Accounting and financial group KPMG has constructed a detailed review of the top 50 listed companies – the ASX50 – following the end of the corporate earnings results.

Here are some key findings, which are revealing:

- Statutory (reported) profits for 12 months ending 30 June 2011 are up 33%

- Underlying (cash) profits for same period up 26%

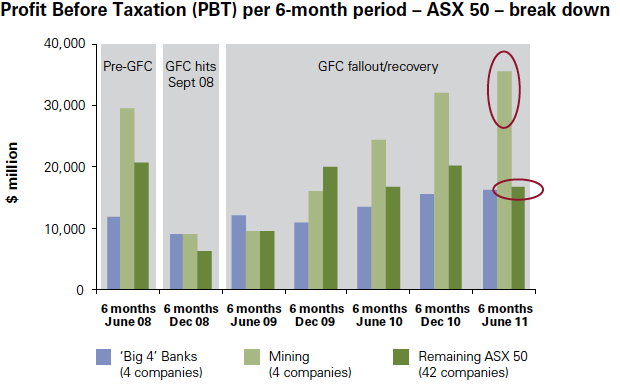

- The big 4 miners (not named, but obviously BHP, RIO, FMG, NCM) account for 52% of ASX50 profits and 78% of yearly profit growth

- The big 4 banks (CBA, ANZ, NAB, WBC) account for 23% of of ASX50 profits and 21% of yearly profit growth

- The remaining 42 companies only had 1% growth in reported profits for the year, and a 17% reduction in profits for the last 6 months

- Only 16 of these 42 companies had an improved result and six of these were in the energy sector (hence relied on high energy prices)

- Three years after the GFC, profits from the non-bank, non-miners are 19% below June 2008 results.

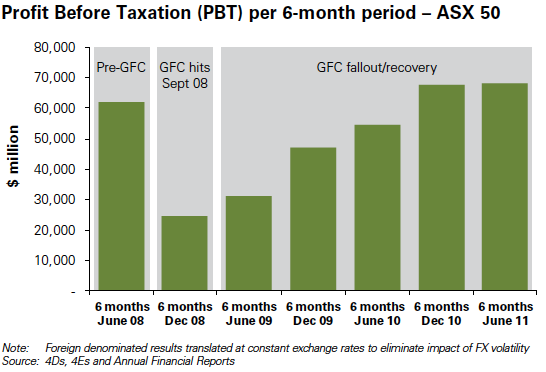

And here are the charts of profit before tax, in 6 months period from the GFC to now:

So the big 8 “Houses and Holes” companies contributed 99% of all profit growth and made up 75% of all profits for the top 50 companies in Australia. The only other profit growth came from energy companies who also require high commodity prices.

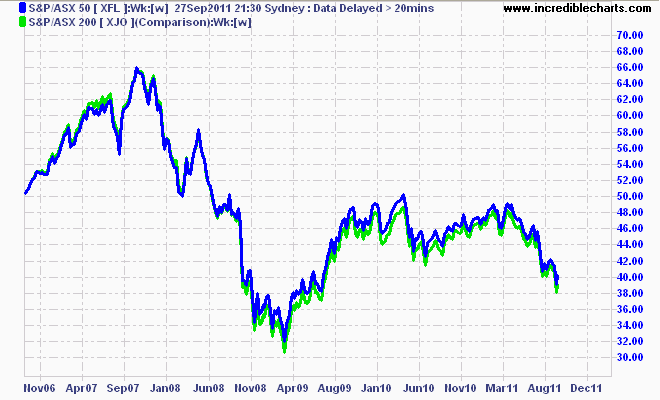

And because of ructions in overseas markets, namely a possible slowdown in China and financial/credit crises in Europe, risk institutions have pushed down the only profitable sectors of the ASX50 (and hence the ASX200 as they dwarf all the smaller companies by capitalization size).

Going by the chart below, it makes more sense to follow the ASX50 instead of the ASX200, and therefore, just follow the “top” (sic) 8 companies, the “ASX8”.

This is the anti-thesis of robustness, of sound economic allocation. This is fragility, writ large.