On Wednesday, Delusional Economics posted a cracking article about a new mortgage product being offered by BankWest enabling first-time buyers to purchase a home with only a 3% deposit:

First homebuyers will be able to borrow 97 per cent of a loan under a new Bankwest mortgage product.

Bankwest managing director Jon Sutton announced the $500m loan strategy this morning, which will be available to WA borrowers.

The loan undercuts the traditional 20 per cent deposit rate normally required of first homebuyers. The bank claimed it would cut the deposit saving time for first homebuyers from four years to six months…

Housing Minister Troy Buswell backed the product as a “new weapon in the housing affordability battle”… He said low deposit loans from the private sector were more effective in helping first homebuyers into the market than a government grant.

Like Delusional Economics I believe lowering deposit requirements (increasing loan-to-value ratios, or LVRs) is a crazy idea for all the reasons Delusional espoused previously:

Affordability is the measure of a cost relative to income. It is not a measure of how easy it is to go into debt. Buyers are “priced out of the market” because prices are too high relative to incomes, not relative to the home loan they can receive from a lender with dodgy standards. Lowering credit criteria or shovelling incentives at people will do what it did last time. Create false short-term demand, push up prices that will then create an even bigger problem. What do we do next? Offer 125% LVR loans?

Increasing LVRs will in no way lead to more affordable housing, it will simply mean that more poor fools go into debt in the belief that they are on the road to riches while paying over-inflated prices for an asset that is already oversupplied… Increasing LVRs is utter madness.

But if Minister Buswell was really interested in finding a solution to housing affordability, he would look to address WA’s housing supply problems by freeing up overly restrictive planning processes which, according to the Productivity Commission’s recent planning review, takes developers between 3 and 10 years (best case / worst case) to navigate before building can commence. Mr Buswell might also want to reconsider WA’s infrastructure charges, which add $20,000 to the cost of a typical new home.

The effects of WA’s slow and costly planning approval processes are two-fold.

First, the construction industry has been unable to respond quickly enough to the recent increases in housing demand caused by WA’s booming economy, easier credit, and high population growth. This is evident by the below charts, showing the sluggish supply response to rising house prices and strong population growth.

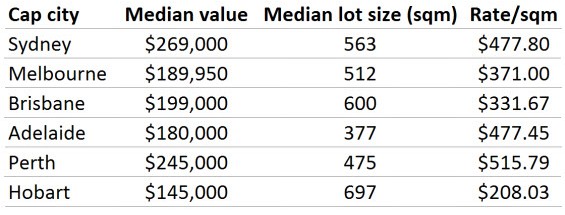

Second, the above factors (planning delays and taxes), combined with Perth’s restrictions on land supply via the urban growth boundary, has forced-up the cost of fringe housing lots, as evident by Perth having the highest land costs in the nation on a rate per square metre basis according to RP Data:

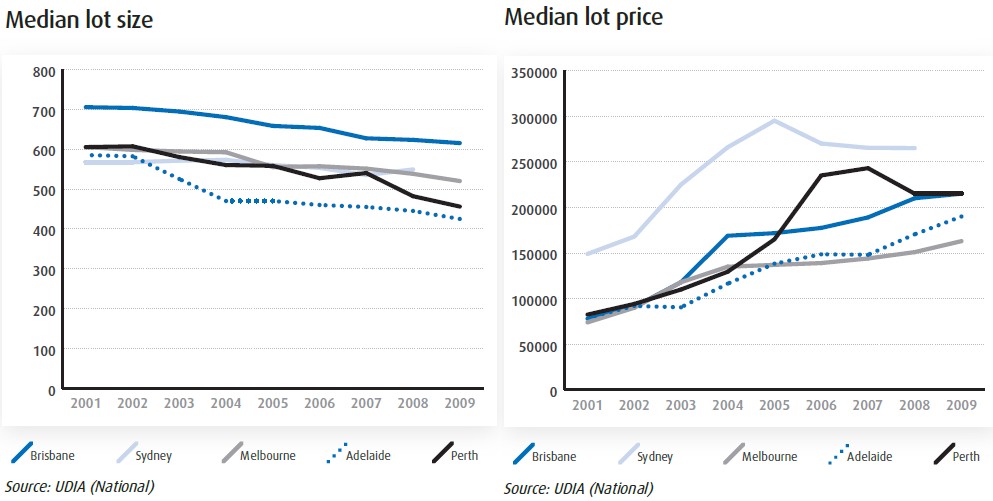

With land prices more than doubling over the past decade as lot sizes have shrunk:

As stated many times previously (for example, here), restricted land/housing supply is a double-edged sword. With supply unable to respond quickly to changes in demand, the housing market becomes overly sensitive to demand shocks, resulting in greater price volatility and boom/bust cycles as demand rises/falls.

During an upswing, the extra demand will automatically feed into higher home prices rather than new construction. In turn, the price rises and perceived scarcity will encourage speculative demand and ‘panic buying’ from first-time buyers, which helps to drive prices up even further. The opposite holds during a downturn, where unresponsive supply will help to accentuate price falls as new housing planned years ago continues to hit the market.

It’s a shame that our political leaders continue to promote failed policies – such as looser credit and first home buyer subsidies – as the answer to Australia’s housing affordability problems, rather than focusing on the underlying structural factors that are pushing-up the cost of housing and create the pre-conditions for housing bubbles to develop.