As I posted this morning the latest EU summit has wrapped up with 25 of the 27 nations signing up to a somewhat watered down version of the European economic suicide pact.

France is unlikely to ratify the European Union treaty on fiscal discipline before the country holds two rounds of presidential elections in April and May, President Nicolas Sarkozy said.

“The treaty will be agreed in March, and as you know parliament doesn’t meet during the election campaign, so I think it would be unreasonable to expect the treaty to be approved before the elections,” he said at a press conference in Brussels and an EU summit.

Socialist challenger Francois Hollande, who leads Sarkozy in the polls, has said he’d renegotiate the treaty.

Obviously, like any statement from a politician, we will have to see if that is actually true if Mr Hollande is successful in his campaign.

Either way, David Cameron’s speech after the summit made it fairly clear that there were still many hurdles ahead for the treaty even if the UK wasn’t going to directly stand in its way.

The summit also approved the early introduction of the 500-billion-euro ($656 billion) European Stability Mechanism (ESM). The mechanism is now set for activation on July 1, one year before its original planned debut. It will run in parallel with the EFSF but the combined limit is still technically only 500-billion euro. That does initially sound like quite a bit of money, but once you understand the mechanisms it really is quite under-whelming. Please read this post for more on this topic.

The other thing to come out of the summit was the oddly named statement entitled “Towards growth-friendly consolidation and job-friendly growth” which contains some wonderful ideas but as far as I can tell nothing of much substance:

The EU will support those efforts, notably by:

- as a first step working with those Member States which have the highest youthunemployment levels to re-direct available EU funds towards support for young peopleto get into work or training;

- enhancing the mobility of students by substantially increasing the number of placementsin enterprises under the Leonardo da Vinci programme;

- using the ESF to support the setting up apprenticeship-type schemes and support schemes for young business starters and social entrepreneurs;

- enhancing cross-border labour mobility, through the revision of EU rules on the mutual recognition of professional qualifications, including the European professional card andthe European Skills Passport, the further strengthening of EURES, and progress on theacquisition and preservation of supplementary pension rights for migrating workers.

I would like to be supportive of this type of document but after two long years of analysing Europe’s failed economic policies it is hard to take this seriously. Everyone knows the best way to help young people into employment is to give them a job. In order to create jobs you need demand for goods and services, but I see nothing at all in the new EU treaty that will create either private sector demand or increased industrial capacity to deliver such things, and all we have seen out of Europe for the last 18 months is policies that do the exact opposite.

I could feel a little more confident in this document if I saw it was part of a well-defined longer term strategy for Europe, but we know that this is not the case. What this document represents is yet another knee-jerk reaction to the failed crisis response from Europe.

More evidence of that failure appeared overnight:

The Spanish economy continues to struggle with the abysmal growth pace, surging unemployment, frail financial sector, and fiscal imbalances.

The economy ended 2011 with contraction as the GDP fell 0.3% and on the year recorded slim growth of 0.3% according to the figures from the National Statistics Institute that were in line with the estimates published earlier this month from the Bank of Spain.

We can surely see the struggling economy faltering again into recession and the Bank of Spain also printed a bleak outlook expecting the nation to contract 1.5% this year and joblessness to surge to 23.4% if the government is to meet its austerity goals.

And just so you understand how way off the mark the economic ideology in Europe is:

“We’re going to present a new macroeconomic framework, but the current one says that we’ll have GDP growth of 2.3 percent this year, these are the last macroeconomic projections in Spain, but it is evident that it won’t end up like this,” Rajoy told reporters after talks with European Commission President Jose Manuel Barroso

We also saw downgrades for French growth:

France has cut its economic growth forecast for 2012 to 0.5 percent from 1 percent, Prime Minister Francois Fillon said Monday. The revision was made to “take into account the deterioration of the economic situation,” Fillon said.

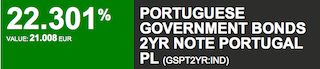

And obviously we can’t forget this:

As I have explained so many times previously, government austerity policy applied to a private sector that is already deflating leads to lowering of GDP. If a government cuts its spending while households are trying to cut their levels of consumption then the aggregate demand of the economy will fall and therefore national income will fall along with it. This falling income will not only counteract the desire of the private sector to save, but it will also reduce the income of the government sector meaning its aims will fail. In parallel this will reduce the demand for imports and, where possible, push the external sector into surplus. This is a positive outcome in the long run, but only if (and it is a BIG IF) there is no expectation that the nation will meet its existing debt obligations.

But this is exactly what is expected of the European periphery which is why austerity is failing and why I have stated numerous times that the plan in Europe is backwards.

What is also concerning about the statement from the EU summit is this point:

It is vital to take measures to prevent the present credit crunch severely limiting the ability of enterprises to grow and create jobs. The recent measures taken by the ECB as regards long-term lending to banks help very much in that respect. National supervisors and the EBA must ensure that bank recapitalisation does not lead to deleveraging which would negatively affect the financing of the economy. Supervisors should ensure a rigorous application by all banks of EU legislation restricting bonus payments.

Lovely words, but completely disconnected from what is actually happening within the Eurozone. Please read this, this and this for more.

So, as I said in the lead up to the previous summit, the only thing that matters is whether we see a credible plan that will transition the Europe you see today into the Europe as defined in the “fiscal compact”. I once again see no such thing, which means I can only conclude one thing from the outcome of this summit.

The ECB will continue to be very busy.