I started watching the live BBC feed last night after it became obvious that European markets had reacted very poorly to the call by the Greek PM to allow for a democratic process to occur in his country by asking its citizens to make a decision as to which poison they will imbibe over the next decade. The Greek PM is now running a fine line between his people, the Greek parliament and the rest of Europe which could fall either way. Overnight there were reports that the government was crumbling, then that the referendum was off but neither were true. There will be a confidence vote on Friday for Mr Papandreou, whom at this stage seems to have the numbers, and a spokesperson for the government has re-stated that a referendum is on.

Obviously the rest of the European elite are in damage control, but exactly how they will fight against a nation’s right to vote on its own future without coming off looking like the erstwhile Col. Gaddafi will be interesting. I note that there have been some ominous signs of something a little more dangerous occurring with a surprise re-shuffle of the Greek armed forces. The latest update is that this was a “planned” event but given the recent history of Greece this is sure to add tension.

Although the markets seem to be of the opinion that the Greeks could scuttle the bail-out plan and therefore doom Europe to a messy default, I am not sure a vote would be that clear cut. This isn’t exactly a choice between two diametrically opposing outcomes, it is a choice between years of hard economic times and years of hard economic times, as I said above “choose your poison”.

What this latest episode once again highlights in the short-sighted memory of the financial markets is that Europe’s leaders are unable to deliver a co-ordinated response to the on-going economic crisis. Many will see this as a political failure, which in some regard it is, but the true problem for Europe has always been that their politcians are unable to tackle the underlying issue that the Eurozone itself is built on unsustainable macroeconomics. This was once again highlighted last night as I watched the feed from the BBC:

18:08 More on the phonecall between Silvio Berlusconi and Angela Merkel (see 1750 entry). AFP reports that Mr Berlusconi assured the German chancellor that Italy was “determined” to introduce the necessary reforms “rapidly”, according to his press office.

…

17:50 Italy PM Silvio Berlusconi says he has spoken to German Chancellor Angela Merkel about the current crisis on the phone and confirmed Italy’s determination to implement reforms, Reuters reports.

These are the same promises that we heard from Greece. In fact we have now heard them from Portugal, Spain and most recently France. What we also heard from those countries was initial denial that they had a problem. We are now seeing the same from Italy as highlighted by a recent interview with Paolo Romani, the minister for economic development:

Italy should not be painted with the same brush as Greece or Portugal as its fundamentals are strong and the economy can support the debt stress it is facing, says minister for economic development Paolo Romani . Excerpts from an interview with Rishi Shah & Amiti Sen .

Are you concerned about the state of Italy’s economy?

The Italian economy’s fundamentals are very good. We are the second-largest manufacturing country in Europe with value added manufacturing of Euro 233 billion, just behind Germany. We only have one problem- our debt is 180% of our GDP (gross domestic product). But it is not a problem of today or yesterday. It is a problem of day before yesterday and dates back to the nineteen nineties. So all this speculation in the market about Italy is not justified. The crisis is related to the paper economy, and we have a real solid economy. But this does not mean that the strong real economy of Italy cannot support this kind of stress.

But markets don’t seem to think that Italian economy will make it through crisis of confidence!

It is because the markets are frightened about Greece, Portugal, Spain and Ireland. Italy is one of the founders of EU and, as I said before, is the second largest manufacturing economy of Europe. It is also the fourth largest economy of Europe. So speculation against our country is a speculation against Europe

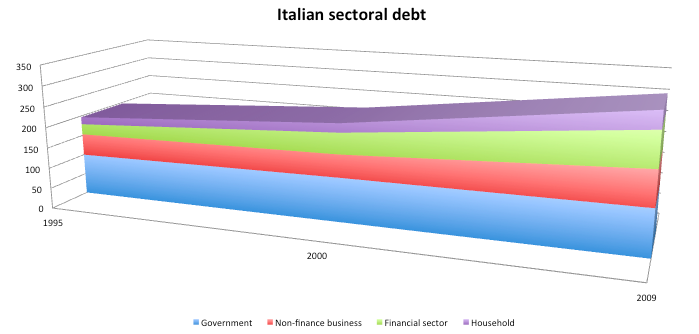

These words seem surreal against the backdrop of the debt markets and a 7% overnight tumble in Italian equities, but they also misrepresent the sustainability of the Italian economy. If you have a look at the sectoral debt of the Italian economy you will notice that that up until 2009 the government debt level hadn’t grown in any meaningful way for over a decade:

But what had occurred was a growth in debt in parts of the private sector. As I have explained previously if a country runs a current account deficit then it must be accumulating debt in one of the non-export sectors. This is simple accounting, but for some reason the world’s economists don’t seem to understand it.

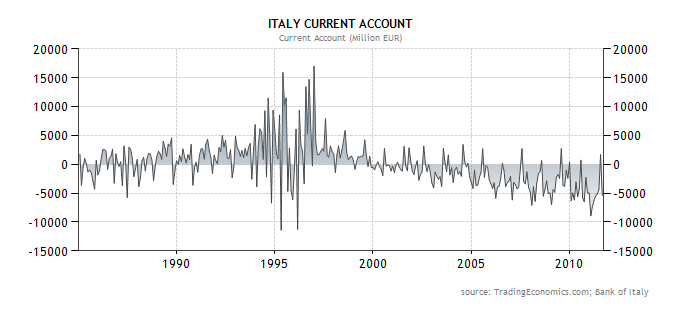

The dynamics of the economy, including taxation, determine exactly where the debt accumulates. It is different in each country but the overall effect and outcome is the same. Paolo Romani’s statements about Italy having debt since the 1990’s is true and before 2000 it may have been sustainable. The Italian current account chart explains why:

Prior to 2000, Italy actually ran current account surpluses. This meant that it was able to offset its government spending with inflows from the export sector. But you can see from the chart that something happened at the turn of the millennium. I’ll let you take a guess when Italy joined the euro.

Was it the currency or was it the deregulation of capital flows that caused the problem? I’ll leave that argument for another day, but either way, once Italy joined the euro it appeared to lose any competitive export advantage it had under its old currency and to maintain its standards of living embarked on a journey of ever greater debt accumulation. This was the engine that ran these economies for the last 11 years. But the outcome was inevitable. Once the debt of one of these nations reached a level where it could not be sustained by the real economy then the implosion would begin. We saw this with first with Greece. Once austerity is enacted the engine is turned off, and the real economy collapses while the debt, and interest on it, continues to accumulate.

Without some mechanism to address this fundamental issue nothing can be fixed in Europe, everything else is a side-show.