In this post I want to compare the difference in dividends in a secular bull and bear market, using the Japanese Nikkei 225 and Australian All Ords Index, where an example of each condition occurred over roughly the same period.

Here’s the chart of nominal performance of the indices, where the secular differences are stark (Nikkei in yellow, All Ords in blue)

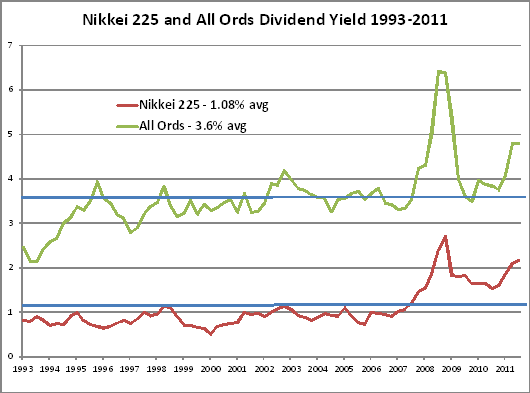

And here’s their respective nominal dividend yields, where the Nikkei averaged 1.08% and the All Ords 3.6% over the same period:

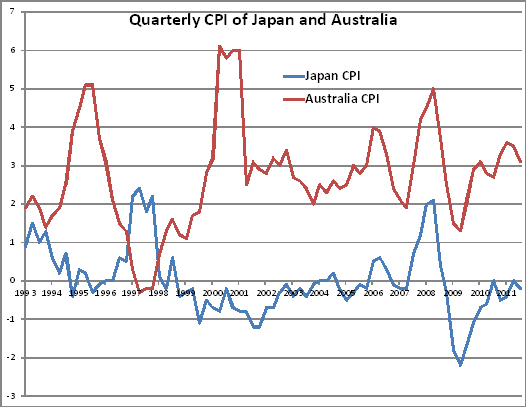

More importantly however, what was the change in purchasing power? Here’s the chart of differing inflation rates, as measured by each countries Consumer Price Index (CPI):

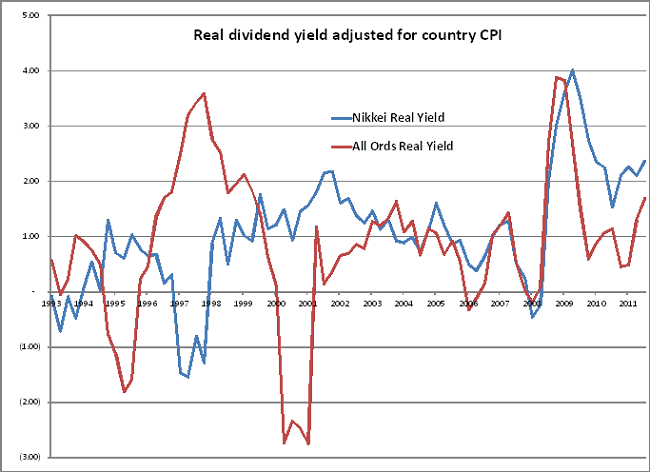

Using this data, provide the inflation-adjusted yield, which shows that the difference – save for shocks like the Asian currency crisis and the spike in inflation around the introduction of the GST in 2000/2001, is not as great as first expected:

I wanted to compare an accumulation index (where dividends received are reinvested), but was unable to find a Nikkei/TOPIX equivalent to go up against the All Ords Accumulation Index, displayed below here:

Why is this study important? As the Australian share market continues to drag sideways in a secular bear market, the focus on dividends may matter more than ever. If the “doomsters” predictions of a debt-induced deflationary recession transpires, as occured in Japan, then even nominally small dividend yields, which could be superior to bond yields that are likely to fall even further, maybe more important than ever.