Over the weekend the AFR’s Anne Hyland wrote a terrific piece on the coal bust:

It’s coal’s darkest hour. The once-in-a-generation coal boom is over. Incredibly, the world’s biggest mining companies such as BHP Billiton and the tribe of billionaires the coal boom enriched – from Gina Rinehart to Nathan Tinkler – didn’t see the end coming. The result: acute over-investment in the industry. Now billionaires’ fortunes have shrunk and companies and shareholders are stuck with unprofitable mines and excess port capacity as coal prices slump amid an oversupply. It’s a sound lesson that vast fortunes don’t always last. But there’s not a lot of sympathy for the coal companies or their top executives or the mining tycoons.

“They have managed the industry poorly,” says Dr Don Barnett, a veteran of the coal industry for 40 years. “The managers are there to maintain profitability of their businesses and they haven’t.” Instead, he argues, they failed to manage costs and then the crunch came.

Surely the warning signs were there for the coal industry?

…Dr Nikki Williams, chief executive of the ACA, says planned coal projects worth $22 billion in Queensland alone have been deferred, projects that would have created 10,000 jobs across the construction and operating stages. Those jobs have evaporated and more job losses are coming for the industry.

Williams says the outlook is “very gloomy because of the current price cost nexus”.

“At current coal prices and exchange rates 52 per cent of metallurgical [coking] coal export production and 68 per cent of thermal export production are achieving operating margins of less than $10 a tonne. Those operating margins are before capital recovery. The view of [consultant] Wood Mackenzie is that there are only three Australian metallurgical coal projects and no thermal coal projects which are viable in the long term. In other words all mines are losing money if you factor in the capital recovery.”

Heaven help me but for once I agree with a mining lobbyist. Mining companies never see the cycle turn. Banks didn’t see the cycle turn. US house builders didn’t see the cycle turn. Tech companies didn’t see the cycle turn. Tulip growers didn’t see the cycle turn. Boom sectors never see the cycle turn. While the shareholders will pay, and the management should suffer, this is no surprise at all and exactly the same thing will happen with the next boom. The same entrepreneurial spirit that creates the boom almost by definition prevents a rational forecast of its end.

The real lesson here is not for the companies. It is for governments (and government forecasters like BREE). Despite the very obvious risk that this boom like all before it would bust governments believed this time was different. That’s what turns a bust into a recession and is why government’s are supposed to “lean against the wind”.

And that’s where this article runs into one small problem. It paints a picture of disaster for coal as we speak, quoting Wood Mackenzie. But that’s not what WM is saying. On the contrary, from the WSJ:

Investment in Australia’s resources sector should remain strong over the next three years, according to consultancy Wood Mackenzie, which Thursday said fears of a sharp slide in spending after a 2013 peak aren’t likely to be realized.

While some major companies like BHP Billiton Ltd. and Woodside Petroleum Ltd. have been shelving resource projects due to rising costs and weaker commodity prices, Wood Mackenzie said it expected committed gas projects like the US$34 billion Ichthys liquefied natural gas project in Australia’s Northern Territory, and the resumption of previously deferred coal developments, to keep investment in Australia near historical highs for years to come…

“Today’s decision makers are faced with different challenges in a changing environment, [but] the outlook for the next three years confirms the strength of the Australian resource sector, as we see investments being made based on decisions taken during the boom years,” said Chris Graham, head of Australasia upstream research for the U.K.-based firm.

The energy and metals consultancy forecast resource sector investment here to peak in 2013 at 85 billion Australian dollars (US$84 billion), but to remain robust for a while thereafter.

“The high investment levels will be sustained over the next three years, surpassing the previous three-year period”…

While the coal industry remains under pressure due to weak prices, deferred projects would ultimately be revisited as prices recover and this, together with the development of new producing areas such as Queensland state’s Galilee Basin, would keep capital spending elevated until at least 2017, Wood Mackenzie said.

“This will drive an increase in coal’s proportion of overall capital spend in Australia, taking over iron-ore’s position as the commodity with the second-highest investment” after gas…

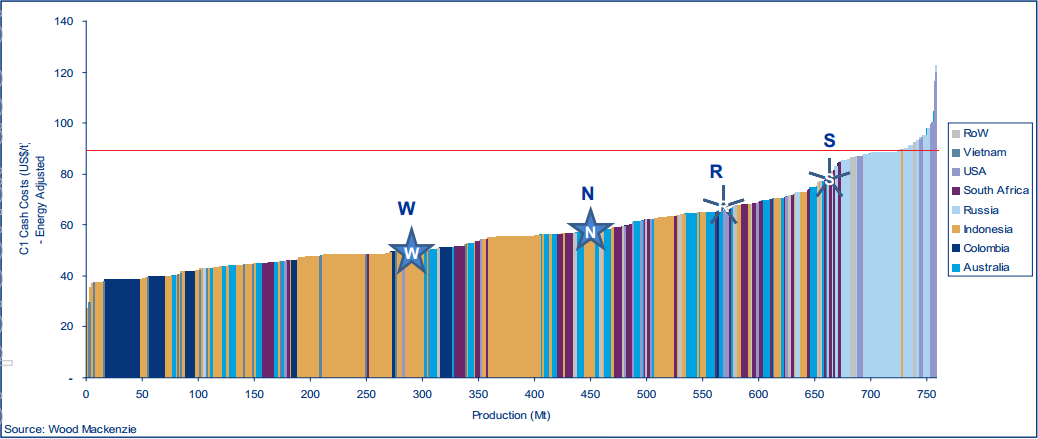

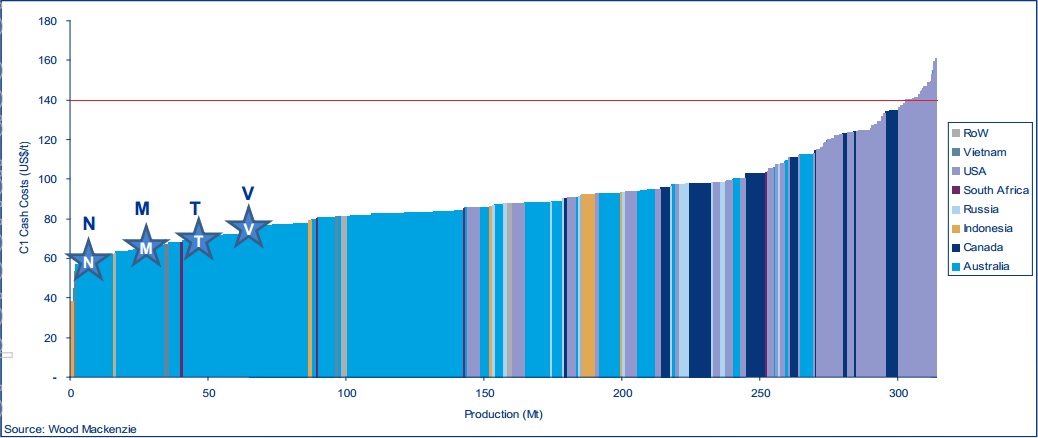

And here are the seaborne coking and thermal coal costs curves from Wood Mackenzie via a Whitehaven presentation:

I’ve added the red line , which is the current spot price. Contract prices are higher. Almost all Australian projects remain in the black at this point. It is the US and Russia that are in deeper trouble. The question is how low will prices need to go to rationalise supply and stabilise prices? On thermal coal, if we believe Ross Garnaut and his supposition that Chinese demand will flat line then the bust has only just begun. Yet much more supply is still in the pipeline. As BREE says:

There were no additional coal projects added to the Committed Stage in the past six months. The value of coal projects at the Committed Stage decreased by $166 million as a result of Ensham Resources’ Ensham mine progressing to the completed stage. The 16 coal projects remaining at the Committed Stage have a combined value of $14.2 billion, of these, 12 projects worth around $12 billion are scheduled to be completed by the end of 2014. These include BHP Billiton’s Caval Ridge ($1.9 billion) and Daunia ($1.6 billion) metallurgical coal mines in Queensland and Anglo American’s Grosvenor Underground thermal coal project ($1.6 billion).

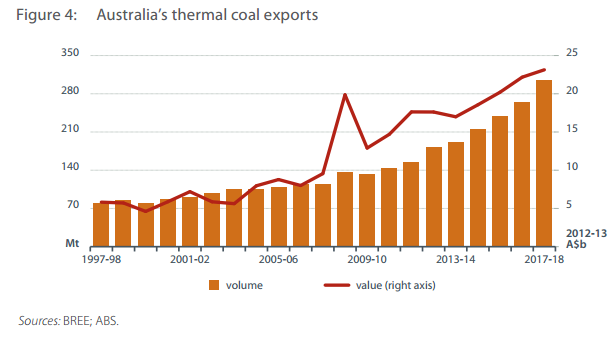

$4 billion of these are directed at new thermal coal mines. Add in the big uplift coming in global LNG volumes and I can see the thermal coal price going 10-15% lower on a sustainable basis. I do not necessarily expect a lot of Australian mines to close but there’ll be no new investment over the next several years at least. And in the mean time costs need to fall, the dollar needs to fall, global supply needs to fall as we enter a battle for market share versus the mad dash to fulfill growing demand. Without Chinese demand growth, BREE’s forecast rise in Australian volumes could be half that anticipated:

For coking coal, my view is similar though the reasons are different. It is less fungible than thermal coal but the pipeline of new Australian supply is large and we are not as far advanced into the rationalisation, as is apparent in the cost curve.

The current wave of projects is expected to increase Australia’s export capacity by about one third in the next few years to 200 million tonnes. Yet Australian export volumes have not grown for three years (in part owing to the QLD floods) and the global price has tumbled anyway.

Alternative supplies and weaker than anticipated Chinese demand growth make coking coal look more oversupplied than thermal in the medium term. Add in the highly likely falls in its twin commodity – iron ore – and the coking coal price has significant further downside, perhaps as much as 25-30%.

Back to the AFR:

A Goldman Sachs report says the mining sector is now better value than the banking sector, having underperformed bank shares by 90 per cent since late 2010. It’s the third largest gap in 50 years. Ian Harding, Wavestone Capital director, agrees it may be a time to buy miners. “The currency adjusting where commodity prices suggests it should be, relieves the pressure on the mining stocks. The mining stocks have been belted. So far they’re pricing way worse outcomes than perhaps people are anticipating.

Quite rightly, in my view. Coal is certainly further into the coming rationalisation but there’s along way to run yet. Commodity prices will suggest the dollar should be lower still before too long. There are better places to invest.