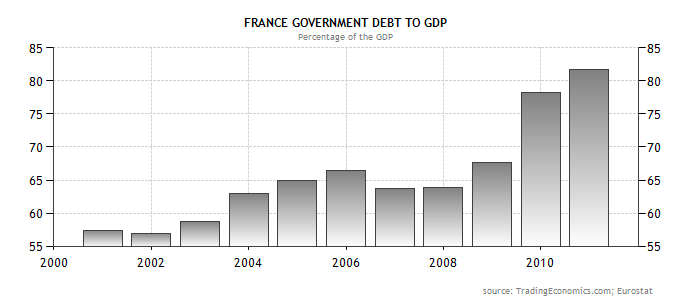

While I was on holiday over the last week I spent some time musing over the current situation in Europe and just how bad I think it can get. I have been wondering for quite a while when France will finally join the PIIGS camp, given that it to is a highly indebted nation with insipid GDP.

I have posted a number of articles over the past months about the fact that Europe will eventually have to face up to a sovereign debt crisis because nothing is being done to address the fundamental issues within Europe. Something I note the ECB’s policy maker made quite clear over the weekend.

Cutting Greece’s debt will not solve the country’s problems, ECB policymaker Jens Weidmann was quoted as saying on Sunday, adding Athens needed to raise its productivity instead.

“Greece consumes considerably more than it produces, the public budget shows high deficits,” Weidmann, head of Germany’s Bundesbank and who sits on the European Central Bank’s Governing Council, was quoted as saying.

“As long as that doesn’t change, a hair cut will not really improve anything,” he said, Bild am Sonntag newspaper reported.

Euro zone policymakers are exploring ways to extend a rescue deal for overborrowed Greece and give it more time to repair its public finances. At the same time, authorities are trying to prevent the debt crisis from escalating in the bloc’s periphery.

On Saturday, German magazine Der Spiegel reported — citing unnamed German finance ministry sources — Greece could cut its public debt by 20 billion euros ($28.2 billion) if it bought back sovereign bonds at market prices as part of a rescue.

The finance ministry declined to comment.

Wolfgang Franz, head of Germany’s “wise men” economic advisers, told Focus magazine on the weekend a hair cut was “inevitable and justified.”

“One possibility would be that the current EFSF euro rescue mechanism swaps — at a significant discount — Greek bonds into bonds it issues and guarantees,” Franz was quoted as saying.

The ECB has signaled it remains fiercely opposed to any form of default. The bank is fearful the problems that have hurt Greece, Ireland and Portugal could spread to other indebted euro zone members if a default were triggered.

The European emergency fund purchasing bonds in the secondary market is just another step towards an actual monetary union. Something the ECB’s Lorenzo Bini Smaghi is obviously pushing for.

The European Central Bank renewed its call for politicians to empower Europe’s rescue fund to buy government bonds on the secondary market.

ECB Executive Board member Lorenzo Bini Smaghi said in an interview with Greece’s To Vima newspaper that it would be “useful” to allow the European Financial Stability Facility to buy bonds on the open market, according to a transcript published by the Frankfurt-based ECB today.

“This would allow the private sector to sell bonds at their market value, which is currently lower than the nominal value,” Bini Smaghi said. “This would allow the private sector to sell while the public sector would save money. Such an option was not included in the design of the EFSF. If there is a way to change the EFSF, that would be useful.”

European leaders in March declined to authorize the EFSF to purchase bonds on the secondary market — a role the ECB assumed last year as the Greek debt crisis escalated. Bini Smaghi said the onus remains on Greece to pursue its fiscal consolidation program. He also encouraged Greek banks to sell foreign assets.

“The Greek banks have to sell some assets abroad, get fresh money in the system to be able to contribute to the recovery, do mergers even with foreign banks to bring foreign capital,” he said. “If you consider the fully hypothetical situation in which all Greek banks were owned by foreign capital, as was the case in eastern Europe, then a lot of problems in Greece would be eased.”

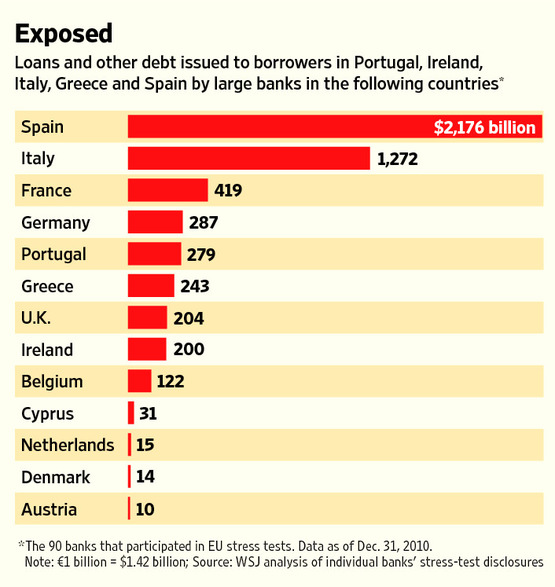

There is an assumption in that last statement that foreign banks are in some sort of position to expose themselves further to Greece and the other periphery nations. The latest european banks stress test suggests otherwise as noted by the Wall Street Journal:

Banks tend to be holding far greater quantities of those commercial and retail loans than they are of sovereign debt, according to a Wall Street Journal analysis of disclosures accompanying the stress tests.

This year’s stress tests represent the first time there has been a uniform way to measure this exposure. Until now, banks have disclosed their portfolios of loans to customers in troubled countries on a piecemeal basis. That made it virtually impossible to aggregate data across the industry or to compare different institutions.

“The country-by-country exposure [data] is better than any data we’ve seen before,” said Alastair Ryan, a London-based banking analyst with UBS AG. “It’s giving me more things to be fearful of,” Mr. Ryan added, referring to the disclosures of some banks’ large holdings of loans to customers in troubled countries.

After Spanish and Italian banks, France’s banks appear to be the most exposed. As of Dec. 31, its four largest banks—BNP Paribas SA, Crédit Agricole SA, BPCE Group and Société Générale SA—were holding a total of nearly €300 billion, or about $425 billion, in loans and other debt issued to institutions and individuals in Portugal, Ireland, Italy, Greece and Spain, the countries that are among Europe’s most troubled. That is largely a result of some of the French banks having big retail- and commercial-banking operations in Greece, Italy and Spain.

The French banks’ portfolios of commercial and retail loans in those countries dwarf their holdings of sovereign debt.

It needs to be remembered that these are countries that have suffered substantial property market shocks and there will be substantial unrealised losses across all of these balance sheets. A quick glance at European bank exposure to the PIIGS should ring alarm bells across the board:

Spanish exposure to itself and other periphery nations is massive. A translation of an article on a Cotizalia a Spanish language website explains just how big the problem is:

With that comes over to the Spanish banks in coming quarters, rising delinquencies, loss of use of its vast real estate assets, reduced margins, loss of turnover, so the open bar ECB’s liquidity, .- etc, the only front that seemed to have solved was that of the wholesale funding by improving markets and emissions with a State guarantee. Now, what entities have not solve the problem, but put it off a few years. Because, although covered with maturities of 2009 (about 80,000 million euros), will face renewed another 240,000 over the next three years.

This is reflected in a report published yesterday by the rating agency Moody’s, which estimates that banks and Spanish will have to cope with maturities of 75.884 million next year, from 63.272 million in 2011 and no less than 100.487 million in 2012 which will be the year more complicated. This is because that is when the bulk of emissions overcome with a State guarantee made in 2009, whose term is three years (although recently Caixa Catalunya , Bancaja and CAM have been issued to five).

Translation: If you thought 2011 was a problem for Europe, just wait for next year.

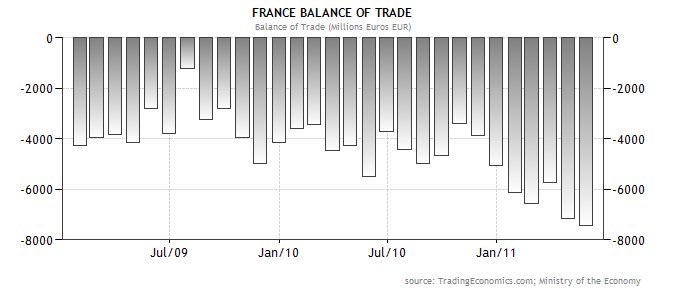

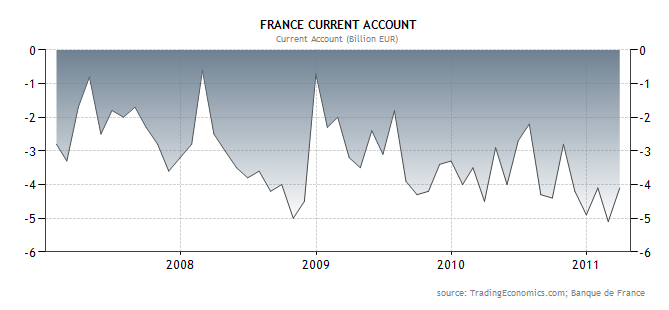

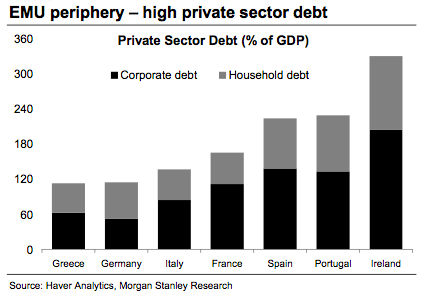

With Greece dead, Spain completed overloaded with debt, Portugal now at junk status, Italy on the suicide radar it is only a matter of time before France joins in. You can see from the above chart that French banks are third in line on the debt hook, yet they still seem to be flying under most radars. A quick glance at French fundamentals tells you they are in a similar position as the Portugal, Italy, Greece and Spain. High debt in both the public and private sectors, trade imbalance that continues to grow and a current account that has been in the red for years.

Once the markets realise that it is actually the F-PIIGS then the ECB will have no choice but to back flip on every single prudent banking rule and the floodgates for a Euro QE program will open. Nothing is being fixed and the news just gets worse by the day.