Earlier in the week I posted on RPData’s press release and queried why the data representation had changed from the previous media releases.

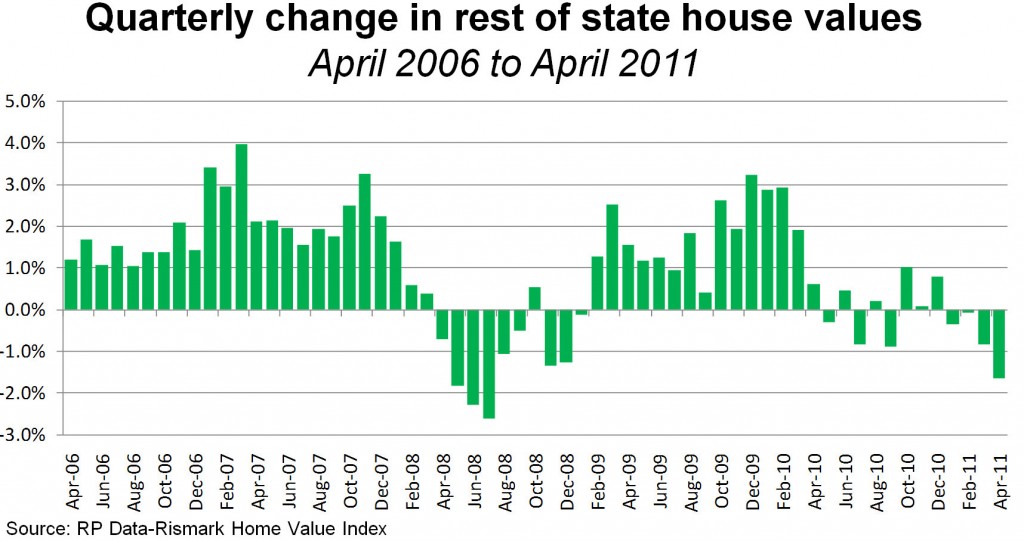

You will note that the second chart is suddenly absent in the May press release even though it has appeared in every other release this year. Now I am aware that I could be being overly suspicious here, but when you are in a battle for the hearts and minds of the public about who is the leading provider of data on the housing market, a “mid-stream switcheroo” certainly does not help your cause.

Once you take a look at the data that is absent from graphical representation this month (i.e. the rest-of-state data) and recognise that it represents around 40% of the housing market, you can understand why a contrarian such as myself becomes a little suspicious of its absence.

If you compare the April and May press releases you can see the change in the rest-of-state data. From the April press release:

- National rest of state house values +0.2% s.a. (+0.4% raw) in month of Mar

- National rest of state house values -1.8% s.a. (-0.7% raw) in Mar qtr

- National rest of state house values -0.5% s.a. over 12 months

And now May:

- National rest of state house values -0.6% s.a. (-0.8% raw) in month of April

- National rest of state house values -1.5% s.a. (-1.7% raw) in April qtr

- National rest of state house values -1.8% s.a. (-1.8% raw) over 12 months

You can determine yourself whether you think this supports the underlying premise from the commentators at RPData that the housing market is stabilising. From my perspective I would like to see RPData publish the “Rolling average change in house values, capital cities V Rest of state” chart for this month so everyone could gain a better understanding of what is happening across the whole market. I am sure people living in Mount Isa have just as much interest in what is happening to the value of their property as do those who live in Bankstown.

“Ask and you will receive” they say. RPData‘s latest newsletter has some good coverage of the regional markets.

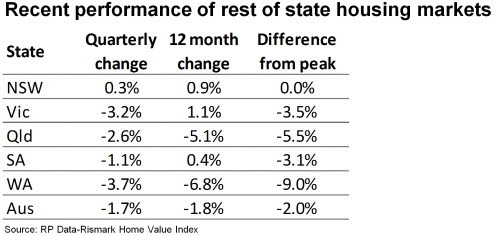

Over the last 12 months house values in those areas outside of the capital cities have fallen by -1.8% however, in many of the major regional centres the falls have been much greater. Property values across the combined capital cities fell by -0.2% during the three months to April 2011 and were down by -1.4% over the year in raw terms. Capital city houses have actually fared worse than units, with house values down -2.0% for the year compared to 0.2% growth in unit values.

Outside of the capital cities we only focus on the detached housing market performance as the supply of units can be quite limited in many of these regions. Across the ‘rest of state’ regions, house values have fallen by -1.8% over the year which is actually a slightly better performance to that of capital city houses.

Across the individual states, New South Wales has had the best performing regional housing market. House values across the non capital regions of New South Wales are currently at an historic high and have increased by 0.9% over the year.

In contrast to the performance of New South Wales, regional markets in Queensland and Western Australia have been particularly poor. This reflects the trend across the capital cities. In Queensland, regional housing markets have recorded a value fall of -5.1% over the year and current values are -5.5% below their peak. The regional Western Australia housing market has recorded a fall in values of -6.8% over the last 12 months with values currently -9.0% below their peak.

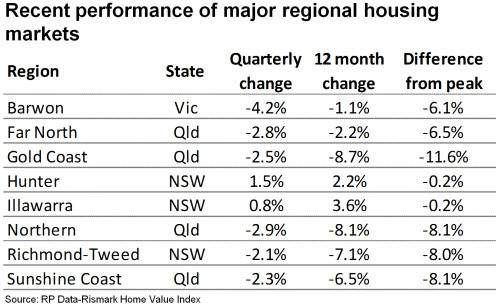

Within the major regional centres of the country house values have in some instances recorded some substantial falls while other regions have continued to perform comparatively well.

The Hunter and Illawarra regions of New South Wales, directly adjacent to Sydney, have each recorded positive value growth over the last 12 months. Median house values have increased by 2.2% in the Hunter region over the past 12 months and values have increased by 3.6% in Illawarra. As far as major regional markets go these two have been the standout performers.

Replicating the poor overall performance of the Queensland and Western Australian regional markets, a number of regions highlighted have recorded larger falls in house values from their peaks. The Gold Coast’s poor performance has been widely highlighted and current house values in the region are down -11.6% from their peak, recorded in January 2008 prior to the onset of the GFC.

Similar to the Gold Coast, the Sunshine Coast has also recorded a significant fall in house values since peaking in February 2010. As at April 2011, house values in the region were -8.1% below the peak. Similar falls have been recorded across the other regional coastal markets of Queensland however, they have typically not been as severe.

Overall, regional markets around Queensland, Northern New South Wales and Western Australia are showing particular weakness. Meanwhile the Hunter and Illawarra regions are holding up comparatively well. The Hunter and Illawarra regions are being supported by a strong mining sector and the fact that they are closely linked to Sydney which is currently one of the more resilient capital city markets for capital growth.

Coastal markets outside of these areas are typically underperforming, hampered by a weak tourism sector, a halting in sea change migration and a lack of economic diversity. These regions tend to be heavily reliant on the tourism, retail and construction sectors, each of which are under performing presently.

The short-term prospects within many of these markets are not particularly strong. Consumers remain cautious, unprepared to spend up big on property and the sea change migration flow has slowed markedly with once prospective retirees now focusing on rebuilding their retirement nest egg. Generally, most of these regions will need to see a rebound in tourism, significant improvements in consumer confidence and an increasing propensity for consumers to spend in order to see improvement in the market. The potential for this to occur seems unlikely over the short-term and these markets probably won’t start to improve until regional economies show some improvement and regional migration flows once again become apparent.

In my opinion RPData is once again understating the demographic dynamics that are creating the underlying direction of the market by suggesting that all of the market influences are “short-term”. I have stated for sometime now that I can’t see any new drivers for increased credit towards housing, outside of a new government stimulus package, and that baby boomer demographics will be a major long term factor driving the market. But again maybe I am just overly bearish.

I do however have to question why 3 negative quarters of accelerating price falls in regional areas was not a significant enough data event to get a mention in the broader media release made earlier in the week, I would have thought that it was quite significant given that the only other time it has occurred in the last 5 years was during the GFC. It is also interesting to note that some of these figures for regional areas are not that much different from those presented by SQM recently. In fact RPData’s figures for the Gold Coast are actually worse than those from SQM. This makes me wonder how it is possible that their models disagree so much when calculating the data for capital cities.

Maybe we will find out in future data release from both companies.