After a brief decline in the wake of the global financial crisis, the ratio then surged again reaching a peak of around 320% in March 2010. With home prices stagnating over the past year, the ratio has settled back to around 300% as at December 2010.

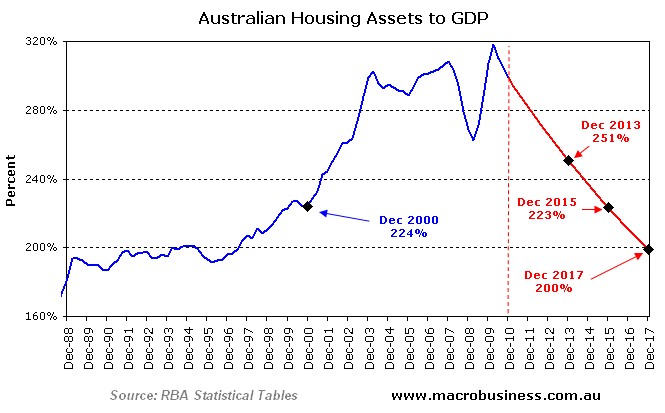

A quick examination of Australia’s GDP data shows that nominal GDP has grown by just under 1.5% per quarter since March 1990. If we hold the level of housing assets constant (just over $4 trillion as at December 2010), and extrapolate quarterly nominal GDP forward by the average rate of growth since 1990, then we get the below chart showing the amount of time that it would take for Australia’s housing assets to GDP to deflate back to pre-bubble levels (i.e. the “slow melt” thesis).

Under these assumptions, it would take around 3 years for Australia’s ratio to return to 250% of GDP; around 5 years to return to 225% of GDP, and around 7 years to return to 200% – the valuation level prevailing prior to 1998.

Obviously, Australia’s actual GDP growth over the coming decade may very well exceed or under perform the average growth rate experienced since 1990. And any deviation would impact the timing of when those various thresholds (250%, 225%, or 200%) are reached under the stagnation scenario.

However, what should be clear is that for home valuations to drift back to their pre-bubble level, prices would need to stagnate for a very long time, or at least grow at a slower rate than nominal GDP.

The question is: in the stagnation scenario, would Australia’s 1.2 million negatively geared investors – many of whom are baby boomers approaching retirement – be willing to hold-on to their loss making investments? Or are they more likely to cut their losses and sell en masse, thereby accelerating any adjustment?

Food for thought.

Cheers Leith