What is asset allocation and why discuss it? Surely super is all about putting money away for retirement: how hard can that be?

In this post, I will outline the conventional thinking regarding asset allocation and why it’s mostly wrong. The empirical evidence regarding this contention is overwhelming and stark. The major academic theories that bind financial planners and the investment industry to this convention have been thoroughly disproved in the real world. They are no more applicable than stating the earth is flat, or that it was made in seven days, even if their originators were awarded Nobel Prizes (or blew up billions of dollars in the process)

In a second post, I will outline my proposed solutions, how an investor may steer themselves through the flotsam and jetsam of flawed conventional thinking on asset allocation, and come out the other side with a clarity on how to apply these solutions to a real world.

What is Asset Allocation?

Asset allocation encompasses three areas:

- Where to put your capital (i.e to get return on your capital)

- When to put the capital in and when to take it out (i.e timing)

- How to manage risk (i.e the return of your capital)

Conventional thinking calls these three areas “Strategic Asset Allocation”, “Tactical Asset Allocation” and “Risk Management”. They are all based on the misnamed “Modern Portfolio Theory” and “Efficient Market Hypothesis”. A background to these theorems, assumptions and concepts is vital in understanding conventional asset allocation.

Modern Portfolio Theory (MPT)

What is MPT? From Wikipedia:

The fundamental concept behind MPT is that the assets in an investment portfolio should not be selected individually, each on their own merits. Rather, it is important to consider how each asset changes in price relative to how every other asset in the portfolio changes in price.

Investing is a tradeoff between risk and expected return. In general, assets with higher expected returns are riskier. For a given amount of risk, MPT describes how to select a portfolio with the highest possible expected return. Or, for a given expected return, MPT explains how to select a portfolio with the lowest possible risk.

A portfolio can therefore be mathematically created and allocated for every type of investor, providing the best expected outcome (adjusted for their tolerance to risk) using the above concepts. The math is interesting, if a little simple (e.g using a normal distribution of returns on assets to calculate risk by standard deviation has been completely debunked), but I won’t repeat it here, suffice to say it feeds into the neoclassical economist tradition of using simple mathematics to try to explain a complex phenomenon that has more to do with irrational human behaviour than numbers.

The result is called the “efficient frontier” (where no economist has gone before?):

Which you’ve probably seen in a glossy brochure or lightweight look at asset allocation on your super funds website in this form:

The Efficient Market Hypothesis – EMH

EMH is the mathematical determination that all financial markets (e.g stocks, bonds, property) are informationally efficient, that is no-one can achieve returns higher than the their respective market, because prices already discount or have already determined the equilibrium value of the underlying asset. That is, price equals value and markets will always (or at least most of the time) reflect this.

The EMH ties into MPT nicely, as it underpins the assumptions used to create the “perfect portfolio” and it further entrenches the dogma that you can divine a specific return from secondary asset markets whilst managing risk.

The Price is wrong, b%tch

Suffice to say, the Great Recession (called the GFC in Australia) finally sounded the death knell of this flawed concept, although it lives on in the minds of failed economists and central bankers. Beyond the practical and empirical refutation, the dogmatic concept that markets are “king” and are the most efficient way of allocating capital (since the market price must equal its value) led to the abandoning of sound regulation and oversight of financial markets, particularly shares and property. One of the worst offshoots was the securitisation and further creation of derivatives (e.g CDO’s, RMBS) using the EMH as a mathematical basis of their “soundness”.

The empirical evidence is stark, particularly after the GFC when commentators, economists and other participants went on an introspective crusade to find out how it all happened. Jeremy Grantham, of GMO has summed it up here:

“In their desire for mathematical order and elegant models, the economic establishment played down the role of bad behavior” — not to mention “flat-out bursts of irrationality.

The incredibly inaccurate efficient market theory was believed in totality by many of our financial leaders, and believed in part by almost all. It left our economic and government establishment sitting by confidently, even as a lethally dangerous combination of asset bubbles, lax controls, pernicious incentives and wickedly complicated instruments led to our current plight. ‘Surely, none of this could be happening in a rational, efficient world,’ they seemed to be thinking. And the absolutely worst part of this belief set was that it led to a chronic underestimation of the dangers of asset bubbles breaking.”

Taking apart the flaws

MPT and EMH, and therefore the basis of how your capital is allocated, rest upon the following flawed concepts:

- Investors are rational and risk averse, which follows that you will only take on increased risk if you get higher returns.

- Risk can be mathematically measured and an expected return calculated for individual investor’s

- Asset risk is determined by their change in price, or volatility.

- Different risk/return profiles can be created, depending on the investor’s tolerance of risk (e.g high growth, conservative and “balanced”)

- Portfolio risk can be reduced by diversification, the process of holding different assets which are not correlated with each other. Therefore, you can have a higher expected return with lower risk.

Rationality is for Vulcans

First of all, investors are neither rational or risk averse. Behavioural economics shows that participants react differently and use different processes, sometimes wildly irrational, in determining investment decisions. This is the reason behind the creation and explosion of bubbles, not supply and demand curves. There are no pointy eared Vulcans at property auctions (maybe real estate agents dressed as Klingons?) or in front of computer screens at the ASX.

This is the first nail in the coffin of “price=value”. On the one hand, emotion drives the market price through fear and greed. On the other hand, we all value things differently – so there is no such thing as “intrinsic value” – the value cannot be calculated as we each have different perceptions of value.

Volatility is not Risk. Risk cannot be measured.

This leads to the very concept of risk. Risk cannot be calculated mathematically using volatility because it is not risk.

- Volatility is the measured change in price.

- Risk is the unknown probability of the investor losing money

These are completely different concepts, yet misunderstood by even the smartest of participants and commentators.

When you enter an investment, you face a series of known and unknown risks. Some of these risks can be hedged or insured away (e.g a property investor can insure against fire and damage). Most risks cannot be insured (e.g management or regulatory risks) – the only way is to avoid them completely, but this leads to another risk – opportunity cost. By not investing, you run the risk of loss of capital due to the hidden tax of inflation. But none of this can be reliably measured beforehand, as no one knows the future with certainty.

Notice the absence of price volatility in that discussion? And yet why the devotion to it by the investment industry in determining if an investment is risky or not?

Remember, risk equals losing money. Does it mean you lose money when your BHP shares are quoted one day at $44 and the next at $42? Only if you sell them at $42 (and if you bought them for a lot more) have you lost any money. What is being recorded is volatility, not a capital loss.

The point I’m trying to make is that some assets will have a lot of volatility, but in the end are low risk, whilst other assets have low or even zero volatility, but could be extremely high risk (e.g holding cash during an inflationary period). What’s important is when and how you make a loss and how you can mitigate that risk.

Lower the risk, higher the return

This statement goes against human nature – surely to get a big return, you need to take on large risks. As a full time trader I know this is a falsehood – I would be out of business if I took higher risks or if I eschewed volatility. For investors, the equation is similar – by lowering your exposure to the probability of loss – by either avoiding, mitigating or lowering your risk, the greater the chance of a positive return on and of your capital.

This is the current case for all the negatively geared property investors. They are exposing themselves to the ongoing real capital losses involved, whilst relying upon a seemingly low volatile asset class – i.e “property always doubles every 10 years”. This is an asset class that is subject to uncertain regulatory risk (e.g reversal of negative gearing legislation or increased CGT), uncertain liquidity risk (you can’t sell property like you can most shares) and other unknown risks (e.g deflating asset prices and rising consumer prices). Higher risk, lower probable return.

Risk Profiling is nonsense

Because risk cannot be measured reliably, and your “expected returns” are almost always undeterminable, the industry standard of “risk profiling” is a nonsense. The major problem is your behaviour as an investor- its very easy to be calm and rational whilst answering a few theoretical questions, but your responses may well change when answering a margin call or listening to your bank manager discuss your loan-value ratio on your investment property. This is borne out repeatedly in market crashes when even the most robust, well-managed and strong businesses are sold off, as even the most conservative investor runs straight to cash.

In my next article, I will contend that there are only two types of investor “profiles”, building on the observation and work of Benjamin Graham who formulated this idea well before the economic academics muddled generations of investors with “high growth”, “moderately balanced” and make navigating your yearly annual super statement a nightmare. I’ll also look at why the default option – used by some 80% of super investors – is actually extremely risky for the majority and should not form part of the MySuper campaign about to be introduced by the Federal Government.

(dumb) Diversification across asset markets doesn’t work

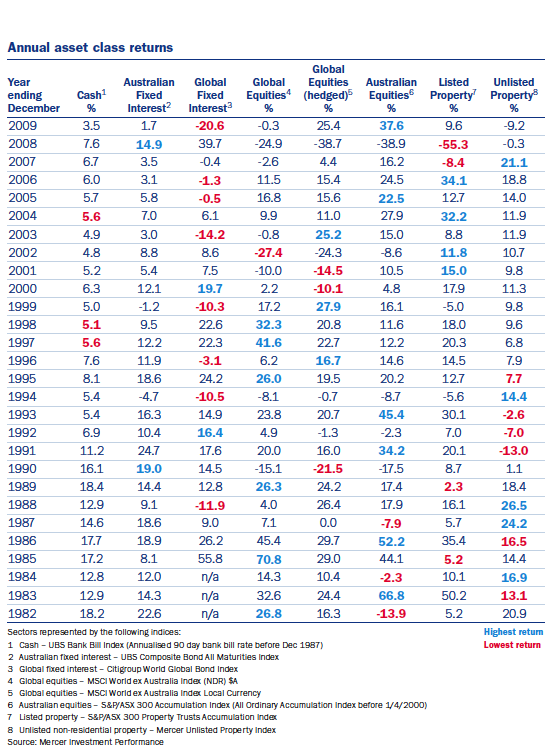

Here is Exhibit A and B, showing the correlation between diverse asset markets over the last decade (represented by a series of Vanguard mutual funds).

Diversification is purported to work based on the notion that you can create a portfolio of assets that have low or zero correlation with each other. That is, losses in one category should be offset by wins in the other category. You are “spreading” the risk, offsetting the chance that one asset may blow up, which can have dire consequences if you concentrate your portfolio (e.g like owning only one investment property).

But the real problem behind the diversification theory is that in a world of inter-connected fragile capital markets, an outcome of globalisation and widespread securitization of sovereign currencies (called a floating exchange rate), correlation is effectively the same. Australian shares behave like US shares, which behave like European shares, which behave like the Euro, which behave inversely to the US dollar, which behaves inversely to gold, which behaves similar to the Australian dollar and so on. In fact, during the GFC most if not all major markets experienced the same volatility going up and down, and it continues to this day.

For the investor, particularly within a large super fund, what’s the point of diversifying when all asset markets are behaving similarly? Why worry about being “overweight” emerging markets, or “underweight” commercial property, or “neutral” shares when there is little or no benefit in diversifying in any of them? Yet these are amongst the myriad of choices given when you select your risk profile. No wonder most (over 80%) go with the default option.

The standard industry doctrine claims that it is pointless trying to “pick stocks or classes” (or heaven forfend, try to time the market) and that widespread diversification is more effective. This type of dumb diversification sells because of the inherent complexity of trying to be a smart diversifier, i.e – to try pick and choose and concentrate where to allocate your capital.

Paradoxically, they are right. Could you have picked the best returns from these asset classes year in, year out?

It is hard, evidenced by the fact that most active (i.e stock picking) fund managers can’t beat the index, something I’ve covered here. Most super funds use a passive policy and invest heavily in index ETF’s (exchange traded funds) or create index following portfolios. Index adherents will point to the ASX200 and All Ords “average” growth over the decades as proof that this diversification policy fits well with a superannuant saving for retirement over the long term. More about this in a later article.

The slavish devotion to markets

My core problem with conventional asset allocation in the super industry centers on the premise that a diversified portfolio comprising mainly risk assets is necessary for almost all participants, and the inevitable risk asset chosen is listed shares. Share markets have become the place to allocate superannuation capital. The question is does this actually provide a net benefit to the superannuant or to the economy?

I’ll leave the second case to other macroeconomic analysts, but this leads me to my final point about the problem with current asset allocation dogma and to the first question raised in this post – if super is for saving for retirement, how hard can it be?

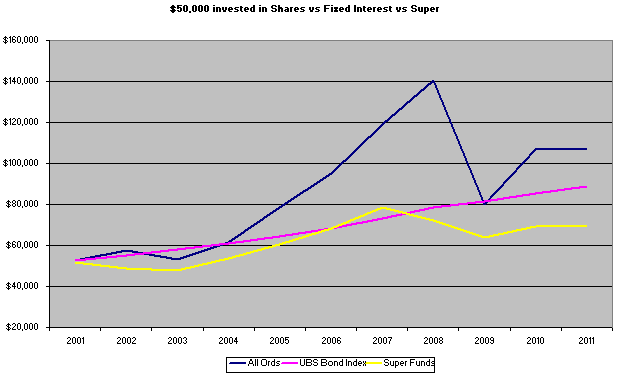

The average super fund has returned 3.3% over the last 10 years, whilst the ASX200 has averaged over 10% and fixed interest (using the UBS Composite Bond Index) has averaged 5.4% – this is the problem with flawed averages that I tried to elucidate in a previous post.

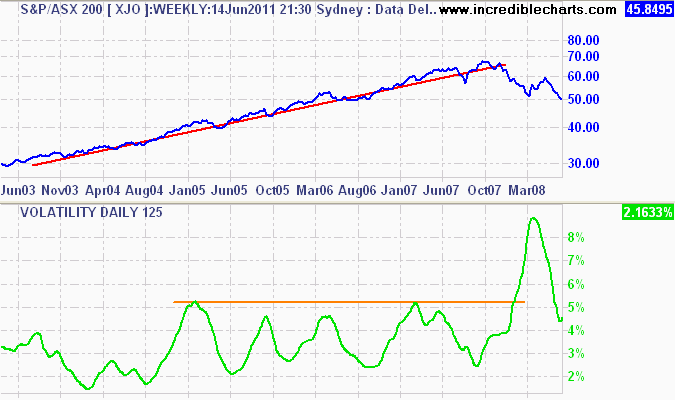

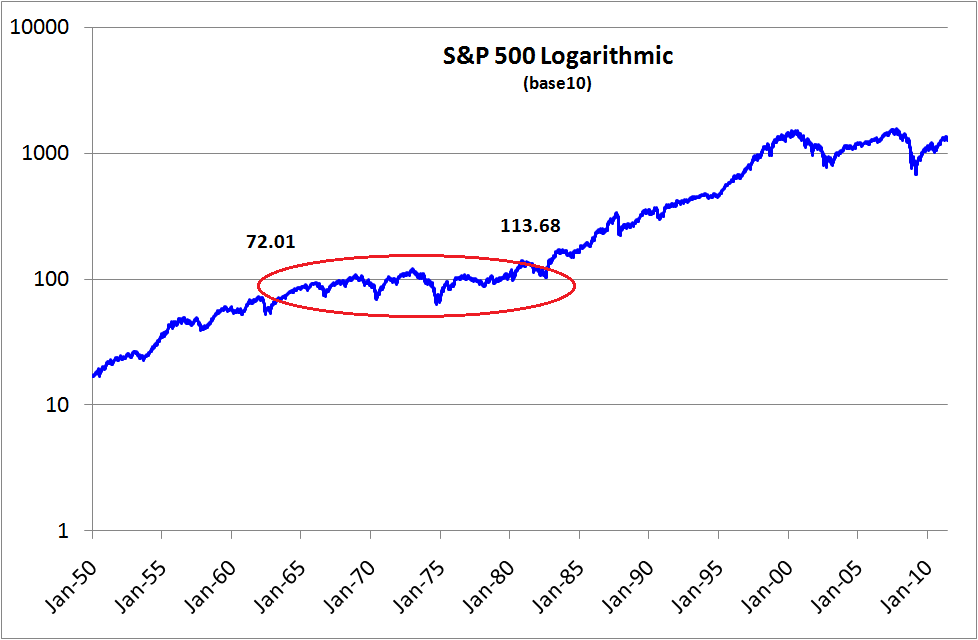

As Jeremy Cooper recently pointed out, since 1980 the All Ordinaries Accumulation Index has dropped more than 10% eight times – and each fall has averaged over 24% – which can have an irrecoverable effect on a portfolio heavily weighted to shares, particularly for someone about to retire. For those with a while to go til retirement, markets can also track sideways, even for as long as a decade, as shown in Q Continuum’s recent post.

American share investors have yet to return to their 2000 highs, repeating the 1968 to 1982 sideways move illustrated above. Don’t be fooled that it can’t happen here – the Australian market has already moved sideways for 5 years, unadjusted for inflation.

Its called saving, not speculating

The perception, that shares should be the No.1 choice for retirement purposes has resulted in a paradigm shift away from what should be at the core of super – fixed interest and other savings like investments.

Investing in fixed interest – e.g corporate bonds, government bonds, convertible shares and other debt securities – provides an economy with ready to go capital and equity for businesses to use to invest, expand and become productive. Yet as a proportion of super assets (excluding self managed funds), fixed interest and cash make up less than 25% – shares and property absorb almost two thirds of all assets, which goes some way to explain why super funds continue to underperform almost every other asset class in the last ten years.

In my next post about super, I’ll go over some different theoretical and practical ways to approach asset allocation.

Disclosure: The author is a Director of a private investment company (Empire Investing). The article is not to be taken as investment advice and the views expressed are opinions only. Readers should seek advice from someone who claims to be qualified before considering allocating capital in any investment.