Overnight the Italian bond auction went as expected:

Italy was again forced to pay above the 7 percent threshold that led Greece, Portugal and Ireland to seek bailouts when it sold 7.5 billion euros ($10.1 billion) in bonds today, short of the maximum target for the auction.

Italy sold 3.5 billion euros in three-year debt, 2.5 billion euros of 2022 bonds and 1.5 billion euros in 2020 bonds, just shy of the top range of 8 billion euros for the sale. The 2014 note yielded 7.89 percent, the highest since September 1996 for a three-year bond and up from 4.93 percent when similar- maturity debt was sold last month. Demand for the 2014 bond was 1.5 times the amount sold and the bid-to-cover for the 2022 bond was 1.34 times, both higher than Oct. 28 auctions.

The yield on Italian 10-year bonds increased less than one basis point to 7.24 percent after rising as high as 7.38 percent, while two-year yields slipped one basis point to 7.10 percent after increasing to as high as 7.37 percent earlier

The auction had higher interest than expected but the yields were well beyond the “manageable” range. The muted response from the equities market, that ended the night slightly up, shows that Europe is flipping into “bad news is good news” mode. This situation is completely unsustainable and Italy has large amounts of debt that must be rolled over in the coming months. They have over 20 billion euro in short term debt coming up during December.

It is still not clear exactly what the next “plan of action” is going to be. As I explained on Monday the current direction seems to be around getting agreements from Eurozone nations to give up some fiscal sovereignty to satisfy the Germans. This is supposedly going to mean that they will capitulate on allowing the ECB to “do more” including providing an explicit backstop to some form of supra-European debt instrument, which means that struggling European nations can do a bond-swap to bring down their cost of funding.

Given Europe’s recent track record on crisis resolution I am not as confident as the equity market appears to be. As far as I can tell the Germans are still a long way from accepting the types of things the market now appears to be pricing in:

Members of parliament from Merkel’s center-right coalition said she told them in a closed-door meeting Europe was “a long way from euro bonds” as it made no sense to sanction euro states breaking fiscal rules on the one hand and reward them with lower interest rates via the collectivization of debt on the other.

The chancellor also reiterated her opposition to using the European Central Bank to solve the euro zone’s debt problems by injecting unlimited liquidity.

There are plenty of other rumours flying around at the moment including, once again, using the IMF, although I do have to wonder exactly what difference it makes. Warren Mosler made that exact point over at NakedCap a few days ago.

While equities are still managing to read some good news from the bond market, the banking crisis creeps on:

The cost for European banks to fund in dollars rose to the highest level since October 2008 for a fifth day, indicating a longer-lasting credit crunch than that following the collapse of Lehman Brothers Holdings Inc.

The three-month cross-currency basis swap, the rate banks pay to convert euro payments into dollars, was 154 basis points below the euro interbank offered rate at 1:40 p.m. in London, from minus 149 basis points yesterday. The gap has widened from as little as minus 8 basis points on May 4

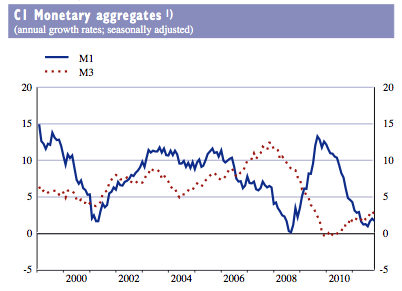

The ECB updated its monetary aggregate data yesterday and the news is still not good. M1 has rolled over again, and as I have spoken about previously it is a leading indicator for recession:

Although the aggregate data looks bad enough, the real issue is the large differential between the periphery and core Europe. In the last 6 months M1in Greece is down 20% in Greece, 16% in Portugal, 11% in Ireland, and 8% in Spain, and 7% in Italy at an annualised rate. The implications are highly recessionary and I suspect this is a mix of capital flight and banks shrinking their loan books in order to meet new capital requirements.

In Greece one of the causes is obvious:

Greek political instability spurred an acceleration of bank withdrawals, with the decline stemmed by the appointment of a new government this month.

Greek banks saw an outflow in deposits of about 13 billion euros to 14 billion euros ($18.7 billion) in the two months to the end of October, said George Provopoulos, the head of the central bank and a member of the European Central Bank Governing Council. Deposits totaled 183.2 billion euros at the end of September.

“One could say these two, two and a half months have been the worst for deposits since the start of the crisis,” Provopoulos told lawmakers in Athens today. He said the decline continued in early November and has since stabilized.

The comments indicate that as much as 8.6 billion euros moved out of the Greek banking system in October alone, since the central bank had reported a 5.4 billion-euro outflow in September. The September figure was the biggest one-month decline since Greece joined the euro as doubts surfaced about the country’s ability to meet the terms of an EU-led bailout.

And to make matters worse Moody’s is warning of future downgrades. ( You can read the full text, including the effected institutions here):

Moody’s Investor Service said it will put European banks in 15 nations under review for possible downgrade. The review will include all subordinated, junior-subordinated and Tier 3 debt ratings of 87 banks such as BNP Paribas, Societe Generale, UniCredit and other large banks.

The subordinated debt assumes that banks receive government support, thus some banks may be prone to a downgrade by one level while other ratings may be lowered by more than one level.

The recession beat is pounding.