Everyday at MacroBusiness we endeavor to cover a wide range of topics about the Australian economy that are either unreported or misrepresented by the mainstream media. One of the major themes since we began, just 7.5 months ago (I know, it does seem longer), has been the changing face of the Australian economy as private sector credit growth shrinks and resource sector investment grows. This dynamic has created quite a lot of friction in the Australian politico-economic landscape and, unsurprisingly, in our very own forum.

I do, however, think there has been quite a bit of confusion generated about what has been going on in the economy over the last decade, so today I want to take a step back and give some broader analysis of the economy using my own economic measure, something I call GPEC. For those of you who didn’t follow my old blog, GPEC is a concept I came up with in order to measure macro-economic policy. GPEC has 4 components.

- sustainable Growth

- Productive gains

- Employment

- social Calm

The reason I use this measure is because it fits my overall ideology of how the economy supports a nation. It also provides a multi-disciplinary view of macroeconomic policy, which in my opinion gives a far better measure of economic success than any single metric can.

For example, the misrepresented Keynesian idea that digging holes and filling them back in or building bridges to nowhere fails the GPEC test. It may create employment and social calm, but unless those holes and bridges are needed to increase productivity then it fails the productive gains and sustainable growth tests. This is why, although I consider myself a chartalist , I am very much against scatter-gun stimulus programs.

So what are the key markers of an economy with a high GPEC rating? Well you would hope to see the following:

- Slow growing real household incomes

- Low levels of inflation

- Improving productivity

- A broad based economy

- Relatively low levels of debt with business investment making up a large proportion of credit.

- Low unemployment

- Low crime rate and high well-being metrics.

So how does Australia rate? And why?

Firstly a definition on productivity from fellow Queensland based blogger Cameron Murray:

Productivity is the key to greater wealth, as an individual, a nation, and a world. Productivity is doing more with less. It is that simple. Unfortunately people often equate productivity with economies of scale and population growth, which leads to a poor understanding how economic growth really occurs.

If a farmer selectively breeds his crop so that the next generation of plants yield 5% more grain, with no further inputs required (no more water, fertiliser, harvesting time etc), then he has made a 5% productivity improvement. The output in terms of grain is 5% higher for the same inputs.

Productivity gains flow through the economy, allowing us to produce more goods over time. When other farmers follow this lead, we find that marginal land can now be used productively. We find that fewer people need to work in agriculture, because each farmer is producing more food. This frees up labour to be employed elsewhere in the economy, producing other goods to satisfy our desires.

Productivity gains normally come from two sources. The first is in the form of new inventions and innovations in the methods of production – a new engine design, a new breed of plant, a new manufacturing technique or a new material. Innovation in the methods of production is THE key driver of our prosperity.

A second way that productivity improves is through economies of scale. Even in the absence of new technology or innovation, we can produce more output with less input by specialisation of labour, and larger and more efficient capital equipment, to achieve economies of scale

So in an economy aiming for higher production you would expect to see a number of key things:

- Incentivisation in the tax system to support business investment in research and development, and therefore a proportion of business profits being re-invested to support greater production.

- A high proportion of private sector debt being used for business investment in non-financial assets.

- Key economic metrics targeting output per unit worked.

For those of you with an interest in functional money (MMT) you will note that the sectoral balance equation shows the linkage between the change in non-financial business assets, private sector savings and the flows in sector balances. See here for more on this point.

So what are we seeing in Australia? Well pretty much the exact opposite of everything I am talking about.

As the Unconventional Economist reported this week household income has actually fallen in real terms over the last 2 years, on top of that we have high levels of household indebtedness and business investment is far less than 50% of total private sector debt.

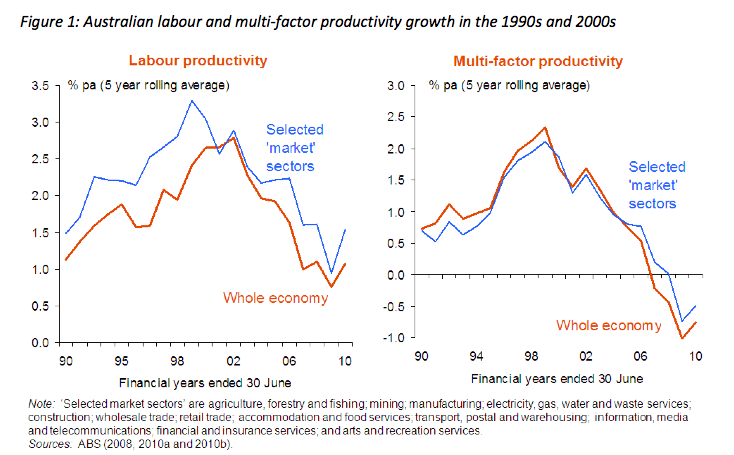

What this means is that although we have a private sector that continues to borrow money it is unable to transfer these borrowings into returns in higher income. This is the exact opposite of what you would expect to see in a country with improving productivity. So it is no real surprise that charts of Australian productivity look like this.

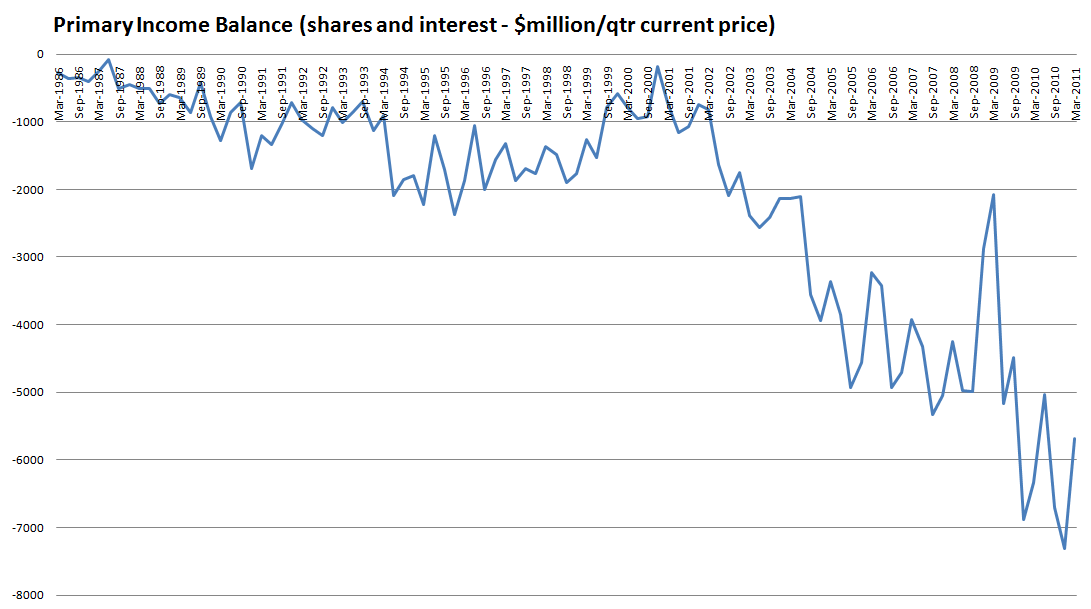

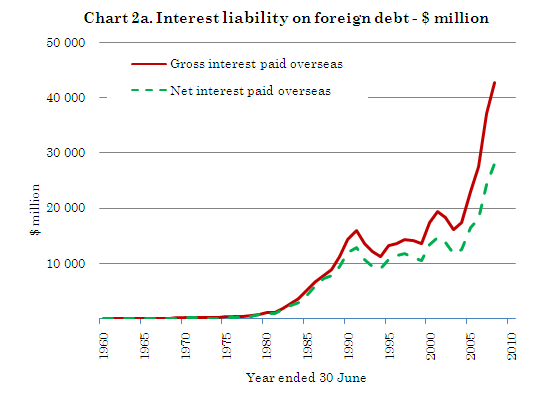

What this suggests is that over the last decade or so the private sector has indebted itself to purchase items that have a return on investment below their on-going debt servicing cost. Given that we know that the government sector in Australia has relatively low debt the only place that the private sector could be borrowing this capital from is the external sector, which we know from the following chart is exactly what has been happening.

It should be quite obvious to MacroBusiness readers exactly what Australian households have been doing. They have been borrowing from the export sector in order to pay increasingly higher prices for housing. Now although the above information displays quite plainly that this type of investment has been unproductive, it has been argued by some that housing itself has some productive value as shelter. This maybe true, although I disagree, but the definition of productivity is producing more output using the same or less input. Existing houses and land have already been produced. So how can paying ever-increasing real amounts of money for them be productive? It can’t by definition.

The growing indebtedness of households to their houses has also led to another issue. Due to their high levels of indebtedness, households have limited capacity to support business investment in Australia. This has meant that Australian industries have had to seek off-shore capital in order to support the productive business investment that the Australian public could have been provided via savings if they actually had some. This has become increasingly obvious during the recent mining investment boom.

Again Cameron Murray covered this well on his blog:

The graph below shows the balance of these two items alone (which comprise about 50% investment income). By my reasoning this means that foreigners are buying up more assets – property (the media has taken note of this in agriculture) and shares – and lending more to local households and businesses over time.

On primary income alone, Australia was $50billion in the red this past year. It takes a lot of trade in agricultural and mining products to offset this transfer of financial assets, and our best effort was a peak of $23.3billion of net exports of goods and services over the past 12 months with an all time high terms of trade (noting that even the balance of trade is usually negative).

So not only do we usually import more than we export, we sell more domestic assets than we buy foreign assets, and the incomes from the transfer of assets to foreign ownership far outweigh the value of the actual trade of goods and services.

A quick example. The government owned business Telstra was privatised, and 25% of the company is now foreign owned. That purchase by foreigners was a transfer of assets to foreign ownership as part of the capital accounts, and the dividends earned on the foreign owned portion now leave the country as part of the deficit in the primary income balance of the current account. The same applies to foreign purchases of agricultural properties, mining shares, and lending to Australian businesses.

So overall we have unsustainable income and debt , falling productivity, growing indebtedness to foreign entities at the same time we are giving up parts of Australia’s assets that are actually producing income to foreigners. You can see why I give Australia a GPEC fail even though we currently have low unemployment, inflation and still rate highly in well-being metrics.

So what to do ?

Well as I have outlined above we have a couple of major issues:

- Households are highly indebted on housing

- Business re-investment in production is limited

- Government and the financial sector support unproductive investment

- Innovation through research and development is not an economic priority

- Household sector has limited capacity to invest in the business sector.

- In order to support all of this Australia continues to “sell off the farm”

I have my own ideas on how to fix some of these issues and I will attempt to cover them over the coming weeks. But before I ram my ideas down anyone’s throat I am interested in getting some reader contributions to the problems I have outlined above, and obviously open the forum to some discussion about possible solutions.