State Administration of Foreign Exchange published the data for China’s third quarter balance of payments.

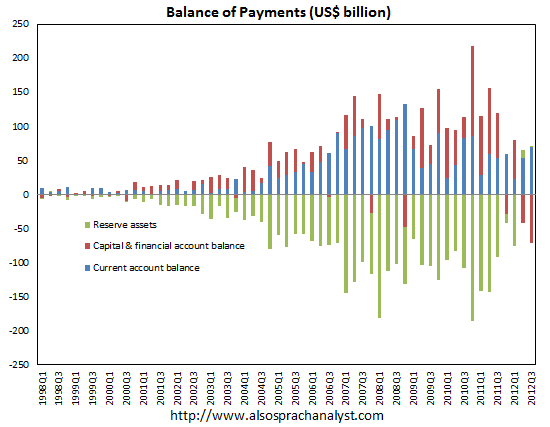

Total current account surplus amounted to US$70.6 billion, while capital and financial account (excluding reserve assets) recorded a deficit of US$71 billion (including errors and omission), leaving a US$400 million balance of payments (excluding reserve account) deficit, which is balanced by reduction of reserve assets of US$400 million, which is negligible. The reduction in reserve assets in Q3 is smaller than US$11.8 billion recorded in Q2.

For the 2nd quarter in a row, capital and financial account net outflow has grown large enough to offset current account surplus, and as a result of that, total reserve assets holding has recorded reduction for two quarters in a row.

This is a new dynamic we see in China’s trade and funds flow. For the most part since 1998 when this time series began, China has recorded both current account and capital account surpluses, which requires the expansion of reserve asset holding as a balancing item (note that all items must add up to zero, so positive numbers from both current and capital accounts must be balanced by a negative number of equal magnitude in the reserve account, and negative number in reserve asset account means an increase of reserve asset).

These findings are consistent with our observation that China has experienced consistent funds outflow since late last year, and the size of outflows has been large enough to offset (and some time more than enough to offset) current account surplus, thus foreign reserve accumulation has totally stopped, which in turn means the lack of expansion in monetary base, something which should not be happening in a slowing economy when the central bank’s task is usually to stimulate the economy.