In case you’ve been living under a rock for the past few months, the US is set to “go broke” by August 2 if its politicians don’t approve an increase in the country’s debt ceiling. I have avoided writing about this topic so far, because, as with most matters concerning the US at present, it is impossible to discuss without getting embroiled in politics. But since the consequences of a default would be so catastrophic, I think the topic deserves an in depth look. Let’s try to sort through all the nonsense and answer some basic questions.

What on earth is the debt ceiling?

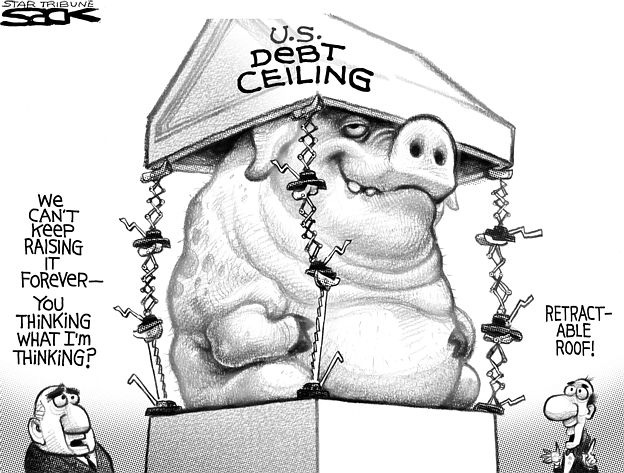

The modern “debt ceiling” was first introduced in 1939, when the US Congress granted Treasury the right to issue debt when needed, as long as the total debt did not exceed a certain limit. Since the US has almost constantly ran budget deficits since this time, the debt ceiling has had to be raised frequently over the years, to avoid default. Predictably, this process usually results in political fireworks.

Now, the strange thing about this process is that the debt ceiling, and the actual spending decisions of Congress, are voted on separately. This can result in the bizarre situation where the same politicians that have already voted for tax cuts and spending increases (thereby increasing the deficit), will then rail against a decision to raise the debt ceiling, which wouldn’t have been necessary if it hadn’t been for their irresponsible decisions in the first place. As James Hamilton puts it:

One of the peculiar embarrassments of the American political process is the fact that Congress votes separately on the deficit and debt, as if they were two different decisions. This bizarre arrangement allows Congress the luxury of instructing the Treasury to spend more than it takes in as revenue while at the same time voting to deny the authority to borrow the funds that would be necessary to implement the plan.

If the government is (a) required by the deficit legislation to spend, and (b) precluded by the debt legislation from borrowing, the Treasury would be forced into default. The greater the likelihood markets attach to such an event, the higher will be the interest rate the government has to pay on Treasury debt. A politician who votes for the spending and tax measures that produced the deficit but against a debt ceiling consistent with these is deliberately wasting taxpayer dollars for no purpose other than to grandstand before voters as a “fiscal conservative”. Anyone playing such a game has complete contempt for the intelligence of their constituents.

And surely nobody would play such a stupid game, would they?

Think again. The very Republicans that voted en masse for the Bush era tax cuts which are a major cause of the current deficit, are now en masse opposing an increase in the debt limit unless certain draconian conditions are met. Amazingly, the normally free spending Democrats have agreed to tie massive deficit reduction efforts to a deal to raise the debt ceiling, and have agreed to a ratio of roughly 3 to 1 of spending cuts to tax increases. However, Republicans are insisting on zero tax increases.

This intransigence is starting to lead even many conservatives to wonder if the Republican Party has completely lost the plot. As David Brooks, the conservative New York Times columnist says:

If the Republican Party were a normal party, it would take advantage of this amazing moment. It is being offered the deal of the century: trillions of dollars in spending cuts in exchange for a few hundred billion dollars of revenue increases.

A normal Republican Party would seize the opportunity to put a long-term limit on the growth of government. It would seize the opportunity to put the country on a sound fiscal footing. It would seize the opportunity to do these things without putting any real crimp in economic growth.

The party is not being asked to raise marginal tax rates in a way that might pervert incentives. On the contrary, Republicans are merely being asked to close loopholes and eliminate tax expenditures that are themselves distortionary.

This, as I say, is the mother of all no-brainers.

But we can have no confidence that the Republicans will seize this opportunity. That’s because the Republican Party may no longer be a normal party. Over the past few years, it has been infected by a faction that is more of a psychological protest than a practical, governing alternative.

The members of this movement do not accept the logic of compromise, no matter how sweet the terms. If you ask them to raise taxes by an inch in order to cut government by a foot, they will say no. If you ask them to raise taxes by an inch to cut government by a yard, they will still say no.

The members of this movement do not accept the legitimacy of scholars and intellectual authorities. A thousand impartial experts may tell them that a default on the debt would have calamitous effects, far worse than raising tax revenues a bit. But the members of this movement refuse to believe it.

For the most part here, Brooks is right.

What happens if we reach August 2 without a deal?

The debt ceiling deadline applies to almost all Federal debt, and it effects all government obligations, which includes interest payments on the debt, social security, funding of the military, and salaries for teachers and public servants. In a similar standoff in 1996, the government narrowly avoided default by putting non-essential government employees on unpaid leave for a week, and shutting down non-essential services like national parks. We could be headed for a similar scenario. Ultimately though, the politicans will reach a deal, because the alternative would be disastrous. S&P has already reduced its outlook on US debt to negative, and threatened to downgrade the US a gazillion notches if it chooses to skip a debt payment on August 4.

And the operative word here is “chooses.”

I say this because the debt ceiling is an entirely self imposed constraint (in fact, some argue that the ceiling is even unconstitutional). Unlike the case of Greece, there is no issue per se with “financing” the US deficit. After all, the US is an independent sovereign nation that is the sole issuer of its own currency. The US can always print more dollars. So operationally speaking, there is absolutely no need to default on its debt.

This is not to say that the soaring public debt isn’t an issue. It is. As I have argued before, continued budget deficits could lead to soaring inflation and currency debasement if they are not corrected by the time the economy returns to full capacity. The US badly needs a plan to reform its dysfunctional healthcare system, which is by far the biggest cause of the long-term deficit projections. But the point here is that these are longer term issues. Debt ceiling shenanigans aside, the bond market appears to agree with this view, which is why 10-year US Treasuries yield only 3.1%, compared to 16.5% for Greek bonds of the same maturity.

Right now, when we have near double-digit unemployment and enormous slack in the economy, is not the time for drastic cuts. In fact, drastic cuts will almost certainly be counterproductive, because (as I wrote about here), one of the biggest causes of the current deficit is the collapse in revenues caused by the weak economy. Slash public spending now and you only exacerbate the cycle of debt deflation and drive the deficit even higher.

Obama hasn’t read Koo

And here is where the political charades surrounding the debt ceiling could lead us to disaster.

Because incredibly, President Obama has adopted the same talking points as his Republican friends, recently stating:

Government has to start living within its means, just like families do. We have to cut the spending we can’t afford so we can put the economy on sounder footing, and give our businesses the confidence they need to grow and create jobs.

Now this is one of those common platitudes recited by politicians that sounds reasonable on the surface but actually doesn’t make sense. Obviously Obama has not read Richard Koo.

Just like the case of Japan in the 1990s and beyond, the “balance sheet recession” that the US is still clawing its way out of is a very different animal to your run of the mill economic slowdown. In such situations, the deleveraging process in the private sector can take a very long time, and while this process is playing out, it is only the government that can pick up the slack and prevent the economy from collapsing.

This is precisely because, contrary to what Obama says, the US government is not like a household. Unlike households, the government has the power to tax, and monopoly rights to issue the currency. In a deep recession, the government can act as an employer of last resort. The US is suffering an enormous infrastructure deficit, and with huge amounts of surplus labour available and interest rates low, there is no shortage of investments that could be made right now to increase the country’s future productive capacity.

Say what you will about Australia’s NBN. But in the USA today, there is absolutely zero political appetite for investing in the future.

Perhaps Paul Krugman is right and we are dealing with President Barack “Herbet Hoover” Obama.