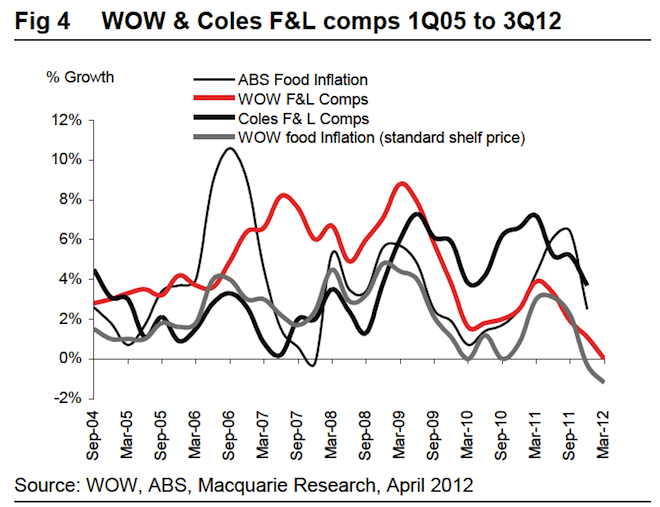

Woolworths (WOW) announced third quarter FY2012 sales recently, with a 3.8% headline increase, or 3.3% excluding fuel. Importantly the comparative sales number was 0.0% with average price deflation at 4.4% in 3Q12.

As exlained in a rather downbeat note from Macquarie Equities today – entitled “deflation or competition to blame?” – this comparative figure puts the sales figures and deflationary pressures in context. First of all, competition can be almost ruled out, given the duopoly in the grocery/non-duscretionary sector that WOW shares with Coles-owner Wesfarmer(WES).

Although WOW is following the Coles recovery model – increasing volume whilst cutting prices, and is picking up its loyalty programs in order to keep customers through the door, its duopoly pricing and power actually masks the underlying “threat” of deflation.

Indeed Macquarie makes a case for deflation “crippling the business model”:

Price deflation accelerated in 3Q12 from 2Q12…. 2Q12 price deflation in the basket was 4.4%, compared to 4.1% in 2Q12. Woolworths suggested that deflation was due to deflation in fresh (produce, bakery, deli and seafood) as well as Woolworths lowering its (packaged grocery and liquor) prices to meet customer demand for value.

Zero comps (comparative growth) in any retail business are likely to cause panic because the consequences can be too horrible to ponder. Ordinarily it means customers who are advocates are declining in number and not returning to your brand each week.

But what do you do when customer counts are up but comps are flat or declining? You cannot quickly change the business model but you can quickly change the price to sell more volume in the hope this compensates for lower unit pricing.

It seems right because a comparative growth of 0% with average price delation of 4.4% implies that volumes grew at that rate – which means the only thing keeping sales growth afloat is deep discounting. This is not sustainable over the long run for a business predicated on increasing profits.

Today’s release of surprising producer price index figures – which undershot significantly, compared to expectations – and tomorrow’s consumer price index release places this leap into a spiral into context, not just for Woolworths but for an economy hooked on growth.