Another odd 24 hours in Europe, especially from the Greek camp, but the real story, as always, is in Spain and Italy.

First to Greece though, former prime minister George Papandreou gave an interview to the BBC trying to explain how disastrous he thought a Euro exit would be for the country and how what Greece really needed to “stop the uncertainty”. Just after that interview the other former Prime minister, Lucas Papademos, talked to the Wall street journal and dropped the comments:

“Although such a scenario is unlikely to materialize and it is not desirable either for Greece or for other countries, it cannot be excluded that preparations are being made to contain the potential consequences of a Greek euro exit.

I share the view that if Greece defaults and exits the euro, the consequences for the euro zone—its financial system and real economy—will be profound and the associated cost will be significant and far-reaching. It will also affect the economies of other countries outside the euro zone.”

So much for stopping the uncertainty. Mr Papademos later talked to CNBC to clarify his comments stating that he wasn’t aware of any preparations being underway for a possible exit from the euro, which makes you wonder why he bothered to mention it.

The damage was done, however, with the markets taking yet another hit on the comments and not bouncing back on the retraction. The Greece stock market is now down 58% for the year, which sounds terrible until you realise the Cypriot index has managed 80%.

I’ve stated previously that there really isn’t much point trying to predict what will happen before the June election, it could be that New Democracy and PASOK come back with even more strength and continue to implement the Troika program. However, even if that doesn’t occur, I am still doubtful that Greece will be going anywhere because in the game of chicken they hold many of the cards. A Greek exit would obviously be a huge upfront hit to the rest of Europe, but it also opens the door of uncertainty that Greece is just the beginning of the exits. Such an exit would come at an economic cost, but more significantly a massive political one, and given the fact that most Greeks want to stay in the Euro, even if they don’t fully comprehend what that means, I struggle to see the majority of Europe accepting this outcome.

On the other hand, the Germans and the Austrians, amongst others, are reportedly unmoved at this point which means we continue to see the world’s economic media reporting that the European banks are unprepared for what’s coming even though comments from the Bundesbank suggest they think otherwise. We’ve also heard rumours of national contingency plans , and even articles running through scenarios of what the exit would mean, some down to the point of working out exactly how much time the Greeks would have to execute such a plan. 46 hours apparently.

So it is possible that I am wrong and we could be heading for a Lehman-like event but what we have seen in Europe over the last few weeks is the growth of far more conciliatory tone than we have seen in a very long time, led in most part by the French.

French Prime Minister Jean-Marc Ayrault Wednesday said a Greek exit from the euro would be a “catastrophe” and Europe must do more to foster growth to emerge from its debt crisis, rather than simply focusing on austerity.

Mr. Ayrault said the meeting between French President Francois Hollande and German Chancellor Angela Merkel in Berlin last week considered the possibility of extra investment to help the Greek economy.

“The majority of Greek people want to remain in the euro so we have to help them,” Mr. Ayrault said on French radio station RTL.

That tone, however, must be tempered with a reminder that France’s political landscape is itself still in a state of flux with June also a key month for that country.

The new French president, François Hollande, is already making headlines with his calls for measures to promote growth. But he won’t have any real power unless the Socialists win the parliamentary election in June. If they don’t, the result will be political deadlock — a development that France and Europe can barely afford.

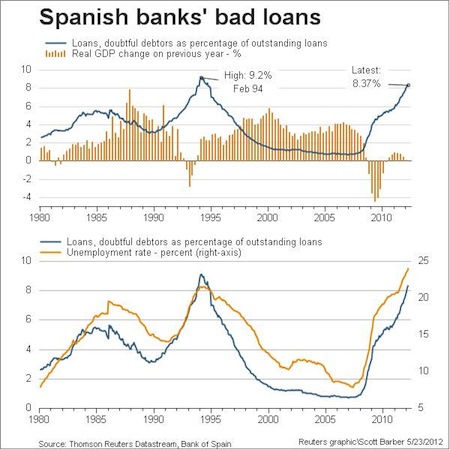

The Greek situation is an important one, but realistically it isn’t Europe’s major medium term issue in my opinion, that is most definitely Spain. As I mentioned previously the country’s problems grow daily led by the continuing fall out from their housing market collapse as you can see from the most recent bad loan rate.

The Spanish authorities have just announced they will be injecting at least another €9 billion into the Bankia group, but this is doubtfully the last of it as Spanish banks hold €656 billion of mortgage debt on top of their exposure to developers and other commercial institutions. The trouble is that even though the Spanish government is attempting to implement new policy to stimulate the market it is no way enough to offset the mix of private sector’s continuing deleveraging mixed with attempted government austerity.

The future for developers, companies that invest in and finance construction, looks equally dark, according to many experts, who are skeptical to a new government reform, announced about a week ago, in an attempt to stimulate the housing market.

The new measures, for instance, aim at making it easier to rent out apartments by allowing for shorter cancelation periods for rental contracts, by only two months. It also reduces taxes on house purchases by up to 50 percent. Moreover, it will require banks to keep provisions of up to 30 percent of the value of their ‘clean’ housing assets, as compared to 7 percent before.

The reform was received with much skepticism among both developers and tenants.

“Many developers, both major and small ones, will go bankrupt in the next months, and banks will be left with their assets,” said José Parra, head of Grupo Main, a bank asset manager, regarding to the new law.

If the banks’ property assets do increase considerably, as he predicts, the next coming months are likely to be marked by sharp declines in housing prices. “The banks will try to sell big amounts of property assets to international investment funds,” Parra said.

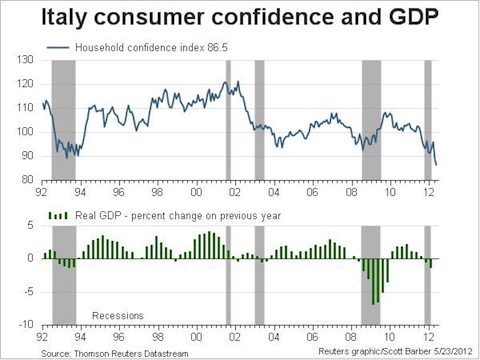

and if Spain is worrying enough then there is always Italy, the real eurozone end-game, and the slow-but-sure creep of contagion.

Those charts are the thing Europe should really be worried about, not the side show that is Greece.

It’s another Euro flash PMI night tonight with German, French and eurozone data out. After the woeful April data hopefully we’ll see some improvement, but I’m obviously not too optimistic.