In 1998, following the release of the Financial System (‘Wallis’) Inquiry’s final recommendations on financial system regulation, the Australian Government implemented a new organisational framework for the regulation of the financial system.

Prior to the Wallis Inquiry, regulation was either governed by the states for some products or based on a sectoral approach with industry specific regulation. The Inquiry recommended that regulation be nationalised and based on functional objectives, with three ‘peaks’ — a single prudential regulator (the Australian Prudential Regulation Authority (APRA)), a regulator for consumer protection and market integrity (the Australian Securities and Investment Commission (ASIC)), and an institution responsible for systemic stability and payments (the Reserve Bank of Australia) (RBA) (see below).

These arrangements were designed to ensure that regulation is consistent for similar financial products.

At around the same time, Britain’s Chancellor of the Exchequer, Gordon Brown, unveiled a radical shake-up of Britain’s financial regulation. Mr Brown stripped the Central Bank, the Bank of England, of responsibility for banking supervision and abolished a range of other financial regulations. In their place, Mr Brown created the Financial Services Authority (FSA) – a mega regulator with responsibility for regulating the entire financial system.

Having lost its responsibility for banking supervision, the Bank of England was left to focus more or less exclusively on inflation targeting.

For the first 10 years, the new structure appeared to work well, with the UK economy growing in line with its long-term trend whilst inflation remained stable. Some were proclaiming it ‘The Great Moderation’, in reference to the UK’s smooth growth trajectory and the seemingly calm macroeconomic landscape.

However, under the benign facade, the UK’s economy was becoming progressively more unbalanced, with demand expanding far quicker than output on the back of the rapid expansion of household debt, much of it mortgage lending.

Then the UK economy took a turn for the worst in late 2007, when UK house prices began falling. UK households suddenly felt poorer, eroding consumer confidence and their willingness to spend (the ‘wealth effect’). And with asset prices falling, and many households moving into negative equity, they had little choice but to tighten their belts and begin the long and painful process of debt repayment (‘deleveraging’).

Suddenly, the UK banks were in a precarious position. Non-performing loans were on the rise and many banks that had carelessly borrowed heavily short-term in the international capital markets to fund the housing bubble, suddenly found that they were unable to roll-over their wholesale funding amid heightened risk aversion from global investors.

In August 2007, Northern Rock bank approached the Bank of England for liquidity support to replace funds it was unable to raise from the money market. This led to panic among individual depositors, who feared that their savings might not be available should Northern Rock go into receivership, culminating in the UK’s first bank run in 150 years.

Northern Rock was eventually nationalised in February 2008. And in October 2008, the UK Government was required to launch a £500 billion bank rescue package aimed at restoring market confidence and stabilising the banking system, as well as providing a range of short-term loans and guarantees of interbank lending.

Back to the future

Fourteen years after being stripped of its supervisory responsibilities, the Bank of England is about to be put back in control of the UK’s financial system in an attempt to address the regulatory failures of the FSA and to try to ensure that no UK government ever has to bail-out the banking system ever again.

The proposed new structure appears to emulate the Australian ‘three-peaks’ model outlined above, but with one significant difference: the Bank of England will receive powers to use macro-prudential tools (e.g. minimum loan-to-value ratios) to tame the credit cycle.

The new regulatory structure is as follows:

- The Prudential Regulation Authority (PRA): will take over the prudential operations of the FSA – ensuring banks hold enough capital and liquidity to withstand shocks unaided. The PRA has a single objective to promote the financial stability of the UK financial system, and is also charged with ensuring that ailing firms can fail without needing taxpayer help or destabilising broader markets. The PRA will be responsible for the prudential supervision of over 2,000 firms, including 157 banks.

- The Financial Conduct Authority (FCA) – will take on responsibility for enforcement and conduct from the Financial Services Authority. The authority will have wide-ranging powers, including the power to oversee the design of financial products, including mandating minimum standards or placing requirements on products. It will also have the power to ban products immediately for up to a year while it considers a permanent ban; or force firms to withdraw or change misleading promotions with immediate effect and publish the fact it has done so.

- The Financial Policy Committee (FPC): charged with ensuring financial stability by monitoring “broader risks in financial markets” and “identifying excesses and vulnerabilities”, plugging a supervisory gap highlighted by the credit crunch. The FPC is expected to have the power to increase loan-to-value ratios for specific sectors or banks. It is also expected to publish regular reports.

In my view, any measures that have the potential to mitigate excesses in the credit cycle, including macro-prudential regulations, are a positive step. However, by themselves, they are insufficient to prevent asset bubbles and potential future financial crises.

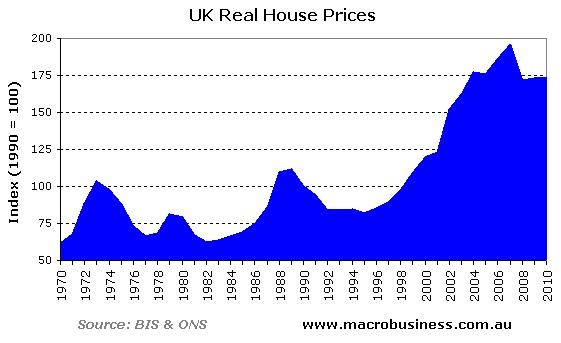

As shown by the below charts, the UK housing market – the key conduit of financial system instability – has experienced high levels of volatility over the past 40 years.

First, consider the annual change in UK house price inflation since 1970:

Now consider the UK’s real house price index since 1970. Note that the UK has experienced four boom/bust episodes over this period despite the fact that the financial sector was not deregulated until the 1980s.

Much of the UK’s house price volatility and unaffordability can be traced back to policies that have placed a straight-jacket on new housing development, including:

- the Town and Country Planning Act 1947, which established that planning permission was required for land development and that ownership alone no longer conferred the right to develop the land;

- the exclusion of large swathes of agricultural land from urban development (e.g. via the green-belt);

- excessive densification targets, whereby 60% of all development is required to be on ‘brown field’ sites; and

- fiscal disincentives placed on local governments to facilitate development. i.e. local governments are responsible for providing services for new housing, but receive little return in the form of tax revenues.

These regulatory constraints on new housing construction have meant that housing supply in the UK has been incapable of responding quickly to changes in demand, thus placing upward pressure on prices and creating expectations of future capital growth.

According to the Joseph Rowntree Foundation’s (JRF) Housing Market Taskforce report on reducing volatility in the UK housing market, only an average of around 180,000 homes per annum were completed in the UK over the past two decades – only slightly above construction volumes in Australia, despite the UK having nearly triple the population (around 62 million).

And as shown below, despite the massive run-up in prices between 2000 and 2007, there was only a minimal supply response towards the end of the latest housing bubble, suggesting that UK housing supply is highly unresponsive (‘inelastic’) to changes in demand.

The JRF Housing Market Taskforce report noted the following in relation to the link between housing supply and house price volatility in the UK:

Improving housing supply is the key to reducing the risks of market volatility in the longer term but cannot remove them altogether. Moreover, a substantial increase in housing supply is required just to maintain current affordability levels [note: the report also recommends credit-controls as well]…

The Taskforce believes that affordability and housing market volatility are closely linked. In the long run, housing supply in relation to underlying demand determines the price of housing, but in the short run, rapid price rises may occur due to demand shocks arising from such factors as rapid falls in interest rates or changes in credit availability. House price rises are most likely to develop into unsustainable price booms if there is an underlying shortage of housing because this places real prices on an upward trajectory and creates expectations of future price rises…

In general the tighter the underlying housing market conditions, the more likely a sudden increase in demand is to result in a rapid increase in prices, setting off another house price boom. In this way underlying supply constraints and volatility are linked.

Getting back to the topic at hand – the UK’s attempts to prevent future financial crises – as long as housing supply remains artificially constrained and unable to respond adequately to changes in demand, it will be very hard for the Bank of England to successfully mitigate against future financial crises. While credit controls alone are a positive step, housing booms and busts will forever be present, creating oscillating wealth effects that feed through to consumption spending.

In this regard, demand-side and supply-side factors cannot be viewed in isolation. A holistic approach is required if the mistakes of the past are to be avoided.

Cheers Leith