The good folk at the government’s commodity forecaster yesterday released their March quarter commodity outlook and it’s happy days for bulk commodities.

For our purposes, there are three sets of updated commodity forecasts to examine.

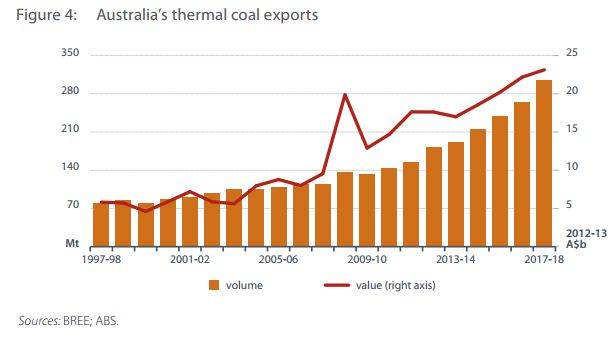

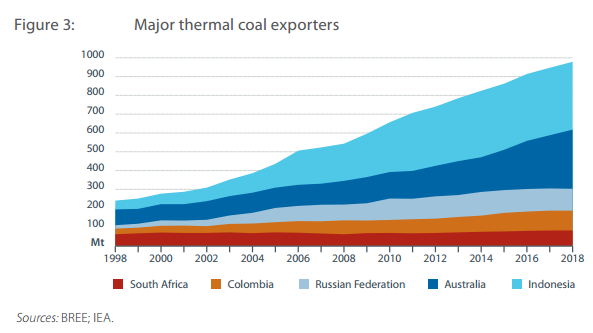

First, for thermal coal, BREE forecasts demand and supply growth of 200 million tonnes or so to 2018.

For global expansion:

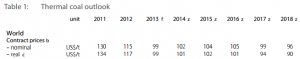

And price:

The fly in BREE’s ointment is that is expects US thermal coal exports to fall significantly from current levels. As the Unconventional Economist has noted, US exports are booming because its gas revolution has displaced coal demand. The US has effectively doubled its thermal coal exports post GFC to 50 million tonnes in 2012.

Moreover, there are plans to expand US thermal coal exports via new ports in its North West to supply Asia with north of an additional 100 million tonnes. Environmental action has delayed planned ports but it is a bold call that not only will none go ahead but exports will halve to 2018.

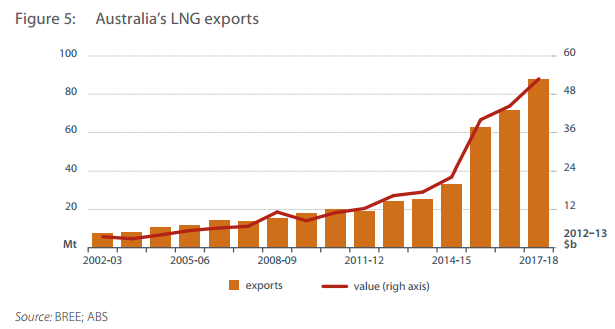

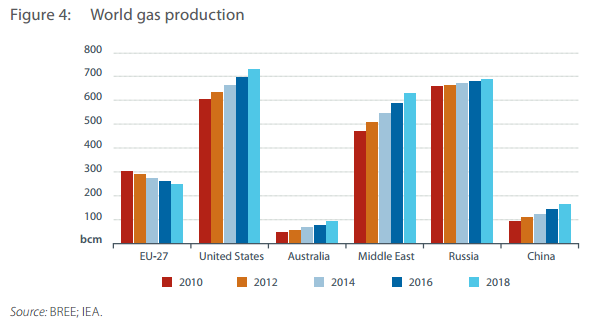

Similar optimism about US failure colours the LNG forecasts. BREE sees global annual demand growth at 2.8% for gas but 7% for Asian LNG. On supply, here’s the chart for local export capacity:

For global capacity:

And price:

Note that BREE is assuming rises LNG prices to 2018 remain at current astronomical highs. It does at least include the following caveat:

Gas supply growth from North America will have a profound effect on global LNG flows. Traditionally a gas importer, the US is currently the world’s largest consumer of gas. However, a trend of decreasing gas imports over the past decade has recently changed because a large number of unconventional gas resources have begun to be exploited. If this supply growth continues over the medium term it could turn North America into a sizeable LNG exporter. Projects once planned for regasification (LNG import) are currently being redesigned for liquefaction (LNG export). The US’ low gas price as defined by the Henry Hub benchmark, combined with rapid growth in demand from East Asia and relatively high prices are likely to result in considerable LNG exports from North America to the region. The knock-on effect of this additional supply will be increased competition for other Asia-Pacific producers, notably Australia, and lower landed gas prices in the leading LNG importing countries.

None of this is certain yet. But it is a substantial risk and a bit of game theory suggests it’s likely. If it happens, Australian LNG contracts will be renegotiated down materially.

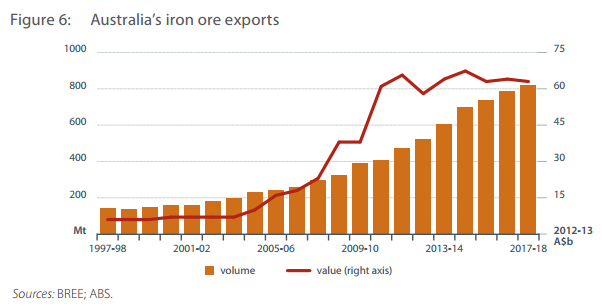

For iron ore, BREE sees 3% demand growth. But double that for supply. Here’s the chart for local export volume:

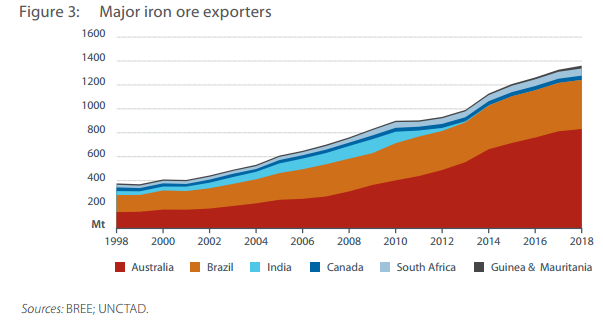

For global volume:

And price:

For the miracle commodity, BREE seems to believe in some kind of magic pudding commodity economics in which capacity can grow at much higher rates than demand yet the latter ease in a gentlemanly stroll down an easy slope.

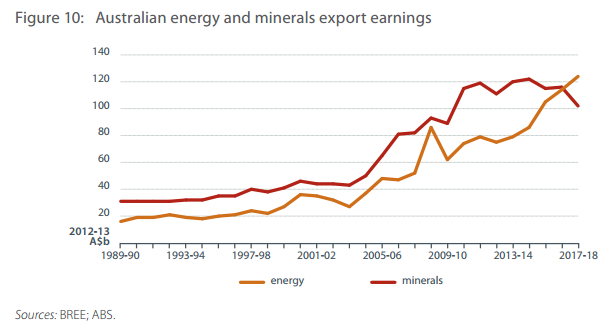

And what’s the result of all of this overall optimism? This:

A very smooth hand off from minerals to energy in Australian exports.

Deliberately or otherwise, this is the same happy assumption currently made by BREE, Treasury and the RBA: that commodity capacity expansion won’t crash prices. Yet in each case there are material risks of increased competition in capacity and undershooting in price.

Wouldn’t it be prudent to discount these risks in forecasts?