Global growth has once again been thrown into the spot light and this should continue over the next twelve hours or so. China’s (HSBC) manufacturing numbers out of the small and medium-sized businesses came in below expectations at 50.5, with the new orders component showing contraction at 48.6 (down from 50.5 in March). It’s also worth remembering that this data source was a more accurate predictor of the weakness seen in Q2 and Q3 of 2012 over the official print, so we should respect this as it could give further signals of a slowing trend.

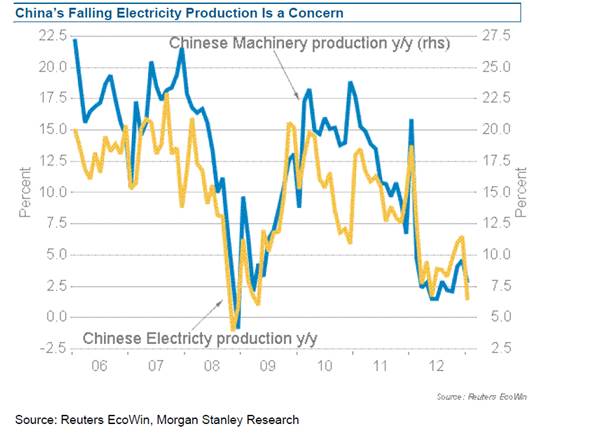

It seemed the market did respect this print and risk came off the table as expected. Copper has predictably found sellers and it’s interesting to see how strong the 30-day correlation is with the AUD/USD (as seen on the chart). AUD/USD has hit a low of 1.0221 today, and despite a number of Japanese life companies talking about increasing their exposure of foreign bonds, the AUD seems to be offered by traders. It’s worth having a look at Chinese electricity production (also below), which many feel is the true and most accurate measure of Chinese growth. As you can see this has been on the decline and it’s something to keep an eye on over the medium term.

USD/JPY reacted quite aggressively to the China data, falling to a low of 98.58, which of course has hurt the long Nikkei trade. Ratings agency S&P also didn’t help when it said there was more than one third chance it would lower Japan’s AA-long term sovereign rating, citing uncertainty that the government could engineer growth. Clearly this will not worry too many in the markets, predominantly as the agencies seem to be having a diminishing effect on bond holdings. We find it interesting that in the AA pool of securities (of which Japan are currently classified ) there is actually more liquidity than any other rating, and thus many feel it is actually not so bad to have a AA-rating as long as borrowing costs aren’t reacting, which in the case of Japan they aren’t.

Australia flew out of the gates on open, largely helped by the second biggest petroleum producer Woodside Petroleum (WPL) detailing a special dividend of 63 cents and targeting an 80% payout ratio of underlying earnings. We aren’t totally shocked by this capital management initiative, although we favoured a buyback given the EPS accretive nature, however the key here is that when the special dividend is included, the stock now trades on a dividend yield of around 7% (depending on whose earnings estimates you use). The stock has effectively become a utility play and perhaps that is prudent given the low growth. However, there is no denying the speed at which it has looked to reward shareholders after dropping its plans for Browse, and whether this is a model adopted by other resource plays is yet to be seen. With costs being cut to the bare bones and global growth slowing (at least in the short-term), perhaps BHP could take a leaf out of WPL’s playbook to win back some much needed PR.

Europe looks set for a flat open, and while the ASX 200 is strong, the remainder of the region looks weak. European manufacturing and services PMIs will be the next part of the growth jigsaw and expectations are for a relatively unchanged picture in the April flash estimates. Of course, a weak print across the region will send the EUR lower and no doubt the different indices. However, the inflation debate is getting interesting and while we live in world of diminishing returns, central banks once again will be leant on to deliver the goods. Price action therefore in gold will be interesting as this could be a good guide to the market’s psyche in terms of the potential for more currency debasement.

On the earnings front, Apple will be closely watched after the close. Consensus in the market is that it will report Q2 EPS of $9.98 on revenue of $42.3 billion. Gross margins are expected at 38.5% (range 37.6% to 41%). Of course the market will be keen to hear more on Q3 estimates, and recall in the previous quarter it suggested it was changing its approach to guidance to become more ‘achievable’. We will be watching out for any increases to its dividend, while cash management initiatives will also be in focus. The average price target of the 65 sell side brokers who cover the stock is $577, so this report could be key to see it gravitate to this target. A good number could certainly help the S&P, which is respecting its channel and finding buyers in all the right spaces.