Once again it is time to look at the the AFG mortgage index report as the data for January was released yesterday. As per usual, if you are new to this, here is the blurb on why I look at this data every month.

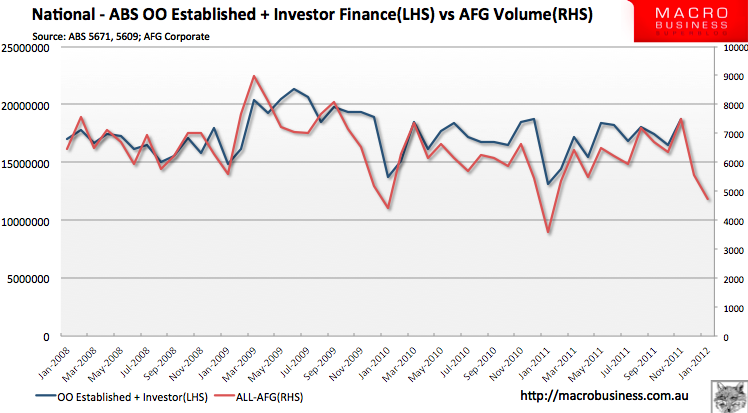

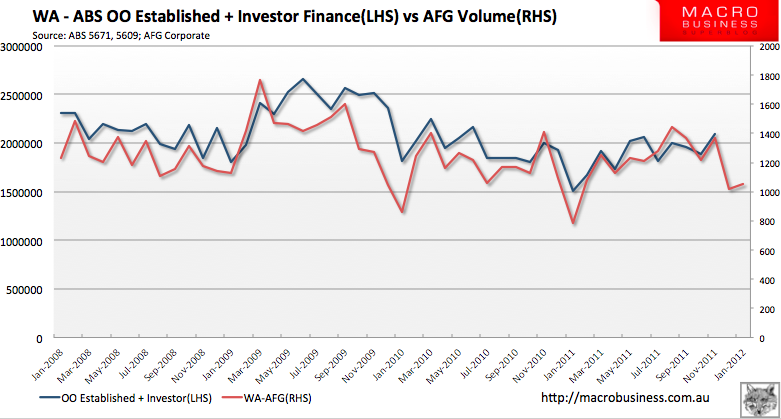

I use the AFG lending volumes as a leading indicator of the direction of the home lending market as they appear to be a relatively good leading indicator for the official ABS data in the 5609 and 5671 datasets.

For those who don’t know, the ABS 5609 and 5671 datasets contain owner occupier and investor housing finance data. The trends in these datasets appear to have a good correlation with the movement in house prices. So basically by using the AFG volume data you get a fairly reliable 1-2 month leading indicator on house price movements across Australia. The correlation to house prices isn’t perfect because you obviously have to take account of the supply side, but you can see from the charts, the data is worth taking notice of.

This particular report is a bit out of the ordinary given that 12 months prior Australia was effected by a set of natural disasters that significantly affected data from Queensland with possible flow-on effects the the rest of Australia. As noted in the report:

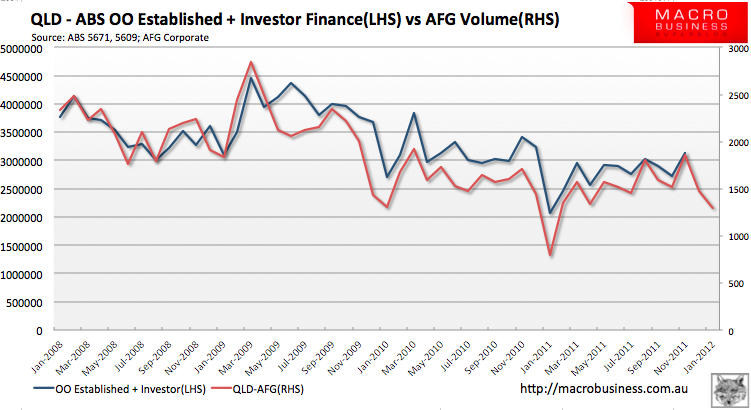

Mortgage sales for January were much higher than in the same month last year, when floods in Queensland, and other natural disasters impacted sales, according to AFG, Australia’s largest mortgage broker. AFG Mortgage Index shows that overall national mortgage sales increased by 40% this January, compared to last, marking a return to more normal trading levels. Sales in Queensland were up 80.6% and in South Australia 84.5%, with other states showing significant uplifts compared to January 2010 – WA (+ 37.4%), Vic (+25%), NSW (+14.5%).

January also saw WA take over from NSW as the most popular state for First Home Buyers. Almost one in five new mortgages (19.1%) in WA was arranged for First Home Buyers compared to 14.0% in NSW. Through the second half of last year, NSW led the country as the most active First Home Buyers market.

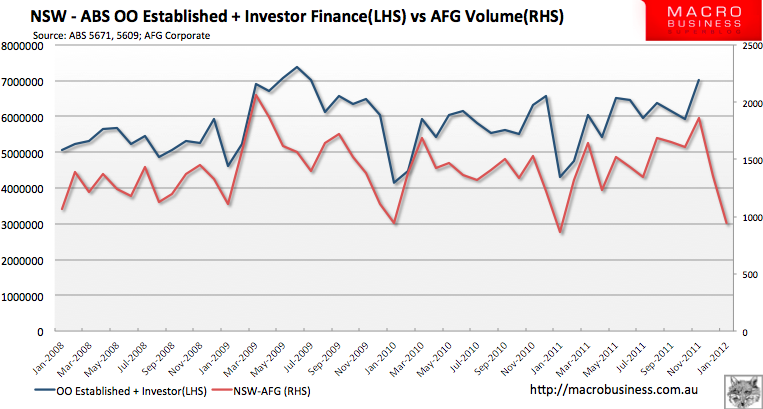

However NSW retains its position as the most popular state for investment, with 40.2% of loans there arranged for investment purposes, compared to 36.8% in Victoria, 34.9% in Queensland, 32.6% in Western Australia and 32.0% in South Australia.

Mark Hewitt, General Manager of Sales and Operations says: ‘While markets across the country have recovered from last year’s natural disasters, right now we have a strong sense that borrowers are playing wait and see on rates. Will the RBA cut rates, and if so, how much of this will be passed on by lenders? It seems that we are moving to a new paradigm where there is less and less linkage between the cash rate and mortgage rates. An RBA cash rate cut will not automatically translate into improved consumer confidence.’

A couple of points to make about the data. I always ignore South Australia in this dataset because the volume of the data in that state is too low. The first home buyer percentage in NSW fell significantly from over 20% in both October and November to 14% in January after the changes in stamp duty took effect. You can also see the significant pull back in the volumes, although much of this is seasonal. On the whole the data looks fairly unremarkable except for Western Australia which appears to have had an abnormal December to January up-tick. Given this is only one months data it is difficult to call it significant, however there has been a solid uptrend in first home buyers in WA over the last 6 months.

To the charts.

Firstly at a national level the data looks to be supporting a continuation of the ‘slow melt’ meme:

NSW taking a larger than normal new year’s nose dive on the back of stamp duty changes:

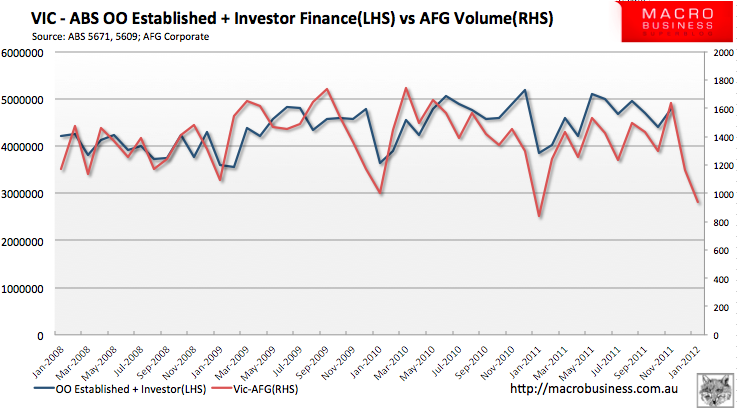

Victoria going nowhere fast on the demand side which, given the supply side, means the continuation of price slides:

Queensland bouncing back YoY due to last year’s natural disasters but overall nothing that looks like it will change the downward price trend:

Western Australia looking flat but displaying an unusual December to January rebound. Something to watch:

I know that a number of our readers watch this data closely and some have their own models based on this data so I am interested to hear any additional points of note from them.

National report below.