I’m flat out at the moment doing some non blogging, but I thought I’d do a quick update this morning because the confluence over night of the ECB’s massive LTRO operation, and Bernanke’s pull back from further stimulus, converged to knock the bulls of their perch a little.

This is really important, because for mine what we have been seeing lately is a market driven by free cash and the hope of more free cash. The BoE and BoJ have both explicitly manned the monetary pump, the ECB has now given away a trillion Euro’s at 1%, and the Fed is committed to low rates for the term of Bernanke’s natural life – or so it seems.

So, in warning the market that the Fed is not yet ready for a new round of quantitative easing, Bernanke seems to have hit a nerve with traders, or at least some of the weaker longs, in the market.

Here are a few charts worth looking at:

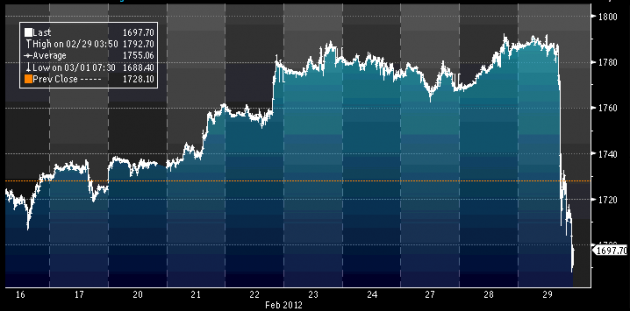

Gold – what a plunge overnight (chart via VantageFX)

Aussie Dollar – near term high and then massive reversal. I am still singing the same song I know, but for the moment I think a decent or price pause is in the offing. That is, it goes nowhere for a while or pulls back into the 1.04/05 region.

The Dow – less aggressive pullback than the above two, but I still think the rally is mature.

For a few weeks now, this market, broadly, has been continuing to climb a wall of worry which is defying the bears, and in many ways, also the bulls. The bears are frustrated that they are either losing money or continuously getting stopped out, and the Bulls are frustrated because the pull backs have been essentially non-existent, so they are probably under-invested (with the benefit at least of knowing where the markets are now anyway).

The data might not be great but it isn’t terrible either, yet we’ve seen somewhere near a 15% rally in equities. This week the Dow closed above 13,000 and the Aussie dollar sat atop 1.08 overnight.

Has this market got legs longer term? I’m not sure, but I think in the context of the past few years, booking some profits on equity and risk asset positions held – or at least covering them with some options – seems the right way to go.

Have a great day

www.twitter.com/gregorymckenna

Please remember these are not recommendations for you to trade these are my views and I have my risk management tools and risk parameters that you do not have access to. Thus, this blog is for information only and does not constitute advice. Neither Greg McKenna nor Lighthouse Securities has taken your personal circumstances, objectives or financial situation into account. Because of this you should, before acting on this information, consider its appropriateness, having regard to your objectives, financial situation