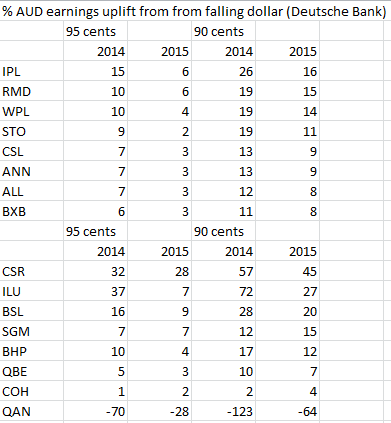

Deutsche Bank has put together a useful list of winners in the equity market if the dollar continues to fall. Its winners included Woodside, Alumina & Iluka. From cyclical industrials: Incitec Pivot, Bluescope, CSR & Aristocrat. Among defensives: Resmed, QBE & Treasury Wine Estates.

I’ve listed most of these below but have split the groups differently, based on some assumptions that Deutsche does not make:

The top half of the list are my picks because each of these has limited or no exposure to the Australian economy. I expect the dollar to fall much further than 90 cents in the next 18 months on local economic weakness so these are the best plays to my mind. I would add NVT to the list, which Deutsche did not look at.

There are some big winners in the bottom half based purely upon currency depreciation. However, these firms are exposed to serious economic risks in my view. The building firms will suffer if the RBA’s rebalancing fails. BHP and all of the major miners are overly exposed to future falls in the iron ore price. QBE is overly exposed to Australian housing through QLMI. Cochlear is too tightly hedged and Qantas I just added for a laugh. For all of these reasons, I have favoured dollar exposed industrials for some time.

Be aware that this is a top down list only. Do your own research into the fundamentals of each firm.