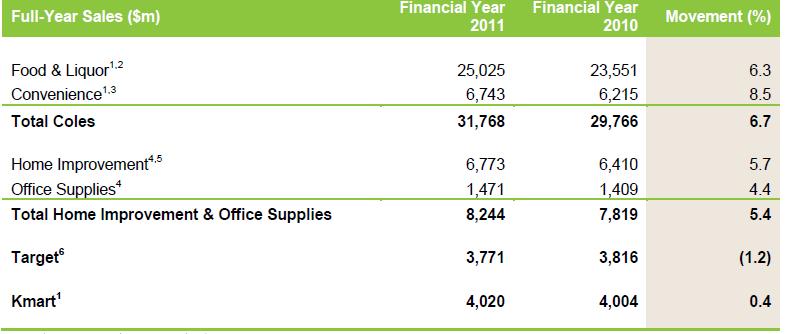

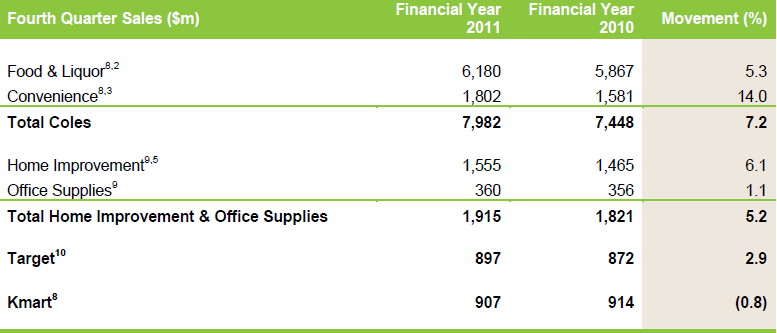

Wesfarmers has come out with a retail update that includes some good-looking sales numbers given Australia’s “cautious consumer” meme. The results by retail area are summarised in the tables below (sourced from the Wesfarmers update):

Full year FY11

Fourth Quarter FY11

The year-on-year details are as follows.

Food and Liquor

- Sales growth of 6.3% YoY

- Food deflation of 0.3%, despite the increase in tobacco taxes and the impact of the floods

- Underlying food and liquor deflation of 1.6% once the floods and tobacco rises are removed

- Coles is committed to its “Down, Down” campaign and continues to focus on cutting business costs

Convenience

- An increase of 8.5% on Coles Express sales was due primarily to fuel price increases, with fuel volumes increasing 2.3%

- Non-fuel convenience sales were up 2.0% YoY, with Coles noting less impulse buying in the Q4 sales results

Home Improvement

- Sales experienced a 5.7% increase YoY as the Bunnings success story continues depsite consumer sentiment

- Two new Bunnings and two trade centres were added to the locations list, with more planned for the future

Office Supplies

- Office sales increased 4.4% YoY, with Officeworks generating an impressive 5.2% growth in sales

- Conditions continued to be volatile given business and consumer caution

Target & KMart

- Sales were down 1.8% at Target, noting erratic conditions in the 4th quarter

- Another 17 Target stores were refurbished

- Kmart sales were flat, wth Home and Apparel sales ok but everything else underperforming

- Kmart still managed to increase transaction volumes

Summary

So the upshot is sales increased 5.2% (47.8B in FY11 vs $45.4B in FY10), but deflation in Food and Liquor ran at an underlying 1.6%, whilst Kmart and Target struggled. No doubt this is a result of Cole’s continued price war with Woolworths as well as the tight-fisted consumer pinching their discretionary pennies.

Given that Woolworths has also recently reported healthy sales increases, the two big boys may be taking a fair chunk of non-discretionary market share from the smaller retailers.

I’ll be very interested to see Wesfarmers retail net profit for FY11 – the combination of greater sales with falling prices will make it very hard to maintain margins. If the retail division manages to maintain or increase margins and NPAT over the FY10 results, then the cost-cutting drives will have proven to be successful.

So while this update looks good on the surface, we won’t know how well Wesfarmers retail has actually done until the full-year results are announced.

Disclosure: The author is a Director of a private investment company (Empire Investing Pty Ltd), which has no current interest in the businesses mentioned in this article. The article is not to be taken as investment advice and the views expressed are opinions only. Readers should seek advice from someone who claims to be qualified before considering allocating capital in any investment.