With a rate cut, the great Australian bubble machine is coughing into life and its target is first home buyers. DE last week exposed the return of undisclosed real estate agents being touted as happy customers. Over the weekend, Stephen Nicholls, property editor at the SMH, offered a shiny, happy first home buyer assessment supported by a melange of innuendo and today its Dr Wilson of APM banging the “Spring bloom” of FHBs.

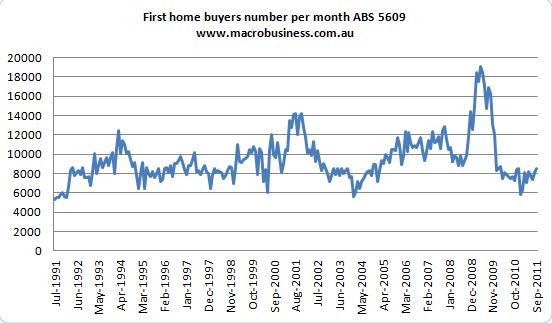

I thought, therefore, it might be timely to take a look at FHBs and whether the rumoured tsunami of activity augers a resurgence in the property market. From the ABS’s last housing finance survey, here is the absolute number of new loans created for FHBs per month:

Yes, that is a good little bounce from October last year, when FHBs cratered. But in the grand scheme of things, FHB originations are now running at the same absolute numbers as they did during in bubble hiatus of 2003 that saw Sydney prices correct, or in the pre-bubble years. Given the much vaunt population growth since, that seems to me quite subdued.

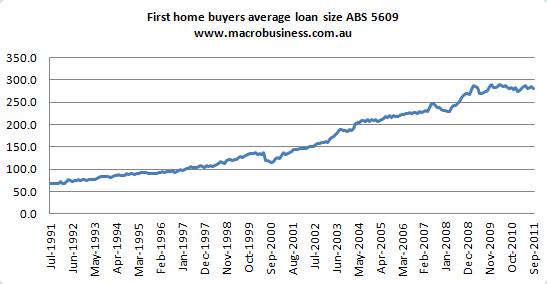

The same subdued mood is apparent in the average loan size taken out by FHBs, which, since the government engineered megaboom of 2009, has gone backwards:

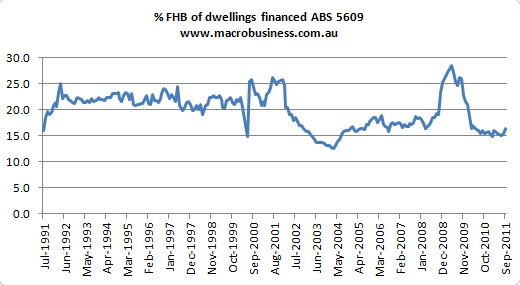

Even as a percentage of overall housing activity, FHBs remain miles below historic norms associated with house price growth:

Now, this is September data so it’s possible that since then FHBs have come storming out of their bunkers, especially following the rate cut. I’d be surprised if there was no response at all but as you can see above, we’ll need a significant increase to give us a data profile consistent with house price rises.

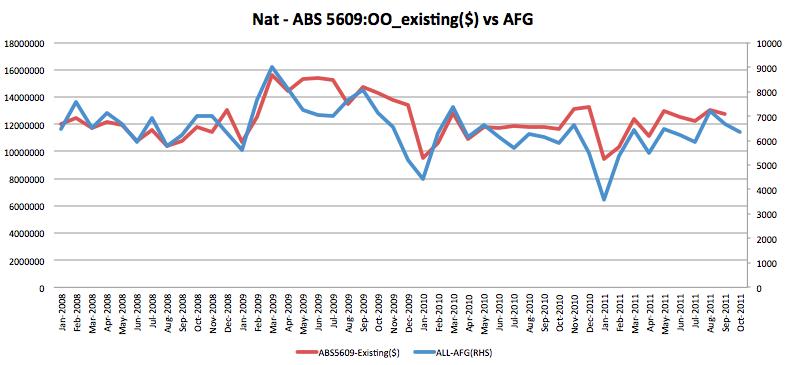

The evidence we do have for October, at least for the market as a whole, is that housing finance growth fell from September levels. Here is the AFG chart, which gives a good read on what’s coming from the ABS:

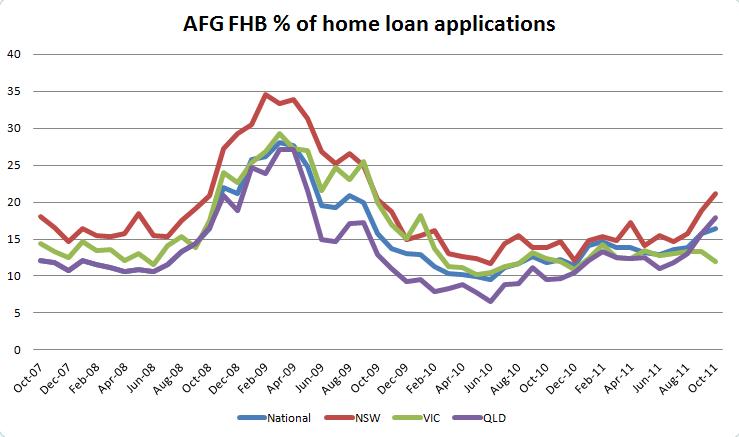

But there stronger evidence of an ongoing recovery in FHB numbers in AFG’s percentage of total financing figures:

Obviously Victoria is missing out, again. And Sydney data is widely accepted to be driven by the short term stamp duty incentives. Qld, who knows? I also can’t explain the discrepancy with ABS data.

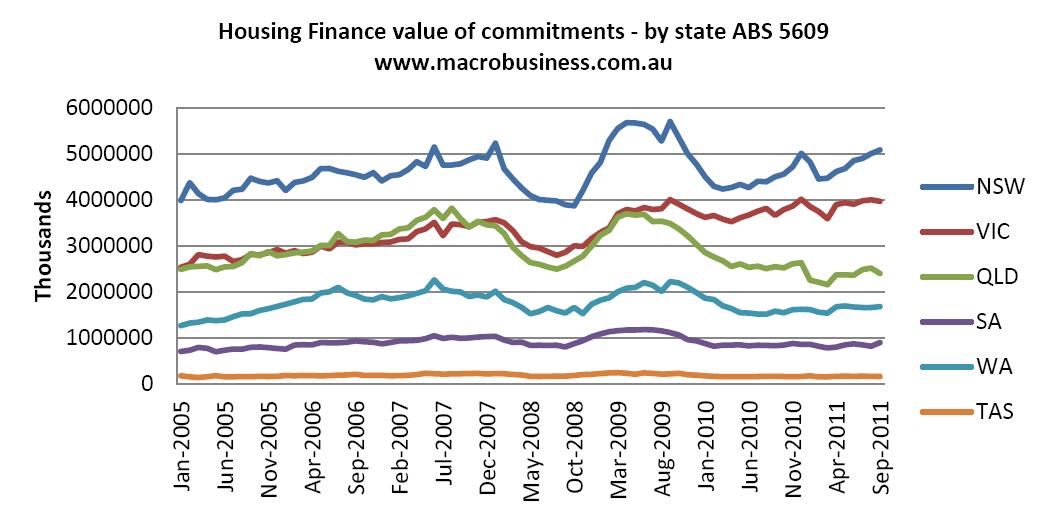

Bottom line, however, is this. Total new issuance of housing finance is going nowhere except in Sydney:

And that data remains consistent with stability in the blue ocean capital and price falls everywhere else.